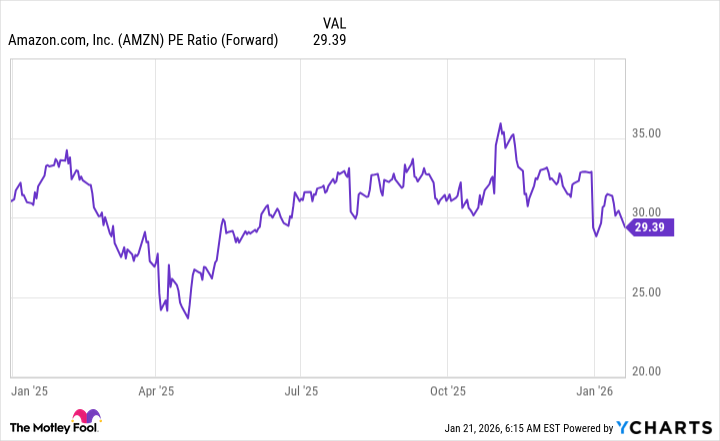

Amazon (AMZN +2.12%) shareholders had a disappointing year in 2025. I thought the company was going to have a strong year, mainly built on the back of its cloud computing unit, Amazon Web Services (AWS). While AWS had a successful year, my caveat regarding the stock was that it traded at an expensive price tag at the time: 44 times forward earnings.

This turned out to be Amazon's Achilles' heel in 2025, as it spent most of the year growing into its valuation. Amazon's stock only gained 5% last year, but its business posted strong growth. I think it's slated to have a much better 2026 now that its valuation has come down, and AWS is free to lead the stock higher.

Image source: Getty Images.

AWS' growth is starting to reaccelerate

Most investors fixate on Amazon's commerce business as a reason to own the stock. This is natural, as this is the part of the business that most people interact with frequently. Furthermore, AWS accounts for only 18% of Amazon's total sales, so it's just a fraction of Amazon's overall sales. But that's the wrong way of looking at it.

Amazon is a very diverse business, and the reality is that its commerce side doesn't make a ton of profit. This isn't anything new. Look at other retailers, and their financials will show you razor-thin profit margins. Cloud computing is a different business entirely. It has strong operating margins, with the third quarter coming in at 35%. So, despite AWS only making up a small chunk of Amazon's total business, it accounted for 66% of operating profits in Q3.

NASDAQ: AMZN

Key Data Points

As a result, I would consider AWS the most important part of the business, because it generates the majority of the profits. Furthermore, AWS' growth rate is accelerating. In Q3, its revenue increased by 20% year over year -- the best mark in several years.

If Amazon can continue accelerating this growth throughout 2026, I have no doubt the stock will catch fire and be one of the best to own, especially since the valuation issue that plagued it in 2025 is resolved.

Amazon's valuation is now in line with its big tech peers

In today's market, most big tech stocks trade for 30 times forward earnings. While this is a historically expensive price tag, it's the reality in today's market. Amazon's stock now trades for 29 times forward earnings, some of the lowest levels it has seen outside the tariff-related sell-off in early 2025.

AMZN PE Ratio (Forward) data by YCharts. PE = price-to-earnings.

I think this makes for an excellent buying opportunity, and I think Amazon's stock will succeed in 2026, mainly on the back of its dominant cloud computing business.