One investor who has burst onto the scene in recent years is Chamath Palihapitiya. The venture capitalist is largely considered a pioneer of the special purpose acquisition company (SPAC) rush about five years ago.

While Palihapitiya's SPAC track record isn't illustrious, the billionaire is still considered a savant in the technology world by many of his peers. Early in his career, Palihapitiya assumed roles across business development and operations at internet behemoths AOL and Facebook, the latter which is now known as Meta Platforms.

After earning a fortune from his corporate gigs, Palihapitiya turned to Silicon Valley. Today, he manages a venture capital (VC) firm called Social Capital. Palihapitiya also co-hosts a popular podcast called All-In with fellow Silicon Valley veterans Jason Calacanis, David Sacks, and David Friedberg.

During a recent episode, the panel revealed their predictions for the biggest business winner of 2026. Interestingly, Palihapitiya didn't mention any stocks, a start-up, or cryptocurrencies. Instead, his eyes are on the commodities market.

Let's dig into what Chamath thinks will be the market's best investment opportunity this year and explore whether this asset deserves a spot in your own portfolio.

Image source: Getty Images.

Palihapitiya has a bold AI prediction for 2026

If you tune into financial news programs, most sell-side analysts are parroting the same idea for 2026: Invest in the hyperscalers.

Companies like Microsoft, Alphabet, Amazon, and Meta Platforms are only just beginning to scratch the surface of how artificial intelligence (AI) is becoming integrated into their ecosystems. This makes chip designers such as Nvidia, Advanced Micro Devices, Broadcom, and Micron Technology nearly no-brainer buys for the current infrastructure boom.

But whenever a new megatrend emerges, the smartest investors look beyond the obvious choices. Against this backdrop, someone like Palihapitiya is thinking outside the usual suspects. More specifically, he's thinking about the nuts and bolts required to build a data center or design a graphics processing unit (GPU) from the ground up.

So, without further ado, Palihapitiya's grand prediction for 2026 is to invest in precious metals -- specifically, he calls out copper as his asset of choice.

Why is copper important for AI?

One of the biggest pain points from rising AI investment lies in the power grid. According to a study from the Pew Research Center, data centers consumed 4% of the total electricity in the U.S. in 2024. By 2030, data center electricity consumption is expected to rise by more than 130% from current levels.

As AI workloads grow, training and inferencing protocols become even more mission-critical. Clusters of GPUs inside data centers are only going to continue to push the limits of power loads. This paradigm is what makes copper so valuable.

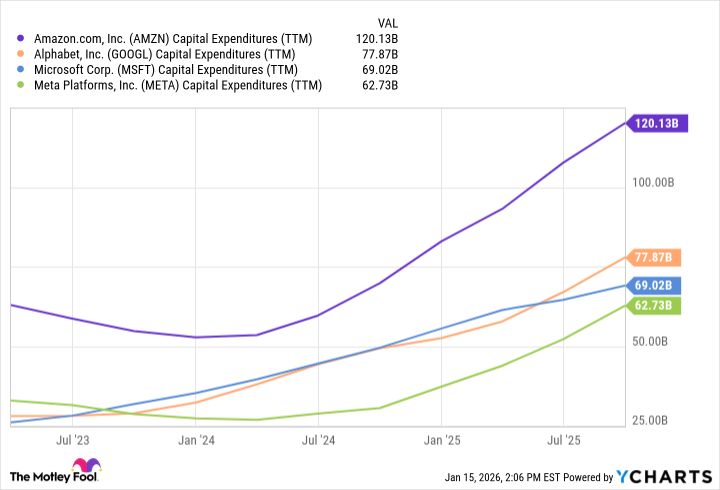

Copper is a conductive material -- manifesting on every chip and server rack through which electricity is moving. As hyperscalers continue to accelerate capital expenditures (capex), I'd expect additional capital to be allocated to both chip procurement and energy infrastructure in the coming years. In fact, we're already seeing this play out.

AMZN Capital Expenditures (TTM) data by YCharts. TTM = trailing 12 months.

A few weeks ago, Alphabet announced that it is acquiring Intersect -- a provider of efficient energy solutions for data centers -- for $4.75 billion. In addition, Amazon recently signed a deal with Rio Tinto to buy newly mined copper to help fuel power demand for Amazon Web Services data centers.

Given copper's critical role in AI expansion, coupled with the fact that it is a supply bound resource, it's unsurprising that Palihapitiya says the asset is set up to go "absolutely parabolic."

How can you invest in copper?

There are many different ways investors can gain exposure to copper. If you're looking to complement existing energy stocks in your portfolio with companies that specialize in copper mining, two blue-chip options are Freeport-McMoRan (FCX +2.23%) and Southern Copper (SCCO +2.93%).

If you'd prefer a more passive approach, investing in a copper-themed exchange-traded fund (ETF) such as the iShares Copper and Metals Mining ETF (ICOP +1.64%) could be a good way to gain exposure to both copper and adjacent raw materials.

Lastly, if you want to follow the spot price of copper, a good bet is the United States Copper Index Fund (CPER 0.64%).

NYSEMKT: CPER

Key Data Points

Over the last year, the United States Copper Index Fund has gained 30% -- nearly double that of the S&P 500. While this implies the price of copper has run up materially in a short time frame, I think the long-term thesis supports a buy.

A good strategy is to employ dollar-cost averaging, or buying at various price points over a long-term horizon. As the AI infrastructure era continues to unfold, complementing your existing stocks with an alternative asset like copper should add a layer of diversification to your portfolio.

To me, copper is a savvy pick-and-shovel opportunity alongside mainstream AI stocks and is positioned to generate substantial gains for years to come.