Since the start of 2025, Intel (INTC 1.03%) has been one of the best-performing big tech stocks on the market. The stock is up over 170% in that time (through Jan. 22), with a large chunk of that gain coming after mid-September. Like many tech companies, Intel can thank the current artificial intelligence (AI) supercycle for much of this turnaround.

As the hardware side of AI becomes more vital with hyperscalers (companies like Microsoft, Alphabet, and Amazon) writing big checks, semiconductor companies are in a good spot to capitalize. Although Intel is one of them, there's a company I wouldn't hesitate to choose over it.

Image source: Getty Images.

What has been going right for Intel lately?

A few years ago, Intel decided to fully throw its hat into the semiconductor ring and become a foundry-first company. It's a move that many felt was needed, but weren't 100% sure the massive costs would justify the results anytime in the foreseeable future.

One major win has been Intel's breakthrough with its "18A" manufacturing process, which allows it to produce more powerful and efficient chips. It's one of Intel's more encouraging wins in quite a while, fueling investor optimism.

Unfortunately, this breakthrough won't immediately translate to Intel's balance sheet, at a time when it could use some growth. In 2025, Intel generated $52.9 billion in revenue, slightly below the $53.1 billion it made in 2024 and the $54.2 billion it made in 2023.

NASDAQ: INTC

Key Data Points

A better option to consider over Intel

Much of Intel's foundry business success will rest on its ability to secure a major contract. It's firmly in the "prove it" stage. Broadcom (AVGO 1.37%), on the other hand, is not.

With a market cap of over $1.5 trillion (as of Jan. 22), Broadcom is the ninth-most-valuable public company in the world and a semiconductor industry staple. It also has major contracts with companies like Alphabet, Apple, and Meta.

Broadcom's role in the AI supply chain is primarily building customer AI accelerators and networking chips. AI accelerators are important because they handle a lot of work in training AI, and networking chips are used to move massive amounts of data. Without both, AI's scale would be limited.

NASDAQ: AVGO

Key Data Points

During the next phase of AI spending, Broadcom is well positioned to benefit from increased demand. That could be a nice boost for a company that increased its revenue ($63.8 billion total) and net income ($23.1 billion total) by 24% and 292%, respectively, in its latest fiscal year (ended Nov. 2, 2025).

Even when the current AI spending spree is over, Broadcom's business will still be in good shape. This AI supercycle is an added bonus, but Broadcom's long-term success doesn't depend on it to keep the lights on.

You're getting a better value with Broadcom

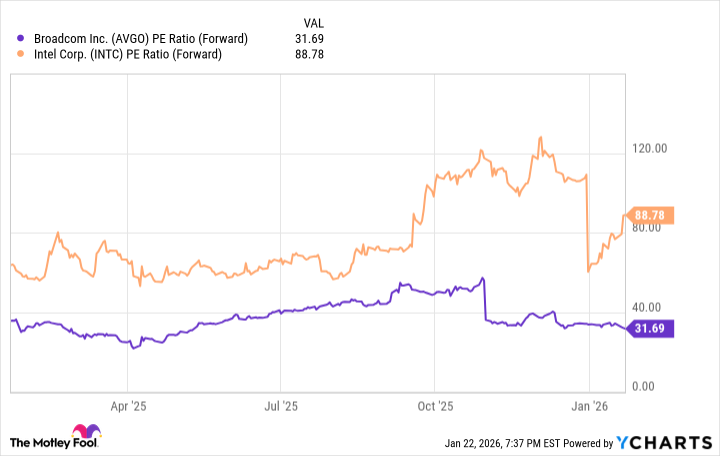

As of market close on Jan. 22, Intel was trading at 88.7 times its projected earnings over the next 12 months. This is expensive by even the loosest of standards. Broadcom is trading well under half ot that.

AVGO PE Ratio (Forward) data by YCharts

At its current valuation, there is undoubtedly a lot of optimism and growth priced into Intel's stock. One sniff of disappointment and many investors are bound to jump ship. That's been the name of the game during much of the recent AI developments.

A good example would be when Intel reported its full-year earnings on Jan. 22. Disappointing results and guidance led to the stock plunging 11% after hours.

To be fair, Broadcom's stock isn't cheap either. It's priced higher than many other big-name tech companies, but it's backed by the money it's making. I'd trust paying for that value over Intel's more speculative story without question.