Despite being one of the biggest Bitcoin bulls out there, Strategy (MSTR 7.76%) hasn't been a great buy of late. Last year was disappointing for the leading cryptocurrency, as its value fell by about 5%, but it was a much worse one for Strategy, whose share price plummeted a whopping 48%.

As the largest corporate holder of Bitcoin, digital assets play a big role in the company's financials and in determining whether it's profitable. The question is, could now be a great time to consider buying shares of the tech company?

Image source: Getty Images.

Strategy's stock often follows Bitcoin, but to greater extremes

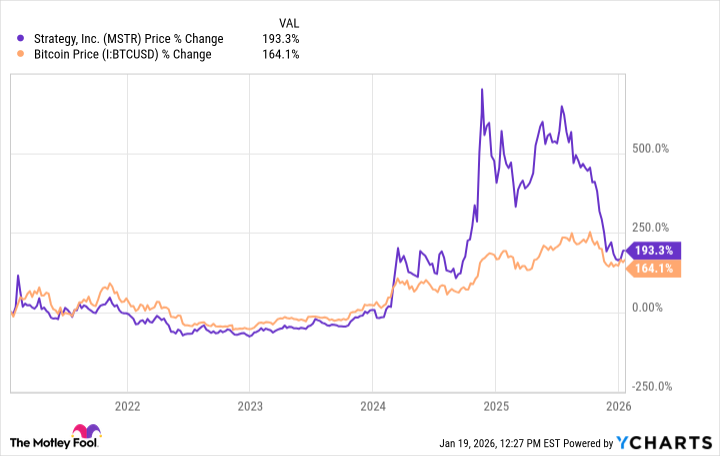

Although there was a big disconnect between Strategy's stock performance last year and how Bitcoin did, generally, these two assets have been fairly closely correlated during the past five years, as is evident in the chart below.

Strategy went on a monstrous rally in 2024 when it rose 359% (Bitcoin jumped by more than 119%), and so it may not be a surprise that in a weaker year, its performance is also much worse than the digital currency. Investing in Strategy has effectively amplified the volatility that might normally come with investing in Bitcoin. Although the cryptocurrency itself is already volatile to begin with, Strategy has shown to be even more extreme in its price movements in recent years.

As of Jan. 19, Strategy's year-to-date gain is 5.5%, while Bitcoin's is up less than 1% (as of Jan. 20). Yet again, Strategy's returns are more extreme than Bitcoin's. The silver lining here is that if you feel confident in being able to forecast how Bitcoin may do, it may not be a whole lot more challenging to estimate how Strategy's stock will perform.

There's little fundamental reason to invest in Strategy

Investing in Strategy is generally most appropriate for crypto investors who have a high risk tolerance. Although Strategy does generate revenue from its enterprise analytics software, that's not a compelling reason to invest in the business, as the company's revenue has been declining in recent years.

It's the unrealized gains and losses from its digital assets that have a much more dramatic impact on whether the company turns a profit or a loss. In its most recent quarter, Strategy's unrealized gain on digital assets totaled $3.9 billion, eclipsing the $129 million in revenue it posted during the period.

The company's focus is also clear in how it has defined itself, which is as "the world's first Bitcoin treasury company." Strategy's goal remains simply adding to its stockpile of bitcoins. This is why the stock is effectively nothing more than a speculative crypto investment. Although that can be appealing if you're bullish on Bitcoin and are convinced its value will only rise, it inevitably comes with significant risks.

NASDAQ: MSTR

Key Data Points

Why investors shouldn't expect a big recovery from Strategy in 2026

How Strategy's stock performs this year will undoubtedly depend on how Bitcoin does. Although the cryptocurrency was doing well out of the gate in 2026, it has since stalled, and things could take a turn for the worse if there are few (if any) rate cuts this year, or if economic conditions worsen. The last time investors were deeply worried about the economy was in 2022, when inflation was problematic, and Bitcoin's value dropped 65%. Shares of Strategy crashed by 74% that year.

Even though Strategy's valuation already took a beating last year, at $50 billion in market cap, this remains an overvalued stock to hold on to, especially given its underwhelming business and lack of any competitive advantage. The stock looks to be a riskier, more volatile version of Bitcoin; you may be better off simply investing in the cryptocurrency itself.