When you think of a U.S.-based rare-earth miner -- if you've ever found yourself thinking such a thing at all -- MP Materials (MP +1.58%) is probably the first mining stock that comes to mind. And while MP Materials certainly deserves its popularity -- it did, after all, ink a landmark $400 million deal with the Department of Defense -- USA Rare Earth (USAR +8.50%) might be the better growth opportunity right now.

Image source: Getty Images.

Like MP, USA Rare Earth is trying to build a domestic supply of rare-earth metals, with the end goal of manufacturing high-performance magnets.

Unlike MP, whose mining output is mostly light rare-earth elements, USA Rare Earth controls a deposit (the Round Top deposit in Texas) that is much richer in heavy earths, such as dysprosium and terbium. This could mean that USA Rare Earth fills a critical gap in the rare-earth supply chain.

NASDAQ: USAR

Key Data Points

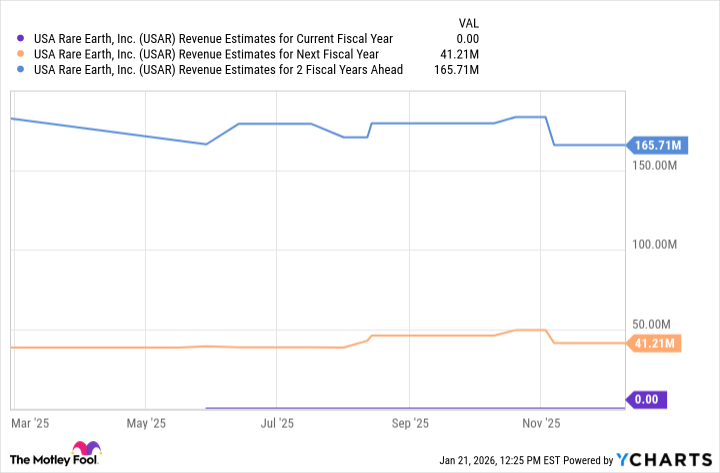

That said, USA Rare Earth is an early-stage development company. It doesn't generate meaningful revenue right now, and it likely won't for several years.

USAR Revenue Estimates for Current Fiscal Year data by YCharts

The company itself predicts that it will finish its first magnet factory in early 2026, while mining at Round Top will likely start in 2028.

As a pre-revenue company with no track record of mining, investors should expect turbulence as the company works to scale its mining and manufacturing capabilities. The stock's market cap is already about $2.5 billion, despite no revenue, and yet if it can build its mine-to-magnet supply chain as it plans, that valuation could look small in retrospect.

A $1,000 investment in the company today isn't without risks, and investors should weigh those risks carefully. But given the importance of high-performance magnets in the U.S. -- which are found in many everyday electronics and devices -- the company seems well-positioned to grow dramatically if it can scale its magnet production commercially.