Quantum computing stocks can go in and out of style in the market. The primary reason why they don't have any staying power right now is that quantum computing technology isn't expected to have a significant effect on industry until about 2030. Quantum computing stocks are equivalent to biotech stocks that are going through clinical trials. They could generate a ton of money someday, but as of now, they're unprofitable and burning cash.

If the market has gotten too bearish on a quantum computing stock, it may be for three reasons. First, the broader industry could be viewed poorly by the market. Second, the company could be struggling in the race to achieve viable quantum computing technology. Or third, an individual stock has sold off too much due to investors losing patience. If a stock is in the third camp, it may be worth buying as the stock could be too cheap to ignore.

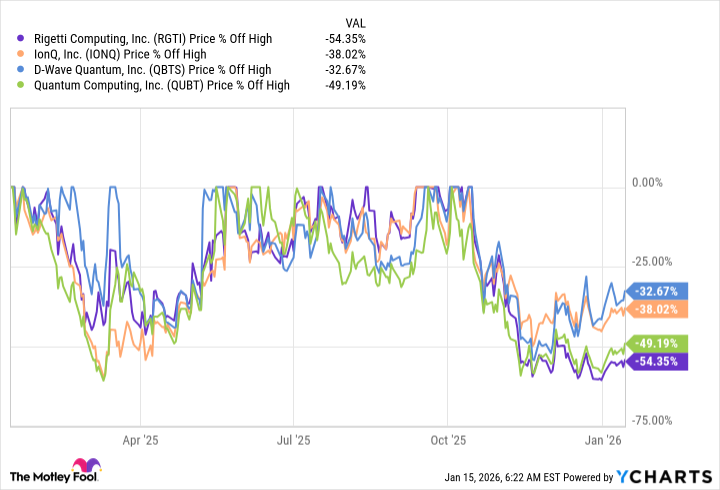

One of the more popular quantum computing pure-play stocks is Rigetti Computing (RGTI +3.72%). Rigetti is an $8 billion company by market cap, although it's over 50% off its all-time high. Is this a buying opportunity for the stock? Or is there a good reason why Rigetti is down so much?

Image source: Getty Images.

Rigetti Computing is pursuing the same technology as tech giants

Quantum computing is an interesting technology because there are a few different approaches companies can take. Rigetti chose the most common approach, known as superconducting. Currently, superconducting isn't the most accurate quantum computing technique, but it does have the best processing speeds. This is more of a long-term play in the quantum computing realm. While an alternative approach, like trapped ion (the technology IonQ is using), provides superior accuracy, it lags in the speed department. If superconducting computers catch up in the accuracy realm, then they will become the go-to option due to their superior processing speeds.

NASDAQ: RGTI

Key Data Points

Rigetti isn't alone in choosing this technology. It's the most common technique, and Rigetti is going up against some stiff competition. Alphabet, Microsoft, and International Business Machines are all deploying superconducting technology, so Rigetti has its work cut out for it.

The biggest issue with Rigetti is that it doesn't have a ton of resources to compete in a resource-intensive industry. In the third quarter, its revenue amounted to $1.9 million, and it posted a $21 million operating loss. Rigetti has about $600 million in the bank, so it has enough cash to survive for a while. However, those numbers are mere rounding errors on its competitors' balance sheets, and if quantum computing becomes an industry where whoever has the biggest wallet wins (similar to how artificial intelligence is playing out), then Rigetti could be in for a huge challenge.

So, is Rigetti still worth buying at today's cheap price tag?

Rigetti isn't as attractive as some options

While the entire quantum computing pure-play industry is down from its all-time highs, Rigetti is one of the biggest losers. Yet, this may be a premature reaction to some of its challenges. Still, if I'm investing in this sector, I want to invest in some of the leaders with the biggest pocketbooks (like Microsoft or Alphabet) or in a company that's pursuing an alternative technology, like IonQ.

Nobody has any idea who the winner will be or what technology will look like five years from now, so spreading your bets across companies of different sizes and computing techniques is a smart move. Rigetti Computing doesn't fit into this mold, so I'm not a huge fan of owning it.

If you're looking to create a large basket of quantum computing stocks, several quantum ETFs give exposure to the big tech companies involved in the space, alongside some of the smaller pure plays as well. Rigetti is fighting an uphill battle. While it could still prevail in the coming years, the odds are against it. As a result, I think there are better quantum computing investments out there.