One of the biggest players in the artificial intelligence (AI) market that's benefiting from strong demand for semiconductor chips is Taiwan Semiconductor Manufacturing (TSM 0.80%). The company is the go-to manufacturer for chips, and when there's an influx of demand, its sales take off.

Business has been booming for Taiwan Semiconductor, which is evident in the company's recent quarterly results. The stock has been a hot buy and a top option for AI investors looking to profit from the growth related to next-gen technologies. Recently, however, it hit a new all-time high, and it has now risen by 50% in just the past 12 months; is it too late to invest in the tech company?

Image source: Getty Images.

Taiwan Semiconductor's bottom line rose by 35% last quarter

When it comes to contract chip manufacturing, Taiwan Semiconductor is hard to beat due to its lean operations. While its revenue growth rate of 21% may not have looked particularly impressive in its most recent quarter (which ended on Dec. 31, 2025), what stood out was its profit growth -- net income rose by a remarkable 35%. This is also now the eighth straight period in which the company's bottom line has increased on a year-over-year basis.

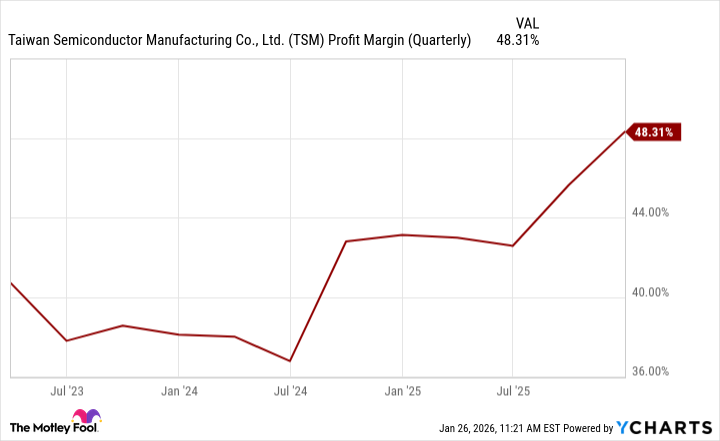

TSM Profit Margin (Quarterly) data by YCharts

Taiwan Semiconductor's strong and growing profit margins make it a promising business to invest in for the long haul, as rising earnings can make the stock seem less expensive over time.

The stock's market cap may be rising, but its valuation remains attractive

At around $1.7 trillion in market cap, Taiwan Semiconductor is among the most valuable companies in the world. But it's always important to take that into context and consider its overall earnings.

And using the price-to-earnings (P/E) multiple can be a helpful way to gauge just that. Taiwan Semiconductor's forward P/E, which is based on analyst estimates for how the business will do in the year ahead, is around 26. That's a bit higher than the forward P/E of 22 that the S&P 500 averages. But for a leading tech company that's in a great position to benefit from AI-related growth, it's arguably not that significant a premium to be paying for Taiwan Semiconductor.

NYSE: TSM

Key Data Points

Although the stock hit a new all-time high recently, it may not necessarily be too late to invest. Taiwan Semiconductor can still possess far more upside in the years ahead, with more growth related to AI likely to come.