After the markets close on Feb. 2, investors will get a look at how the artificial intelligence (AI) narrative is holding up as data analytics specialist Palantir Technologies (PLTR +0.34%) reports earnings for the fourth quarter and full year 2025.

Let's explore what investors should expect for Palantir as earnings season approaches and assess if now is a good time to load up on the stock.

Image source: Getty Images.

What should investors expect when Palantir reports earnings next month?

When Palantir reported third-quarter earnings back in November, management shared its outlook for the fourth quarter and full year 2025. Per the company's guidance, investors should expect revenue of $1.3 billion and adjusted operating income in the range of $695-$699 million for Q4.

For the full year, Palantir's revenue is expected to be around $4.4 billion, while adjusted operating income and adjusted free cash flow are forecast to be $2.2 billion and $2 billion, respectively.

Should Palantir meet these targets, it would represent revenue growth of 51% year over year while operating income and free cash flow would be rising by 100% and 60%, respectively.

NASDAQ: PLTR

Key Data Points

History is on Palantir's side

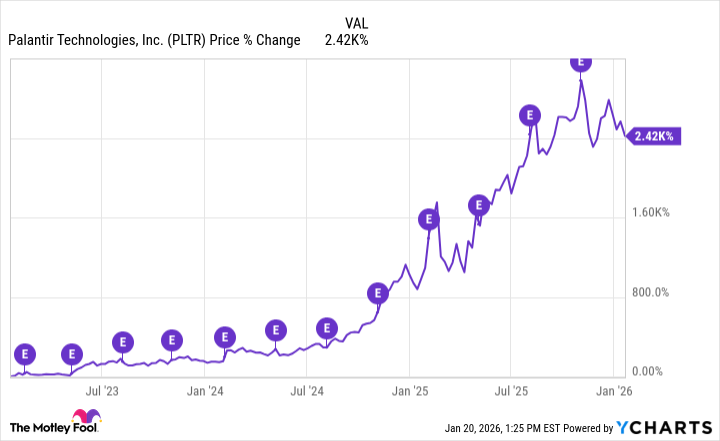

Throughout the AI revolution, Palantir stock has risen by more than 2,400%. As the chart below illustrates, the most pronounced spikes in Palantir stock have typically occurred after the company reports earnings (depicted by the purple circles). The reason behind this momentum is Palantir's ability to consistently beat Wall Street's expectations while simultaneously raising its own outlook quarter after quarter.

Is Palantir stock a buy before fourth-quarter earnings?

The biggest drawback to an investment in Palantir is its premium valuation. Even with shares down 5% so far in 2026, the company still trades at a historically elevated price-to-sales (P/S) multiple of 111.

That said, Palantir has demonstrated an uncanny ability to execute on lofty growth targets. Given that investments across the AI value chain are expected to accelerate over the coming years, I think Palantir is in a position to continue generating strong revenue and profit growth.

While trying to time your buys is not a hallmark of smart long-term investing, I see now as an interesting time to consider nibbling on Palantir stock prior to earnings given the company's track record.