The Magnificent Seven technology stocks offered investors spectacular performance in recent years and powered the S&P 500 higher. This is thanks to these market giants' well-established track records of earnings growth in businesses ranging from e-commerce to cloud computing, and their potential for more growth ahead. Many of these players also are leading the way in the high-growth area of artificial intelligence (AI), and that could spark a whole new era of explosive earnings gains in the years to come. And in some cases, we've already started to see AI-linked successes.

Now, as 2026 begins, investors might be wondering about this group's potential performance in the months to come. The following three AI powerhouses may score the biggest win. Let's find out why...

Image source: Getty Images.

1. Nvidia

Nvidia (NVDA +0.84%) is the world's leading AI chip designer, making the most sought-after graphics processing units (GPUs). These products drive crucial AI tasks, helping large language models (LLMs) "learn" and go on to solve real-world problems. This has resulted in double- and triple-digit earnings growth for the company in recent years, with earnings reaching record levels.

This year could be another big one for Nvidia because, in recent times, data center customers have been ramping up their capabilities to meet current and expected demand. In fact, Nvidia predicts that AI infrastructure spending may reach as much as $4 trillion over the next few years. Nvidia is perfectly positioned to benefit because, as part of the buildout, GPUs and related products are key elements. So this ramp-up should result in significant growth for Nvidia as of this year.

NASDAQ: NVDA

Key Data Points

Nvidia stock isn't cheap at 40x forward earnings estimates, but this level is reasonable considering the points I've mentioned here, and it leaves room for Nvidia to run this year and beyond.

2. Alphabet

Alphabet (GOOG +1.17%) (GOOGL +1.25%), as a leading cloud service provider, already has brought in billions of dollars in revenue as customers seek out generative AI and infrastructure. The company provides these elements that are much in need right now and should continue to be in high demand as this AI story unfolds.

NASDAQ: GOOGL

Key Data Points

This player, through Google Cloud, offers customers access to top platforms from providers such as Nvidia, but Alphabet also has developed its own LLM, Gemini, and its own AI chips too. So the company is a developer of AI, a seller of AI products and services, and Alphabet is benefiting from its own use of AI -- for example, it's using Gemini to improve Google Search, a move that may keep us loyal to the popular search engine and, as a result, drive advertisers to increase spending here to reach us.

Alphabet is among the cheapest of the Magnificent Seven stocks, trading for 29x forward earnings estimates, a point that may prompt investors to give this stock a try in 2026.

3. Meta Platforms

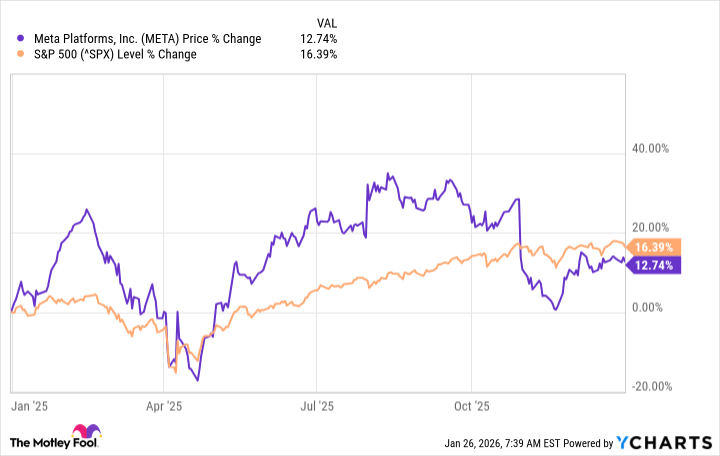

While Meta Platforms (META 0.49%) climbed last year, it still underperformed the S&P 500, and its gains paled compared to many other AI players.

Investors have worried that any potential slowdown in demand may hurt players that have been investing heavily, and these concerns may have weighed on appetite for Meta shares. But it's important to consider comments from chief Mark Zuckerberg. In the most recent earnings call, he said that if there were to be any slowdown, Meta could slow spending and grow into its capacity.

You probably know Meta best for its social media apps, from Facebook to Instagram, but the company's focus on AI in recent years has positioned it as a key player in the AI race. Like Alphabet, Meta generates revenue from advertising -- and as AI improves its business as well as the advertising experience, advertisers may lift their spending here.

Meanwhile, Meta is the cheapest of the Magnificent Seven stocks as it trades for 21x forward earnings estimates -- so as some AI investors look to rotate out of certain high-flying stocks, they may appreciate the potential and dirt cheap price of Meta. And all of this could make Meta one of the biggest Magnificent Seven winners of 2026.