For the last three years, there has been no company in the semiconductor industry as dominant as Nvidia (NVDA 4.42%). The company kick-started the artificial intelligence (AI) revolution with its Hopper graphics processing units (GPU) -- following up its smash original series with sequels featuring the Blackwell and new Vera Rubin architectures.

More recently, however, Nvidia is beginning to get a run for its money. And no, I'm not talking about competition from Advanced Micro Devices or custom silicon designed by Broadcom.

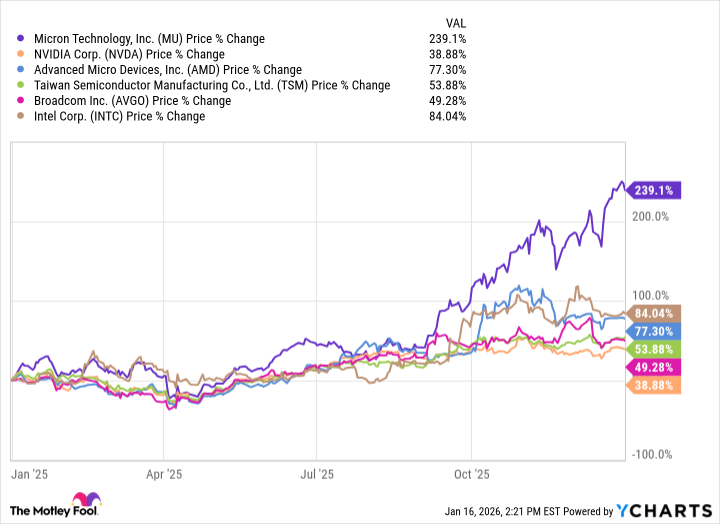

In 2025, Micron Technology (MU +0.62%) was the top-performing AI chip stock among mainstream players. Its 239% gain last year handily placed it among the leaders of the Nasdaq-100 index. While this level of momentum is hard to keep up, one analyst on Wall Street just got even more bullish on Micron.

Beth Kindig of the I/O Fund listed Micron as one of her top 10 stocks to own in 2026. Even more interesting? Micron is Kindig's No. 1 choice among AI chip stocks -- and I think she could be spot on about this.

Below, I'll dig into what makes Micron such an important player in the semiconductor value chain. From there, I'll analyze Micron's valuation profile and explain why 2026 could be another monster year for the growth stock.

Image source: Micron Technology.

Who is Beth Kindig?

If you tune into financial news programs on CNBC or Fox Business, it's not unusual to hear Wall Street parrot the same talking points. Specifically, analysts can sometimes become a bit obsessive over traditional valuation metrics -- citing sales and earnings multiples relative to historical benchmarks.

While this approach can be useful, dialing in on numbers can often lead to paralysis by analysis. What I mean by that is constantly tweaking financial models can lead to missing the bigger picture.

Beth Kindig is the founder of technology research firm, I/O Fund. Unlike many of her peers, Kindig tends to take a more macro view point in her investment outlook.

Instead of relying purely on technical analysis, Kindig takes a more thematic approach. In her reporting, Kindig often cites trends that she sees among capital expenditure (capex) budgets and supply chain cycles, and then ties these dynamics into a broader growth narrative among industry leaders.

As it pertains to AI, Kindig's analysis has been largely been accurate among the hyperscalers. Said differently, when many on Wall Street became cautious about big tech's ability to fund its AI ambitions -- alluding to a potential bubble -- Kindig doubled down on the growth narrative.

While Nvidia remains a top pick across Wall Street, Kindig sees some hidden value in less-appreciated names. This is what makes Micron so interesting right now.

Why is Micron stock going parabolic?

The surge in Micron stock has everything to do with the company's value proposition. GPUs and AI accelerators designed by Nvidia and AMD are the brains that power generative AI applications. But behind the scenes, Micron is playing a mission-critical role in keeping GPU clusters running at top speeds around the clock.

AI workloads are becoming larger and more sophisticated as new use cases come to life. This places enormous strain on training and inferencing AI models. As such, memory and storage -- how data flows across GPU clusters -- becomes a major pain point.

These dynamics make Micron's high-bandwidth memory (HBM) solutions an absolute necessity for the AI infrastructure era. To put this into perspective, just look at the rate at which Micron's business is growing.

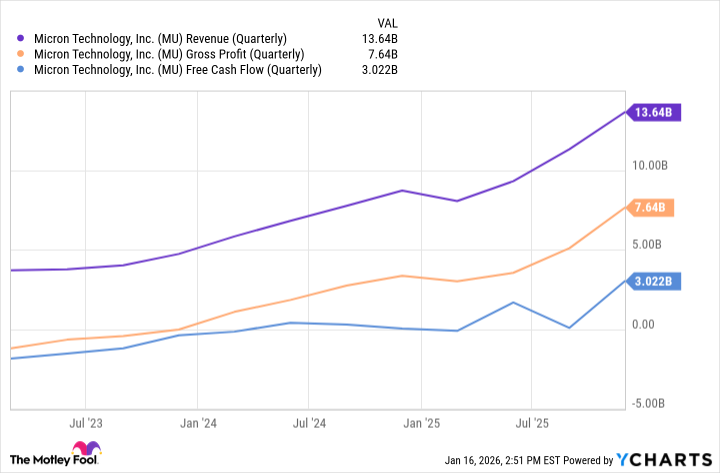

MU Revenue (Quarterly) data by YCharts

Over the last year, Micron's revenue acceleration has steepened materially. More importantly, however, the company's gross profit is rising in lockstep with the company's top line. As a result, Micron can command compelling unit economics in the form of steady, robust free cash flow.

As hyperscalers double down on their infrastructure plans and chip designers continue to release next-generation architectures, Micron's HBM platform should continue to evolve into a durable business supported by a strong, secular AI narrative as opposed to the cyclical upgrade cycles that plague the PC and smartphone industry.

NASDAQ: MU

Key Data Points

Can Micron stock beat the market again in 2026?

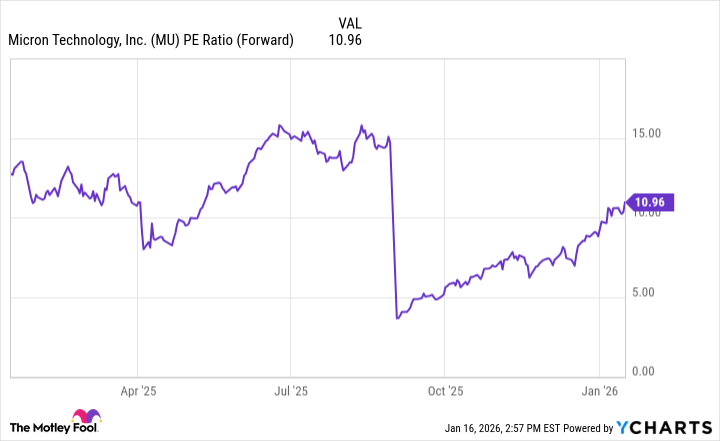

Despite its dramatic rise over the last year, Micron stock still trades at a modest forward price-to-earnings (P/E) ratio of just 10.9. I think there are two factors influencing Micron's valuation.

MU PE Ratio (Forward) data by YCharts

First, growth investors remain intensely focused on the GPU industry. Against this backdrop, Micron stays in the shadows of Nvidia and AMD. In addition, I think not enough investors truly understand Micron's importance on a technological level. In other words, investors may not fully appreciate Micron's position to grow alongside its adjacent chip counterparts.

Nevertheless, Wall Street is quietly calling for Micron to have a record year in 2026. The consensus estimate for earnings per share (EPS) this fiscal year is $32.61 -- nearly a threefold increase over the company's trailing 12-month earnings.

This degree of compounding growth should fuel meaningful valuation expansion as more investors come to understand Micron is sitting on a multi-year growth arc powered by accelerating AI infrastructure investment.

In my eyes, Micron stock remains dirt cheap and a no-brainer buy right now. I agree with Kindig's assessment that shares of Micron could continue to rally during 2026 and beyond.