Tech goliaths Amazon (AMZN 0.53%) and Alphabet (GOOGL +0.71%)(GOOG +0.75%) spent years developing artificial intelligence. But the arrival of OpenAI's ChatGPT in November 2022 was still a seismic shift for the technology industry.

In this emerging AI era, industries are being reinvented, and new companies are rising to challenge established players. Even in this dynamic environment, Amazon and Alphabet are adapting quickly and already showing signs of AI success.

But is one of these conglomerates a better long-term investment in artificial intelligence?

Image source: Getty Images.

How Amazon benefits from AI

Amazon is in an excellent position to capitalize on artificial intelligence. It's known as an e-commerce giant, but arguably its greatest AI advantage is its Amazon Web Services (AWS) division.

AWS is the world's cloud computing leader, with a 29% share of the market. This helped the division produce third-quarter revenue of $33 billion, up 20% year over year. That income is poised to grow significantly in the coming years thanks to AI.

Artificial intelligence systems are housed in cloud computing data centers. As increasingly sophisticated AI capabilities -- for example, agentic AI -- emerge, the need for more computing power increases. This has led to massive demand for services such as AWS.

Industry estimates predict that the AI infrastructure market will expand from $59 billion in 2025 to $356 billion by 2032. Amazon is capturing its share of this market. In November, it signed a multi-year, $38 billion deal with OpenAI to provide computing capacity.

In addition to AWS, Amazon is injecting AI across its businesses. The company is a pioneer of recommendation technology that suggests products customers may be interested in. AI is supercharging this ability, enabling deeper, more personalized suggestions while continuously improving what's presented to customers.

An indicator that Amazon's AI investments are succeeding is rising retail revenue. Its North American and international divisions both posted double-digit year-over-year sales growth, resulting in total Q3 net sales of $180.2 billion, up 13% from 2024.

NASDAQ: AMZN

Key Data Points

Alphabet's AI success

The debut of OpenAI's ChatGPT was thought to be the catalyst that would erode Alphabet's Google Search dominance. Three years into ChatGPT's launch, Google's strength remains intact.

Alphabet injected AI into its search engine, and the results are affecting the internet economy. Many users now get their search queries answered by AI, then leave Google rather than visiting websites for answers. This caused upheaval for numerous website publishers, who experienced visitor traffic drops of 30% to 40%.

Meanwhile, Google usage is increasing. Alphabet CEO Sundar Pichai stated: "AI is driving an expansionary moment for Search. As people learn what they can do with our new AI experiences, they are increasingly coming back to search more."

As a result, AI drove strong revenue growth. In Q3, sales soared 16% year over year to $102.3 billion, as Google's Search income increased.

Google isn't Alphabet's only division benefiting from AI. The conglomerate's Google Cloud service, which is the third largest cloud provider with a 13% market share, experienced 34% year-over-year sales growth to $15.2 billion. Google Cloud is positioned to benefit from the same AI infrastructure tailwind as AWS, and its sales should continue to grow as a result.

NASDAQ: GOOGL

Key Data Points

Choosing between Amazon and Alphabet stocks

With each company seeing success from AI, the ideal strategy is to invest in both. But if you had to pick one, the choice comes down to your preferences and goals as an investor.

Alphabet has an edge over Amazon for income-oriented investors because it delivers a modest dividend, currently yielding 0.25%. Amazon doesn't offer a dividend, which makes sense given its more cash-intensive retail business.

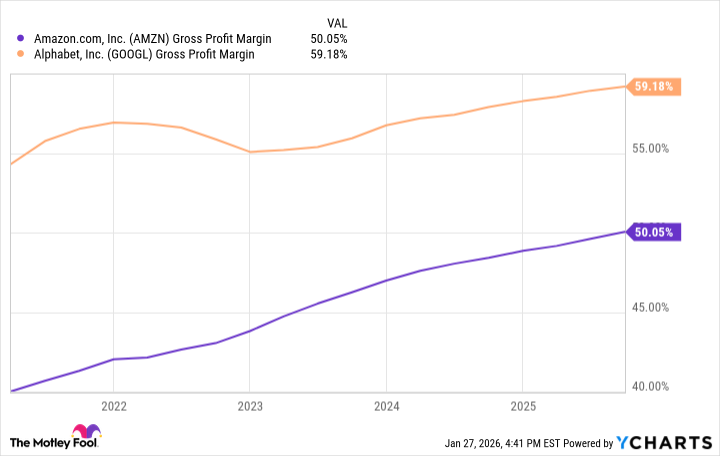

Since Amazon's retail operations incur higher operating costs, Alphabet sports the superior gross profit margin, and it's grown steadily over time.

Data by YCharts.

That said, the chart reveals that the advent of AI has enabled Amazon to improve its margins, thanks to AI-driven cost optimizations. Moreover, its leading market share in the expanding AI infrastructure sector gives it an edge over Alphabet's Google Cloud.

Amazon is also involved in many industries that benefit from AI. Artificial intelligence is improving Amazon's army of over a million robots, strengthening its logistics operations. The conglomerate is developing a self-driving car service called Zoox, which relies on an AI driving system.

Ultimately, both companies are excellent long-term holdings with strong AI capabilities. Investing in either is a great way to gain exposure to the game-changing artificial intelligence industry.