When thinking about the great investments of the last 40 years, athletic apparel company Nike (NKE +0.65%) would almost certainly make the list. But Nike shareholders haven't seen an all-time high since 2021, and their shares have lost over 60% of their value since then.

Nike stock would seem to be a bargain because the price per share has dropped so much. But the stock price alone doesn't actually tell the whole story. After all, if a stock trading at $100 per share was hypothetically worth $20 per share, it would still be overvalued if the price were cut in half.

Image source: Getty Images.

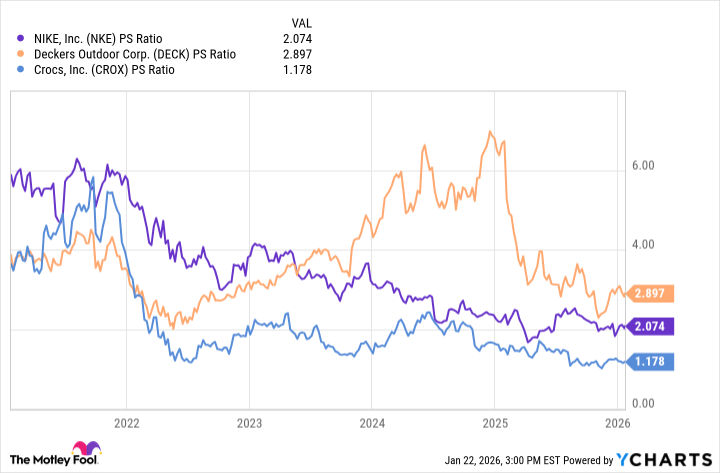

To be sure, the valuation for Nike stock is cheaper than it used to be. Within the last five years, it's traded at a price-to-sales (P/S) ratio of 6, whereas now it has a P/S ratio of 2. That's a lot better.

However, is Nike truly a bargain stock now? I don't think so; I think it's valued like a typical shoe stock. To support my opinion, I compare Nike's valuation with the valuations of Deckers and Crocs. Crocs is cheaper and has a significantly higher operating margin, making it the better deal in my view. For its part, Deckers has a higher valuation, but it's growing much faster than Nike, supporting a higher price tag.

NKE PS Ratio data by YCharts

Therefore, I don't believe investors should be overly excited about the opportunity in Nike stock today -- it looks more fairly valued, not incredibly undervalued.

However, even if it's not the steal of the century, Nike stock could still be a good investment today. It simply needs to find growth and boost margins.

What Nike needs to do to win for shareholders

To be a winning investment, Nike needs to grow its business, which will be a challenge for a company with a market cap of nearly $100 billion already. The first half of its fiscal 2026 ended on Nov. 30, and revenue for this six-month period was only up 1% year over year -- that's not going to be enough.

NYSE: NKE

Key Data Points

Nike's lackluster growth is problematic from a profit perspective. On the one hand, its costs of goods have gone up by 6% recently, leading to a significantly lower gross margin. Moreover, in the fiscal second quarter, management spent 13% more on demand creation, but sales only went up by 1%.

In short, Nike's sales have stalled, expenses are up, and spending to encourage customers to buy is barely moving the needle. This all needs to change if Nike stock is going to get back to its winning ways.

I'll leave shareholders with an encouraging thought: I believe new CEO Elliott Hill will do everything in his power to see Nike make a comeback. Hill worked for Nike for over 30 years, retired, and was then brought back in late 2024 as CEO. And he clearly wants to see Nike succeed.

Moreover, Hill actually seems to believe that Nike will succeed. For evidence, consider that Hill increased his position in Nike stock by about 7% on Dec. 29, using $1 million of his own money. That high level of confidence from the CEO could point to better days ahead.