In December 2024, I made a bold prediction that Palantir Technologies (PLTR +0.28%) stock would fall in 2025. That prediction turned out to be incredibly inaccurate, as the stock tore off a 135% gain in 2025. If you followed my advice and sold, I'm sorry. However, the reality is that my investment thesis still isn't wrong -- Palantir's stock is still incredibly expensive.

However, I underestimated one fact about Palantir's stock, and it's one that investors shouldn't ignore.

Image source: Getty Images.

Palantir's business is booming

Palantir makes artificial intelligence (AI) software that assists users in making split-second decisions with the most up-to-date information possible. This software was originally developed for use by the government, but has found widespread adoption in the commercial sector as well.

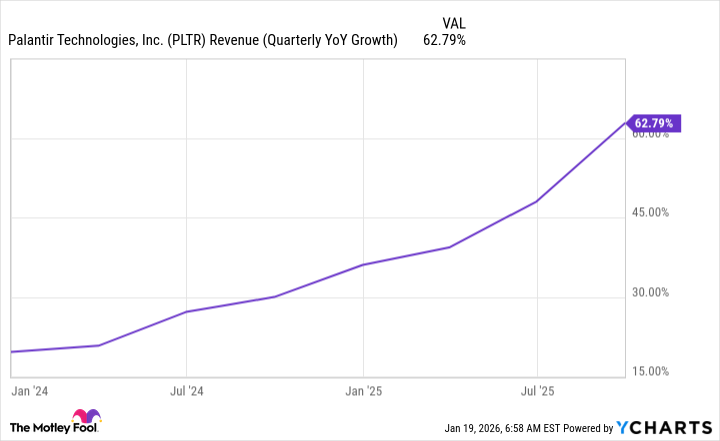

Palantir had an excellent 2025 from a business standpoint, and its revenue growth accelerated each quarter.

Data by YCharts.

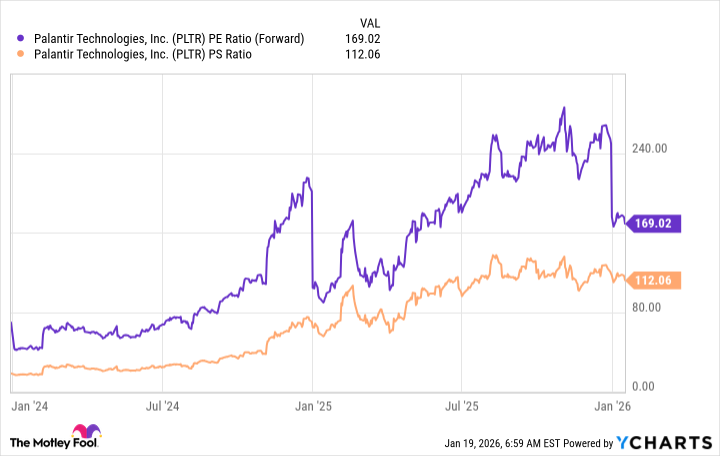

I'll be the first to admit I'm a huge fan of Palantir's business model and execution. However, my issue lies with the stock, not the business. I think the two have become uncoupled, as Palantir's stock trades for an unbelievable 169 times forward earnings and 112 times sales.

Data by YCharts.

Both of those metrics are incredibly high numbers, indicating the stock is ripe for a pullback should its growth falter. That presents a huge risk for investors, but because Palantir's revenue growth continued accelerating throughout 2025, it wasn't enough of a reason to sell. The first quarter in which Palantir reports a slowdown will be a painful one for investors, and that will cause the stock to sell off, but it may not be by as much as I expected.

Individual investors hold a large quantity of shares

Palantir shares a somewhat unique characteristic with another stock that defies logical valuation expectations: Tesla. Neither company makes valuation sense with traditional earnings metrics, but their stock prices remain elevated. A large part of that can be chalked up to large individual ownership, as opposed to ownership by large institutions. Individual investors are more likely to hold on to these two stocks even if each appears overvalued.

NASDAQ: PLTR

Key Data Points

Big tech companies like Alphabet and Microsoft have 78% and 73% of their shares owned by institutions, respectively. Meanwhile, Palantir and Tesla have 56% and 48% owned by larger institutions. This could explain why Palantir's stock has reached such heights despite all fundamentals pointing toward those heights being dangerous.

So I still believe Palantir's stock is overvalued and ripe for a pullback in 2026. However, if it does nothing and stays on its upward trend, I wouldn't be too surprised, as market trends can be difficult to disrupt without a significant outside force.