Thanks to the rise of big tech and broader technology advancements, growth stocks have been the most popular on the market over the past decade or so. They get much more attention than dividend or value stocks, and in many cases, they're more lucrative, too.

That said, not all growth stocks are created equal. Even with the flash, headlines, and big promises, some growth stocks haven't fully proved they have what it takes to succeed long term. In other cases, their long-term success is a relatively safe bet.

If you're looking for growth stocks that fall into the safe bet bucket, look no further than these two. It won't always be smooth sailing, but I trust their long-term trajectory.

Image source: TSMC.

1. Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM 1.31%) (TSMC) can sometimes slide under the radar, but much of the technology people use daily relies on the company's ability. It manufactures semiconductors (chips) used in many items, from smartphones to laptops to TVs to data centers.

NYSE: TSM

Key Data Points

TSMC is a good long-term option because of its competitive moat. If manufacturing chips were easy, most major tech companies with billions to spare would be making their own chips instead of relying on TSMC. Unfortunately, it's not easy. It's much more cost-effective and reliable to rely on TSMC to do it.

Advancing in semiconductor manufacturing requires tens of billions of dollars spent yearly on research and development, factory development and maintenance, and a highly skilled workforce. That's why TSMC has managed to keep its industry leadership for quite a while.

Its market share is around 72%, but it's much higher for advanced chips, such as those used in artificial intelligence (AI)-related hardware. Mega companies like Nvidia, Apple, and Amazon have long-term contracts with TSMC. This is key to sustainability because it's a steady stream of revenue. It's also not easy to switch manufacturers because chips are designed around a certain factory's process, so companies would rather pay a premium and stay with TSMC.

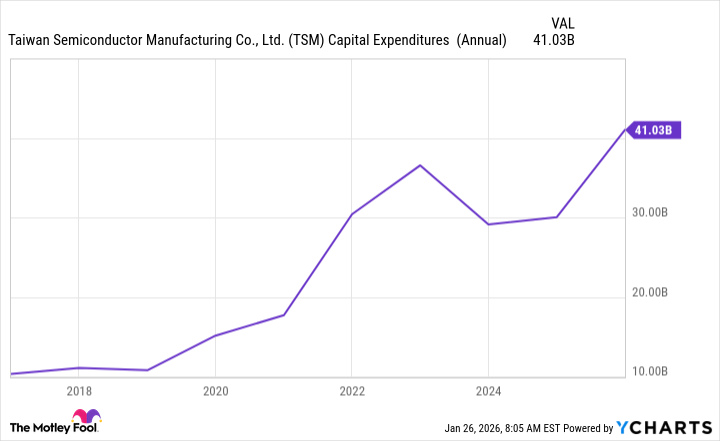

Even with its leadership position, TSMC hasn't gotten complacent and continues to invest a lot in expanding its capabilities. In 2026, it expects to spend between $52 billion and $56 billion on capital expenditures (capex). This mindset gives me confidence that TSMC will be here for the long haul.

TSM Capital Expenditures (Annual) data by YCharts

2. CrowdStrike

It's hard to overstate the importance of cybersecurity in today's digital world. It's essentially insurance for businesses: pay a consistent fee now to avoid paying a much larger fee later -- financially and reputationally.

CrowdStrike (CRWD 5.95%) is a cybersecurity company that has shown it has some of the best tools on the market. It's routinely recognized for its ability to protect network-connected devices (phones, laptops, tablets, etc.).

CrowdStrike's growth continues to be impressive, with the company consistently growing revenue (subscription and total), profit, earnings per share, and free cash flow. Just as encouraging as the current growth, though, is just who's using CrowdStrike. It protects 300 of the Fortune 500, 543 of the Fortune 1,000, and major companies across different sectors.

Having major corporate customers is key to longevity because they tend to sign long-term contracts, and switching costs between cybersecurity providers are high due to expenses and the overall technical complexity.

According to McKinsey & Company, the cybersecurity industry could grow to $2 trillion. CrowdStrike obviously won't be the only beneficiary from this growth, but it'll be a major one. The $1.2 billion in revenue it reported in the third quarter will look modest compared to what it can be years down the road at or near its current pace.

NASDAQ: CRWD

Key Data Points

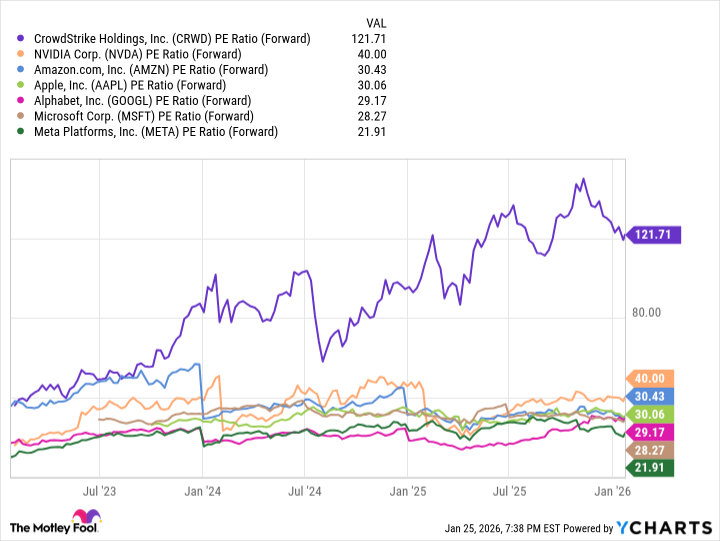

One thing to be cautious about with CrowdStrike is how expensive the stock has become. It's currently trading at more than 121 times its projected earnings for the next 12 months. That's much more expensive than some of the world's top-tier tech companies.

CRWD PE Ratio (Forward) data by YCharts

CrowdStrike's high valuation means there are a lot of investor expectations, and if it begins not meeting those (justified or not), the stock could see a lot of volatility or a pullback.

However, if you're investing for the long term, this isn't as much of a problem. I would use dollar-cost averaging to slowly but surely increase my stake in CrowdStrike.