Ark Investment Management, which was founded by seasoned investor Cathie Wood, releases a new edition of its "Big Ideas" report every year to highlight potential opportunities across the technology space. In the 2025 edition, the firm discussed how autonomous vehicles could turn ride-hailing into a $10 trillion industry over the long term by making travel significantly more affordable for consumers.

Tesla (TSLA 4.17%) is one of the world's leading developers of self-driving cars. Its Cybercab robotaxi is slated for mass production later this year, and CEO Elon Musk wants to build a ride-hailing network where it can autonomously transport passengers at all hours of the day.

However, Tesla might not be the biggest winner of the self-driving revolution. Uber Technologies (UBER 1.33%) operates the world's largest ride-hailing network, and it has partnered with over 20 companies developing autonomous vehicles and delivery robots so far. One of them is already completing over 450,000 trips per week.

Here's why Uber could be a much better investment compared to Tesla as the autonomous revolution gathers momentum.

Image source: Getty Images.

Uber already has a distinct advantage over Tesla

Winning the autonomous ride-hailing race will require more than just a good self-driving car. It will take significant digital infrastructure, a user-friendly platform, and a network that customers trust to quickly provide a ride on demand. A company can't provide that timely service if it doesn't deploy enough cars -- but if it deploys too many cars, it will have an underutilized fleet that burns money.

Uber has 15 years of experience in all of those areas across most of the world's major cities. Its platform is so convenient that 189 million people use it every month (as of Sept. 30), and that number continues to grow. Tesla, on the other hand, still has to build an entire platform, network, and all associated infrastructure from scratch if it wants to compete in the ride-hailing space. Therefore, it's a long way behind before its Cybercab even hits the road.

NYSE: UBER

Key Data Points

Although Uber hasn't developed a car of its own, it used its immense scale to attract partnerships with over 20 companies in the autonomous industry. As the world's largest ride-hailing network, Uber can give those companies access to the most potential customers, and simply take a cut of every ride along the way.

Alphabet's Waymo is one of Uber's top partners, and it's already completing 450,000 paid autonomous trips every week across five U.S. cities. Another is Stellantis, which owns Chrysler, Jeep, Dodge, and other brands. It's building 5,000 robotaxis specifically for Uber's network, which will be powered by Nvidia's autonomous vehicle platform, which is called Drive Hyperion.

Simply put, Uber doesn't have to rely on the success of any single robotaxi design to dominate the autonomous ride-hailing market. By owning the world's largest network, it's positioning itself to win no matter which companies end up with the best cars. Tesla has a much steeper mountain to climb just to compete in this space, let alone succeed.

Uber is more attractively valued than Tesla (by a wide margin)

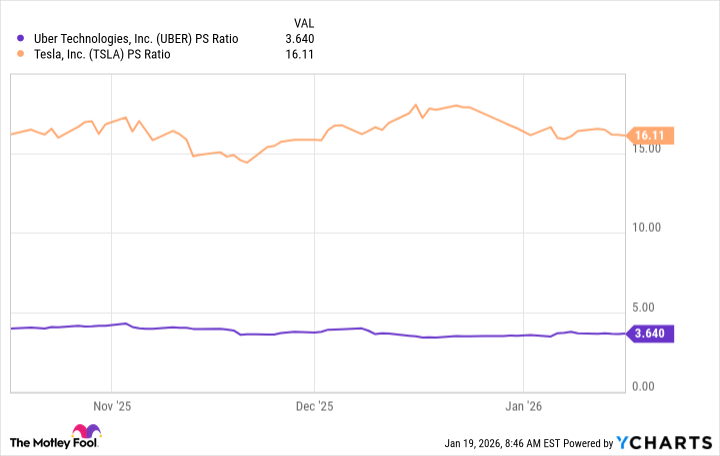

Uber's revenue grew by 17% during the first three quarters of 2025, whereas Tesla's revenue shrank by 3% over the same period due to declining sales in its flagship electric vehicle business. Nevertheless, Tesla stock is a whopping four times more expensive than Uber stock on a price-to-sales (P/S) basis, which doesn't make much sense.

Uber's P/S ratio is 3.6, whereas Tesla's is 16.1.

UBER PS Ratio data by YCharts

Tesla stock also trades at a sky-high price-to-earnings (P/E) ratio of 292, making it nine times more expensive than the Nasdaq-100 technology index. Therefore, it's a very difficult investment at the current price, independent of what Uber is doing.

Autonomous ride-hailing could transform Uber's financial results very quickly. During the third quarter of 2025 (ended Sept. 30), the company paid $22 billion to the 9.4 million drivers operating in its network, which was the single largest component of its $49.7 billion in gross bookings (the dollar amount customers spent on its platform). Self-driving robotaxis will reduce Uber's labor costs, resulting in more of its gross bookings converting into revenue (and profit).

Therefore, if autonomous ride-hailing does become a $10 trillion opportunity like Ark Invest expects, Uber's top and bottom line could be poised for explosive growth from here. Factor in Uber's much cheaper valuation, and I think it's a no-brainer buy over Tesla for investors who want exposure to this mobility revolution.