Inflation has made eating out much more challenging for consumers to afford a decent meal while keeping their budgets intact. Trying to eat healthy is even more difficult, as paying for fresh ingredients can raise prices further.

It may not come as much surprise, then, to learn that two companies that have focused on healthy eating alternatives have performed so poorly last year. In 2025, shares of Sweetgreen (SG 12.30%) and Beyond Meat (BYND 6.03%) were both down nearly 80%.

Both of these stocks come with risks, but which one is the better buy today? Let's take a closer look.

Image source: Getty Images.

Which company has been achieving better growth?

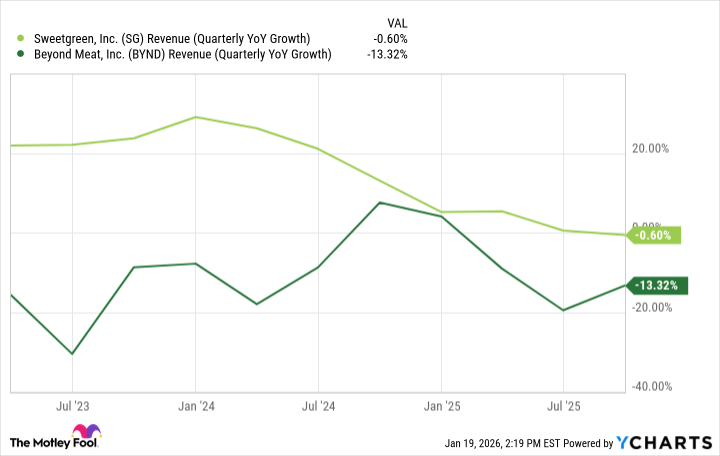

Both Sweetgreen and Beyond Meat experienced declines in their growth rates in recent quarters, and that's been a key reason behind their abysmal stock performances.

NASDAQ: BYND

Key Data Points

Fast-casual restaurant chain Sweetgreen has become known as the company that sells $20 salads, while Beyond Meat's alternative meat products have been facing tremendous competition, and there have been growing concerns about just how healthy its heavily processed products really are. The end result hasn't been pretty for either of these companies or their respective growth rates.

SG vs BYND: Revenue (Quarterly YoY Growth) data by YCharts

Sweetgreen gets the edge in terms of growth, simply because it hasn't gone deep into the negative.

Which company has better margins?

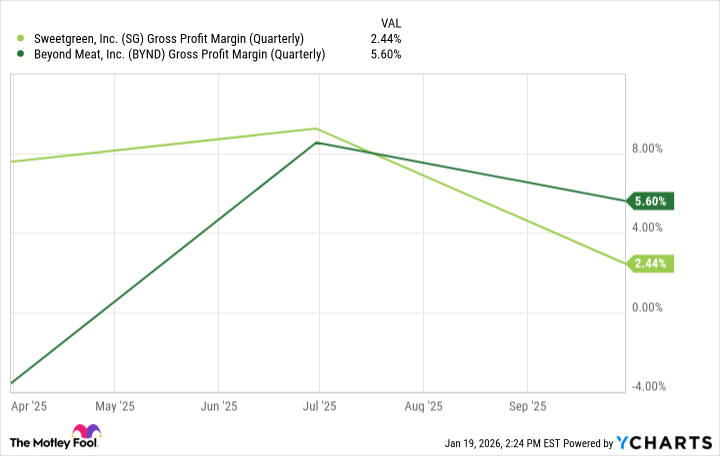

Both of these companies have been incurring losses in recent quarters. However, one number that may be of key importance to investors moving forward is the gross profit margin, which can provide an indication of which company may be better poised to get back to profitability in the near future.

SG vs BYND: Gross Profit Margin (Quarterly) data by YCharts

Beyond Meat has done better of late, but Sweetgreen also hasn't reported negative gross margins in recent quarters, which is a horrendous sight for investors. But with both companies' margins being incredibly low, I don't see one being in a terribly better position than the other; this looks like a tie.

Which company is in deeper financial trouble?

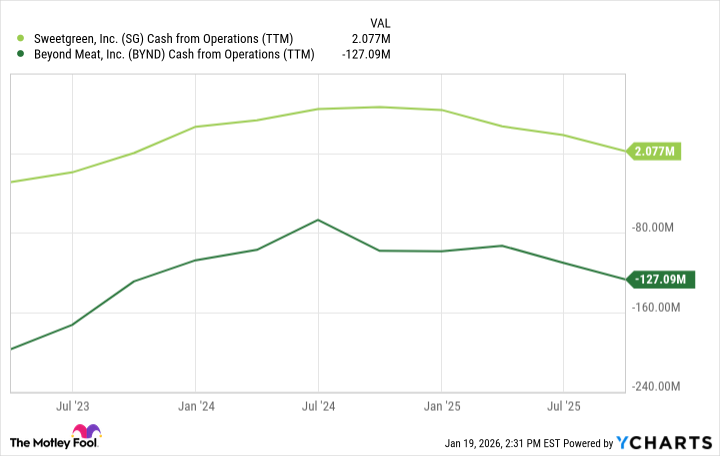

The biggest concern I'd have with businesses that are in such a troubled situation is whether they have strong enough financials to survive the next few years. If the economy is heading for a recession, things may get even worse before they get better for these businesses.

A key number to focus on here is operating cash flow. If a business is burning through a lot of cash, investors may need to brace for significant stock offerings (i.e., dilution), which will undoubtedly weigh down the share price.

SG vs BYND: Cash from Operations (TTM) data by YCharts

Sweetgreen has been generating positive cash flow over the trailing 12 months and has a clear advantage over Beyond Meat in terms of risk.

What's even more trouble for Beyond Meat is that its cash and cash equivalents balance as of the end of September was just $117 million. Without a slowdown in its burn rate, the company could conceivably burn through its cash in the next 12 months. While it can always take on debt or issue stock, neither option is an attractive one for investors.

NYSE: SG

Key Data Points

Sweetgreen is far and away the safer stock to own in 2026

If I were to invest in one of these stocks as a potential turnaround play, I'd pick Sweetgreen, easily. With stronger fundamentals and positive operating cash flow, it's a less risky option than Beyond Meat, which has struggled to grow even as it has been reducing prices and offering value packs -- a huge red flag.

While both of these stocks could very well struggle this year, if you're choosing a contrarian stock to go with, Sweetgreen may have a better chance of turning things around than Beyond Meat.