If you're an investor looking to generate passive income from your portfolio, dividend stocks are for you. Companies that pay dividends tend to outperform those that don't, but not all dividend payers are created equal. Some companies prioritize dividend growth, while others focus on achieving high dividend yields.

Two stocks with very appealing dividend yields are AGNC Investment (AGNC 0.53%) and Ares Capital (ARCC 0.12%), which offer yields of 12.7% and 9.4%, respectively. This can make these stocks highly appealing to investors prioritizing income over growth. However, they are distinct businesses with varying risks, and are not ideal for every investor.

If you're weighing an investment in high-yield stocks, here's what to know about AGNC Investment and Ares Capital.

Image source: Getty Images.

AGNC invests heavily in mortgage-backed securities

AGNC Investment is a real estate investment trust (REIT) that invests primarily in mortgage-backed securities (MBSs). It differs from other REITs because it doesn't own physical buildings that it leases or rents. Instead, the company invests in bundles of home loans using leverage, which is how it can pay a double-digit percentage dividend yield.

The company invests primarily in agency MBSs, which are mortgages guaranteed by government-sponsored entities, such as Fannie Mae (Federal National Mortgage Association) and Freddie Mac (Federal Home Loan Mortgage Corporation). These loans carry less risk because they are backed by the full faith and credit of the U.S. government.

NASDAQ: AGNC

Key Data Points

However, to juice returns, AGNC uses leverage, borrowing short-term through repurchase agreements or other debt (with repayment periods generally of less than a year) and investing those funds in long-term MBS. As of Sept. 30, AGNC's at-risk leverage ratio was about 7.5 times its tangible net book value. As a result, its earnings and book value can fluctuate based on changes in the yield curve.

Ares Capital extends loans to overlooked middle-market companies

Ares Capital operates as a business development company (BDC). Both BDCs and REITs are pass-through entities that are legally required to distribute almost all of their taxable income to investors, which is why they have high dividend yields. Besides that, they are very different businesses.

Ares Capital invests in middle-market companies, those with earnings before interest, taxes, depreciation, and amortization (EBITDA) ranging from $10 million to $250 million. During the past several decades, banks have pulled back from funding these companies due to stricter capital requirements, which have led them to prioritize loans to large corporations over those to smaller and mid-market companies.

NASDAQ: ARCC

Key Data Points

It primarily invests in first- and second-lien loans, which have priority in the event of bankruptcy. Its portfolio comprises 587 companies across 34 industries, with no single company accounting for more than 1.5%, providing diversification that should help mitigate risk. The weighted-average yield on its portfolio is about 10%, and it primarily invests in floating-rate loans, making it an appealing choice during periods of rising interest rates.

Both stocks are sensitive to changes in interest rates

When comparing AGNC Investment and Ares Capital, both offer attractive dividend yields, but they perform differently in various environments.

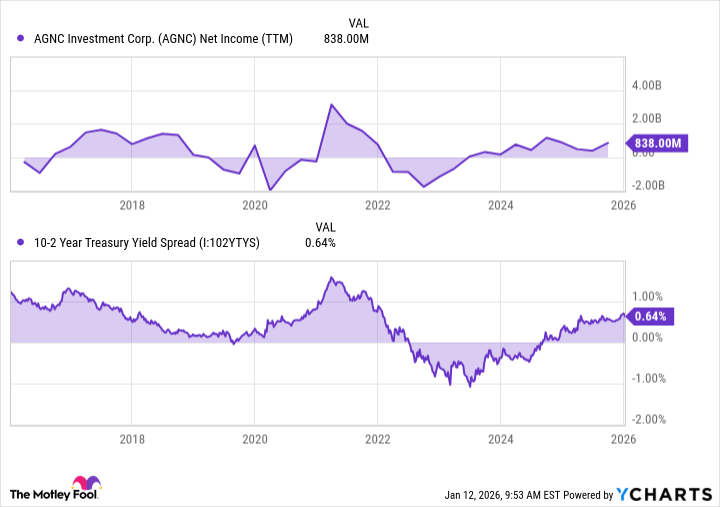

Because AGNC borrows on a short-term basis and invests in long-term MBSs, it is vulnerable to changes in interest rates across the yield curve. The yield curve describes the slope between short- and long-term interest rates. If short-term interest rates decline and long-term interest rates remain elevated, this can benefit AGNC by allowing it to borrow at a lower rate while investing in higher-yielding long-maturity MBSs. This widening spread boosts its earnings and, in turn, the dividend.

AGNC Net Income (TTM) data by YCharts

Ares Capital, on the other hand, invests heavily in floating-rate debt. When interest rates rise, as they did in 2022 and 2023, it boosts Ares Capital's income, assuming default rates remain the same. However, when interest rates decline, this can be a headwind for its business because it earns less on its floating-rate loans.

Which stock is right for you?

Currently, markets are pricing in additional Federal Reserve interest rate cuts, which will help lower short-term interest rates. Meanwhile, interest rates on the longer end of the curve could stay elevated or drop more slowly than the short end due to concerns about structural inflation. These dynamics should benefit AGNC Investment over Ares Capital in the near term.

While AGNC offers higher potential rewards from a steepening curve, its leverage makes it volatile and sensitive to rate swings. Meanwhile, Ares Capital provides more stability, as its floating-rate model enables it to thrive in a "higher-for-longer" environment, generating steady income from elevated rates with less price erosion.

For investors looking to play near-term tailwinds, AGNC is a good choice. But for investors seeking steady income, I think Ares Capital is a better long-term investment.