Advanced Micro Devices (AMD +0.04%) and Nvidia (NVDA 4.38%) are rival chipmakers, but it hasn't been much of a close race in recent years. Nvidia has far and away been the more profitable company and the better stock. In five years, it has soared more than 1,300%, while AMD's stock is up just 160%.

Last year, however, investors gravitated more toward the smaller chipmaker, perhaps seeing more upside in its future. Shares of AMD rose by 77% and outperformed Nvidia, which gained just 39%.

Was this an anomaly, or could AMD prove to be the better stock in 2026 as well?

Image source: Getty Images.

AMD's growth prospects are encouraging

The looming question about AMD is whether its chips can be viable alternatives to Nvidia's high-priced products. And there is reason to be optimistic because many big-name tech companies are using AMD's chips, including ChatGPT maker OpenAI and IBM, which says that AMD's chips can help with its development of quantum computers. CEO Lisa Su believes that over the next three to five years, AMD will be able to expand its top line by more than 35% annually.

NASDAQ: AMD

Key Data Points

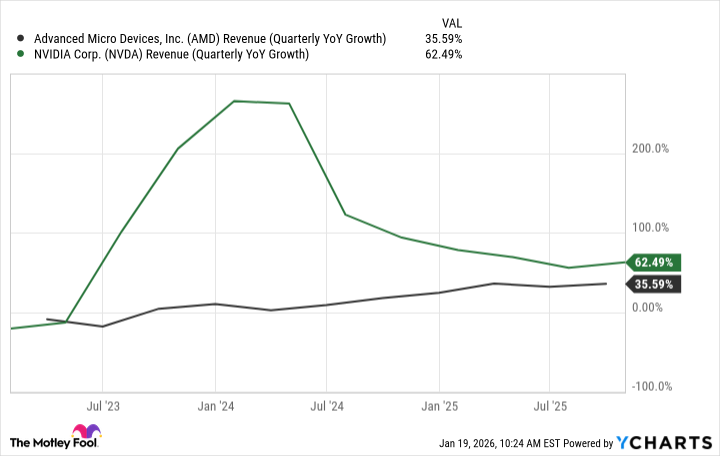

The company's growth has been accelerating over the past couple of years, which is a great sign that its new chips are doing well and generating strong demand. At the same time, Nvidia's growth rate has been slowing drastically.

AMD Revenue (Quarterly YoY Growth), data by YCharts; YoY = year over year.

AMD is smaller than Nvidia, but not necessarily cheaper

AMD's market cap is around $380 billion, making Nvidia, which is valued at $4.5 trillion, worth nearly 12 times as much. With that kind of a delta in valuation, it may seem like a no-brainer that AMD is due for greater gains in the near future than its much larger rival.

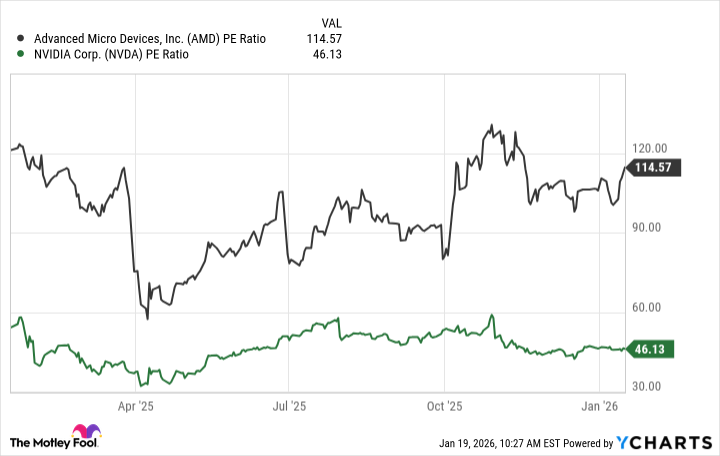

But when you take into account their respective per-share profits, Nvidia is actually the cheaper investment -- and it's not even close.

AMD PE Ratio data by YCharts; PE = price to earnings.

As AMD ramps up development of its artificial intelligence (AI) chips, that should improve profitability and bring down its earnings multiple in the process. Based on analyst projections, the stock's forward price-to-earnings multiple (P/E) is much more modest at 37. But that is still higher than Nvidia's forward P/E of 24.

NASDAQ: NVDA

Key Data Points

Investors should always consider overall profitability when analyzing stocks because, while one may appear to be undervalued, it may not necessarily be the case after factoring in earnings. Over the past 12 months, Nvidia has generated earnings of nearly $100 billion. By comparison, AMD's net income during its past four quarters has totaled just $3.3 billion.

With a vastly larger, more profitable business, and deeper pockets to work with, Nvidia may still be better positioned to outperform AMD in the long run.

Is AMD a better buy than Nvidia in 2026?

Picking a winner between these two stocks is not easy, as there are compelling cases to be made for each of them.

AMD is smaller and may have more upside, but only if its earnings can improve drastically. Revenue growth alone may not be enough.

Nvidia, on the other hand, is the AI chip leader, and it's not destined to lose that status anytime soon. As long as AI spending remains strong, the stock can still do well. But there may be some apprehension from investors in making the stock even more valuable than it already is.

Ultimately, I think AMD will outperform Nvidia this year. While its earnings are a fraction of the size of its larger rival, they should improve as AMD scales up its AI chip business. And with growth investors finally starting to take AMD seriously, it may still be the early innings of a much larger rally for the tech stock.