Last year, both the S&P 500 (^GSPC +0.48%) and Nasdaq Composite (^IXIC +0.31%) soared to record highs -- notching double-digit returns for the third year in a row.

Sectors including technology, industrials, energy, and utilities are leading the stock market higher primarily thanks to tailwinds driven by artificial intelligence (AI). While the market's momentum looks unstoppable, smart investors may want to take a step back and assess the bigger picture.

Could the ongoing bull market rally come to a screeching halt in 2026?

Image source: Getty Images.

The S&P 500 is flashing a warning sign rarely ever seen

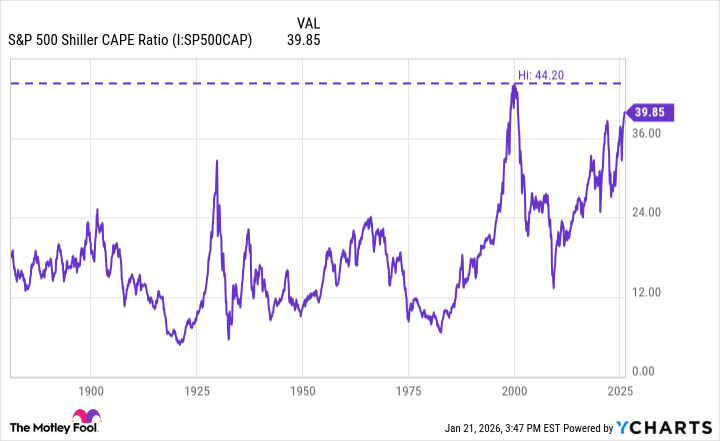

There are endless ways to analyze whether the stock market is overvalued or undervalued. One of the lesser-known methods is to look at the cyclically adjusted price-to-earnings (CAPE) ratio. Unlike a regular P/E multiple, the CAPE ratio takes historical trends into account as it captures 10 years of earnings results relative to how stock prices fluctuated over that same period.

S&P 500 Shiller CAPE Ratio data by YCharts

Currently, the CAPE ratio is about 40. Investors can see in the chart above that there are only two other times in history that the CAPE ratio hovered nearish this level.

In the late 1920s, the CAPE ratio reached levels in the mid-30s, while back in 2000 the indicator reached an all-time high of 44. In both instances, the same outcome occurred. Following soaring prices in the 1920s, the stock market crashed, leading to the Great Depression. Similarly, after sentiment around the internet boomed during the late 1990s, stocks eventually reached a ceiling as the dot-com bubble burst in spectacular fashion.

Will the stock market crash in 2026?

While the details above might suggest the stock market is destined to crash in 2026, there are more details to uncover.

First, the reality is that the S&P 500 is currently being propped up by 10 or so companies. The majority of these trillion-dollar businesses have already monetized the market's newest megatrend: AI.

This is a key point to understand, as many early adopters of the internet era never turned a profit. In other words, the profitability profile of the current AI supercycle stands in stark contrast to the dynamics of the dot-com bubble.

This is all to say that the gains seen in the S&P 500 over the last few years could be sustainable for the foreseeable future as the world's largest companies continue to accelerate growth in both their top and bottom lines.

In addition, the fact that the CAPE ratio has only hovered in its current range twice before isn't statistically significant. While epic crashes happened both times in the past, I think the current environment is quite different.

How should investors approach the market in 2026?

While history might suggest a sell-off will occur in 2026, the bigger idea to be thinking about is whether it could be a full-blown crash or a short-lived correction. In either scenario, investors could employ the same playbook.

For now, I think reducing exposure to speculative positions or unpredictable growth stocks is a prudent choice. Instead, smart investors should be building a diversified portfolio featuring blue chip businesses with resilient, durable business models complemented by a healthy cushion of cash.

This structure will insulate your portfolio from outsize losses should a sell-off occur, while also positioning you to benefit from ongoing bullish themes for the long run.