You've probably heard the advice countless times. Just buy an index fund built to mirror the S&P 500 (^GSPC +1.16%) and leave it alone. You'll do just fine. You'll likely fare better than most investors do, in fact, since complicated strategies and too much trading often ends up undermining your performance.

There are exceptions to the norm, however, and not necessarily the ones you'd expect. While growth stocks still offer bursts of bullish brilliance, if you'd truly like to buy-and-hold your way to a millionaire status, dividend stocks may actually be the smarter way of getting there.

But not just any dividend stocks. You want to own the right Dividend Kings.

Image source: Getty Images.

There's power in reliably rising income

There are dividend payers, and then there's dividend royalty.

Ever heard the term Dividend Aristocrats®? (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services, LLC.) These are S&P 500 constituents that have raised their per-share payout annually for a minimum of 25 consecutive years. That's more than a little impressive.

Some dividend-paying companies will continue to raise their annual dividend payments even when they can't quite afford to for a little while. Time and reality eventually catch up with these outfits, though. To be able to afford such a lengthy stretch of ever-rising dividend payments is a true testament to a company's staying power.

There's a whole other echelon of dividend royalty above the Dividend Aristocrats, though. That's the so-called Dividend Kings. These are companies that have raised their annual per-share payments for a minimum of 50 consecutive years in a row. As of early 2026, there are only 56 stocks that can claim the title.

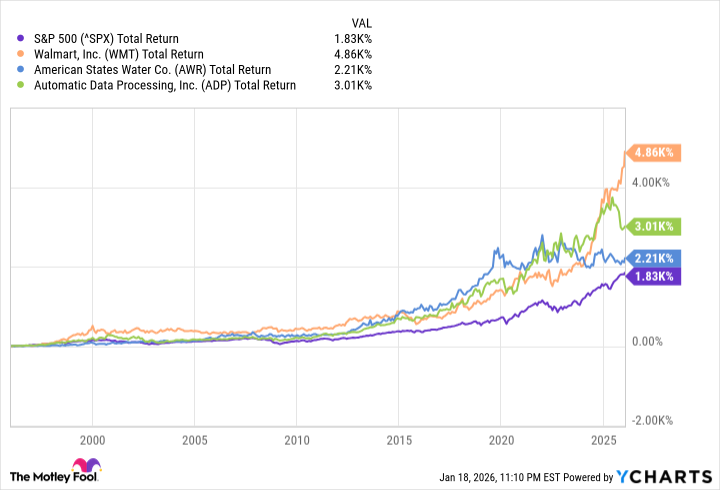

The wild part? Almost all of these stocks represent boring, stodgy, slow-moving companies. When reinvesting their dividends in more shares of the company paying them, several of these names actually outperform the S&P 500's long-term performance.

Surprised? As mutual fund company Hartford explains in its research into this phenomenon, "corporations that consistently grow their dividends have historically exhibited strong fundamentals, solid business plans, and a deep commitment to their shareholders."

Better still to investors looking to add a little more reliable "oomph" to their portfolios, a handful of these names are likely to continue beating the broad market, turning thousands of patient investors into millionaires they may have never expected to become.

With that as the backdrop, here are three such Dividend Kings to consider adding to your portfolio as soon as possible, even if your chief goal is growth.

1. Automatic Data Processing

Just as its name suggests, Automatic Data Processing (ADP +0.74%) helps enterprises manage mountains of digital (and sometimes analog) data. Its claim to fame, however, is processing payroll -- and handling all the complicated tax reporting that comes with it -- for over 1 million corporate customers. In fact, one out of every six workers living in the United States gets paid by its service, and the company's expected to do $21.8 billion worth of business this fiscal year, up 5.8% from the prior year's top line.

It's a business that's obviously well-suited for supporting recurring dividends; its client companies essentially pay ADP a percentage of the amount of payroll it processes on an ongoing basis. As long as they've got employees, ADP will generate revenue.

NASDAQ: ADP

Key Data Points

Still, there's no denying it's not much of a growth business.

What's largely underappreciated about ADP, however, is how reliably profitable it is. Between 20% and 25% of this organization's top line is consistently converted into net income, which is more than enough to comfortably afford an ongoing, ever-rising dividend in perpetuity. Inflation-driven pay raises and population growth help in this regard as well.

Newcomers will be plugging in while the stock's forward-looking dividend yield stands at 2.6%, which is based on a dividend that's now been raised for 51 straight years.

2. Walmart

Although it's hard to believe it's existed that long, yes, Walmart (WMT +0.55%) has not only been around since its first store was opened 1962, but it's now upped its per-share dividend payout in each of the past 52 years. You can get in now while this year's projected dividends are 0.8% of the stock's current price.

No, that's not much for anyone needing immediate and meaningful income. However, owning a Dividend King doesn't inherently guarantee a sizable dividend yield. It only offers some assurance that whatever dividend is currently being paid out should continue to grow.

NASDAQ: WMT

Key Data Points

What this ticker lacks in yield, it more than makes up for in potential price appreciation. The stock price has risen 156% over the past three years alone, significantly depressing the yield percentage. Walmart isn't just the world's biggest brick-and-mortar retailer. It dominates this space so well that it's practically impossible for a rival to find any toehold.

That's particularly true within the United States, where 90% of the population lives within 10 miles of one of its 4,606 U.S. stores. Walmart has become the country's biggest grocer, in fact, taking hold of a market that's here to stay, helping fuel its non-food business with this deep reach.

Perhaps more important to investors is what this reach means. Although retailing isn't exactly a high-margin business -- only between 3% and 4% of this company's top line is converted into net profit -- Walmart is so big that it clears enough earnings to fund sizable and sustained stock buybacks. The company has reduced its share count by roughly 40% just since the mid-1990s, adding value in ways well beyond dividends.

3. American States Water

Finally, add American States Water (AWR 0.45%) to your list of Dividend Kings to buy because its market-beating (net) performance is likely to persist well into the future.

Data by YCharts.

Yes, it's a utility company. American States Water provides water (and in some cases, electricity) to over 1 million people in nine different states. And it's clearly good at what it does. The decades-old company has now upped its dividend payment every year for 70 consecutive years, and by more than just a little. Over the course of the past decade, the utility outfit has raised its per-share payout at an annualized average of more than 8%, easily outpacing inflation during this stretch.

NYSE: AWR

Key Data Points

Credit the nature of its businesses, mostly. While utilities have historically been a slow-growth industry, growing scarcity of potable water and now the rise of electricity-hungry artificial intelligence data centers has provided established utility companies with plenty of pricing power -- more so than they've enjoyed in the past. There's no end in sight to either of these trends, either.

You'd be buying a stake in this Dividend King while its forward-looking dividend yield stands at a respectable 2.8%.