The Nasdaq Composite has stitched together impressive overall gains of 111% in the past three years, outpacing the 74% jump in the S&P 500 over the same period. The Nasdaq's outperformance is a result of the technology sector's healthy growth, primarily driven by the adoption of artificial intelligence (AI) across multiple industries.

It won't be surprising to see the tech-focused Nasdaq Composite index head higher in 2026 as well. After all, global AI spending is poised to hit $2.5 trillion this year, according to Gartner. That would be a nearly 44% increase from last year. What's more, global AI spending is anticipated to jump by another 32% in 2027.

That's why now is a good time to take a closer look at a couple of tech stocks poised to benefit from higher AI spending in 2026 and potentially deliver healthy gains for investors.

Image source: Getty Images.

Applied Materials: Strong equipment sales can send this stock higher

Shares of semiconductor manufacturing equipment company Applied Materials (AMAT +1.16%) have jumped by 72% in the past six months. That's not surprising, as there is a healthy demand for chipmaking equipment driven by the robust demand for AI-specific semiconductors. Market research firm Omdia estimates that the semiconductor industry's revenue could increase by almost 31% this year to more than $1 billion.

NASDAQ: AMAT

Key Data Points

However, there is a shortage of both logic and memory chips, as evidenced by recent results from Taiwan Semiconductor Manufacturing and Micron Technology. This is why the demand for chipmaking equipment is set to jump in 2026. According to industry association SEMI, semiconductor equipment sales could increase to $145 billion in 2026 from $133 billion last year. However, don't be surprised to see a bigger increase.

TSMC, for instance, is on track to increase its 2026 capital expenditures (capex) by $13 billion at the midpoint of its guidance range. Micron, meanwhile, intends to take its capex to $20 billion in the current fiscal year from just under $14 billion in the previous fiscal year, an increase of $6 billion. So, the actual jump in semiconductor equipment spending this year could be much larger than SEMI anticipates.

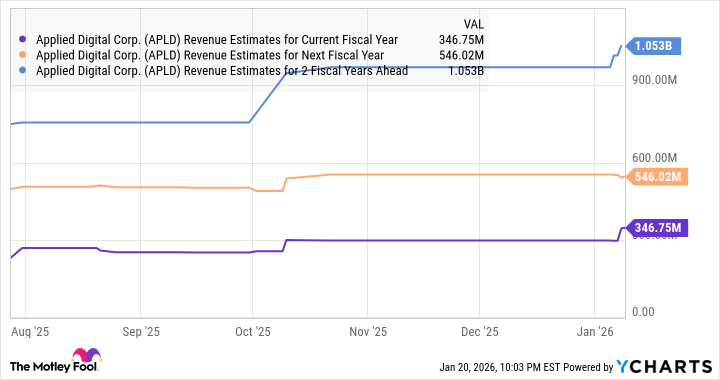

This could pave the way for potentially stronger growth at Applied Materials. The company's revenue in fiscal 2025 (which ended on Oct. 26) increased by 4% to a record $28.4 billion. Consensus estimates aren't projecting a major increase in Applied Materials' revenue in the current fiscal year, but they do expect its growth to pick up in the next one.

Data by YCharts.

However, don't be surprised to see Applied Materials exceeding expectations in the ongoing fiscal year, thanks to the favorable scenario in the semiconductor equipment space. With Applied Materials trading at 9 times sales right now, almost in line with the U.S. technology sector's average sales multiple, there is a chance this semiconductor stock trades at a premium multiple if it can outperform consensus estimates.

That could pave the way for more upside in this Nasdaq stock, which is why it may be a good idea to buy it before it jumps higher.

SentinelOne: AI is set to drive solid growth for this cybersecurity specialist

SentinelOne (S +0.67%) had a forgettable 2025. The share price of the cybersecurity specialist fell 32% last year, as the company was unable to satisfy Wall Street's quarterly expectations. It is worth noting that SentinelOne traded down around 19% in 2024 as well.

NYSE: S

Key Data Points

However, the pullback means that investors can buy this cybersecurity stock at 4.6 times sales and 38.6 times forward earnings. Doing so could turn out to be a smart move, as SentinelOne has been experiencing healthy growth in revenue and earnings, driven by the company's AI-focused offerings that are gaining traction among customers.

SentinelOne made a smart move last year by acquiring Observo AI for $225 million. The company made this move to boost its real-time threat-detection capability, contributing to SentinelOne's AI-powered Singularity product platform. Singularity is an AI-native platform that helps customers predict and address cyberthreats in advance using real-time data.

Importantly, SentinelOne management remarked on the company's December earnings call that Singularity is helping it win substantial contracts and build a robust revenue pipeline. The latest acquisition should help SentinelOne further strengthen this platform, potentially improving cross-sales opportunities and attracting new customers.

A look at the company's recent results for the third quarter of fiscal 2026 (which ended on Oct. 31) reveals that its revenue increased by 23% year over year to $259 million. Its remaining performance obligations (RPO), however, increased at a faster rate of 35% from the year-ago period to $1.3 billion.

RPO refers to the total value of contracts that a company has yet to fulfill at the end of a period. So, the bigger increase in this metric as compared to SentinelOne's revenue jump is proof that it is landing more business than it is fulfilling. The bigger contracts are also having a positive impact on its margin profile, boosting the non-GAAP (generally accepted accounting principles) net income margin to 9.6% in the previous quarter from breakeven in the year-ago period.

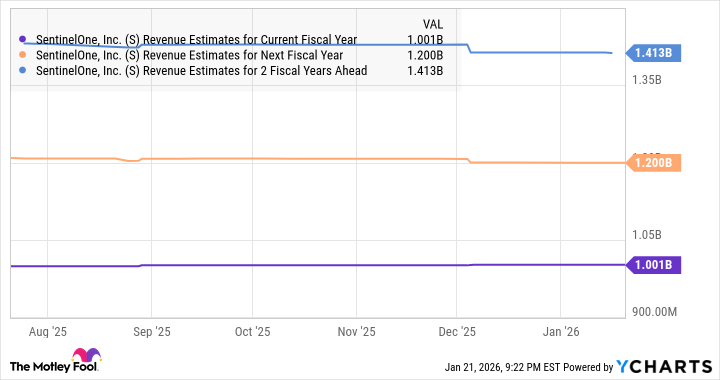

As such, it won't be surprising to see SentinelOne's growth outpacing expectations going forward, especially considering the impressive jump in its pipeline.

Data by YCharts.

Even better, the stock's 12-month median price target of $20.50 points toward a 48% jump from current levels, according to 39 analysts covering SentinelOne. The company could indeed achieve such gains, as it is pulling the right strings to capitalize on the AI-focused cybersecurity market, which is expected to nearly double in size this year to $51 billion, according to Gartner.