Two words that have often been associated with each other are "AI" and "bubble." While many are convinced the AI spending spree is just another round of the dot-com bubble that burst in the early 2000s, the reality is that there is real profit being made from AI, and the biggest tech companies in the world are shelling out billions of dollars in cash flows to invest. Most of the spending is legitimate, and valuations are sane, but there are a few examples of companies that I believe are actually in a bubble and could have a rough 2026.

One of those is Palantir Technologies (PLTR 0.80%). Palantir has been an amazing stock to own since the AI revolution began in 2023. Its stock is up around 2,700% since then and has at least doubled every year since then. That's an incredible performance, but it doesn't quite match up to how the company is actually doing.

As a result, Palanitr is on my watch list for a company whose bubble could burst in 2026. If you're a shareholder, you may want to consider taking action now.

Image source: Getty Images.

Palantir's business is seeing strong growth

Palantir makes artificial intelligence-powered data analytics software that helps its users make real-time decisions with the most up-to-date information possible. Palantir's original customer base was government clients, and it sold its products for military and intelligence use, but there were also applications outside of that, such as resource distribution. Palantir successfully catered to this unique client base with government customers worldwide. But there was a bigger market to capture.

NASDAQ: PLTR

Key Data Points

Palantir eventually expanded its offering to the commercial side of the business world and was equally successful. Both commercial and government revenue are important for Palanitr, with the third-quarter's revenue split being $633 million for government and $548 million for commercial. The revenue growth rates for each sector are equally impressive, with government revenue rising at a 55% pace and commercial revenue increasing at 73%. Clearly, Palantir's software is incredibly popular and being rapidly adopted, as evidenced by its quick growth rates.

Since the start of 2023, Palantir's trailing 12-month revenue total has increased by 104%. That doesn't jibe with the 2,700% the stock has risen, which points me toward wondering if this stock is in a bubble.

Palantir's stock has gotten in front of its business

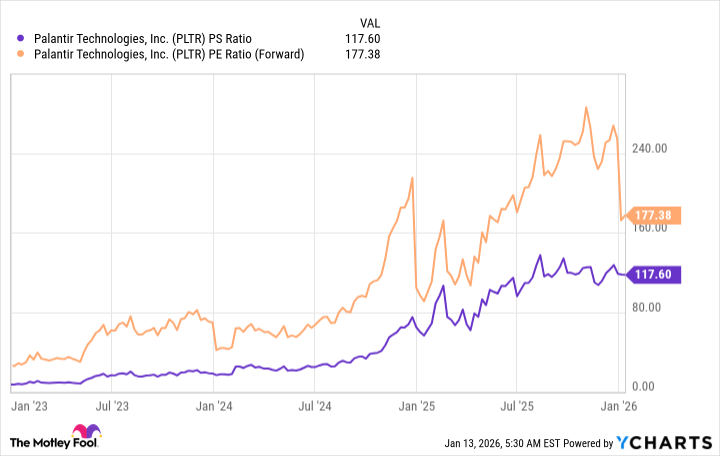

With the stock rising much faster than its business has grown, it's obvious that the stock could be in an overvalued state. At 117 times sales and 177 times forward earnings, I think this fact is confirmed.

PLTR PS Ratio data by YCharts.

Those are two incredibly expensive valuations to live up to. Most companies that trade for more than 100 times their sales are doubling or tripling their revenue each quarter. While Palantir's revenue rose by an impressive 63% in Q3, it's nowhere near the level needed to justify that valuation. Furthermore, Wall Street analysts project Palantir's revenue growth will be 42% in 2026. That's far too slow a growth rate to justify a premium like that, and the first earnings report after Palantir's growth slips could be a huge issue.

Another factor that could cause issues is Palantir's profit margin. Most growing software companies aren't profitable and have room to expand their margins. Palantir isn't in the same boat; it posted an impressive 40% profit margin during Q3. That's excellent work by management, but it will be hard for Palantir to improve its margins much beyond that point. As a result, it's about as optimized for profits as it's going to get. So, it will need to grow its way into its 177 times forward earnings valuation for the stock to make sense to buy here.

I think Palantir is an excellent business and one that should be studied and celebrated. What it has done is truly incredible. However, the stock has gotten ahead of itself too far, and I think it's ripe for a major pullback to return to more reasonable valuation territory.