Shares of AeroVironment (AVAV 1.40%) crashed over 20% this week, according to data from S&P Global Market Intelligence. The military drone maker and cyber warfare specialist fell after an unexpected work stoppage on a U.S. military project that could have large ramifications for its 2026 revenue and profitability. Despite this fall, AeroVironment's stock is up 70% in the past twelve months.

Here's why shares were falling this week, and whether it is a buy right now.

NASDAQ: AVAV

Key Data Points

Work stop order on satellite technology

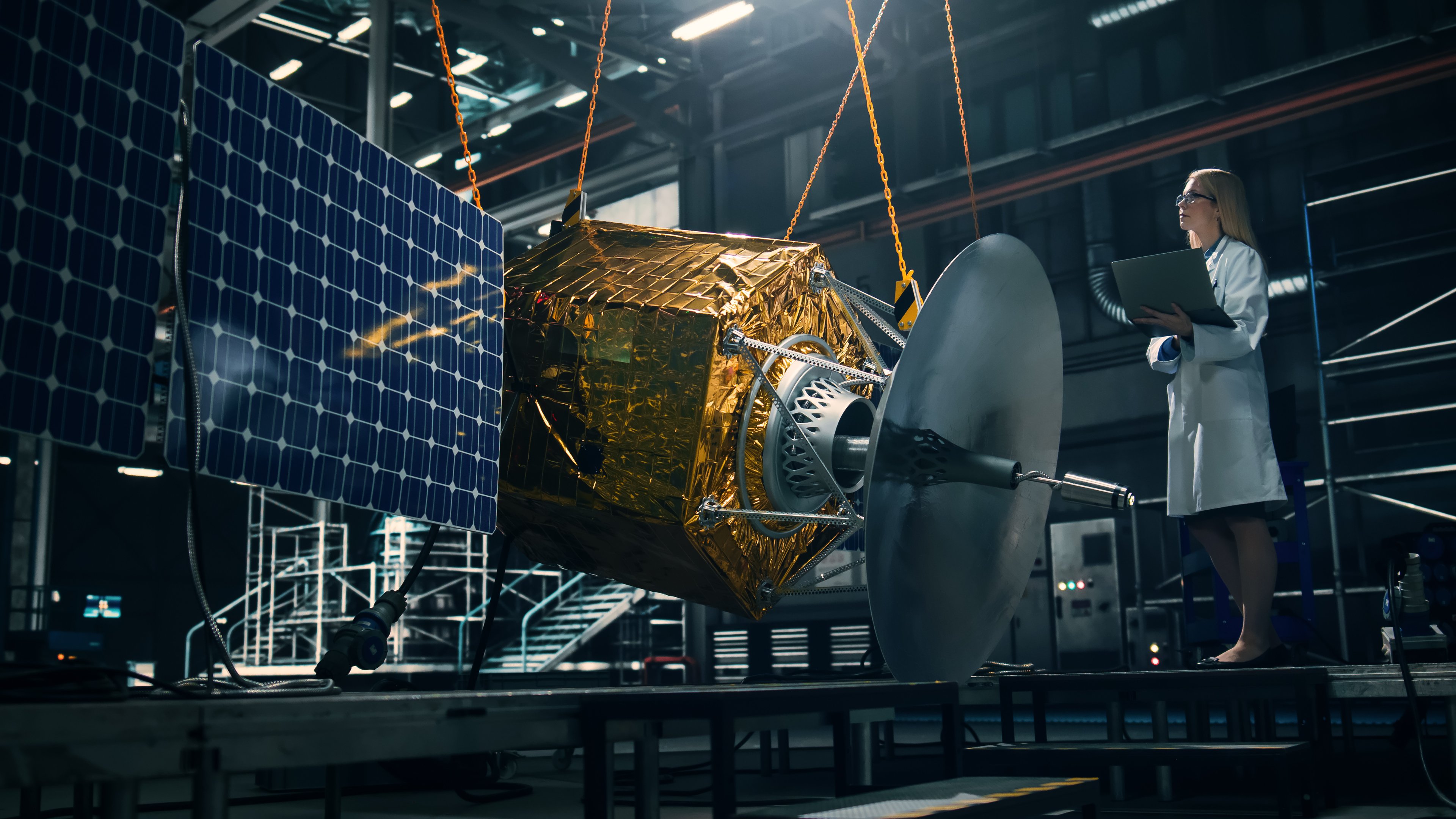

AeroVironment sells unmanned aircraft and drones to the U.S. military, with its "Kamikaze" drones gaining in popularity after the sustained Ukraine v. Russian war. Now, it is beginning to expand to satellite and cyber systems to ride the military spending wave in space with new projects such as the Golden Dome.

Its BADGER system is a ground support communication system for satellites that leverages new technologies to manage multiple small satellites in orbit, with built-in damage and jamming resistance. These new technologies are vital for the future of warfare, which is why AeroVironment's stock has soared in the last year on potential revenue opportunities from the U.S. Space Force.

Now, this week, the company has received a setback with the BADGER system, as the government has given it a work stop order for two systems in the disruptive project. The company is now going to renegotiate with the U.S. government due to new capabilities needed for these satellite management programs. Importantly -- and not a good sign for the business -- is the fixed price nature of these contracts. This puts the burden of profitability on the defense contractor instead of the U.S. military, meaning that if AeroVironment's development costs are too high, it may significantly hurt its profitability.

News of this has had AeroVironment's stock down this week. AeroVironment may earn hundreds of millions or even billions for this project, but it may come with little profit if things go wrong.

Image source: Getty Images.

Time to buy AeroVironment stock?

After this sharp drawdown, AeroVironment stock now trades at a market cap of $15 billion. Remember, it is still trading 70% higher than 12 months ago. It has a price-to-sales ratio (P/S) of 8.6, and is currently unprofitable. Revenue has grown around 250% in the last five years, but it is failing to generate positive operating earnings.

2026 may continue this trend of losing money for AeroVironment, which has investors worried about the stock. If cost overruns happen for the BADGER system, AeroVironment's stock price may fall further, making it risky to buy right now.