There are several ways to benefit from the fast-growing demand for artificial intelligence (AI) technology. From chip designers to semiconductor foundries to power companies to software specialists, investors are spoiled for choice if they are looking to make money in AI.

Companies such as Palantir Technologies, Nvidia, Broadcom, and others have become popular among investors looking to capitalize on the AI boom. That's not surprising, as these companies are the leaders in their respective markets.

But there's one company that has outperformed all of them in the past year and has the potential to beat its more illustrious tech peers once again in 2026: Ciena (CIEN 0.80%).

Let's look at the reasons why Ciena could be one of the best AI stocks to buy for 2026 and the long run.

Image source: Getty Images.

Ciena is a key player in the AI hardware ecosystem

Ciena manufactures optical networking components, routers, and switches that enable high-speed data transmission in telecom networks, enterprise networks, and data centers. It also offers software services that enable customers to automate and monitor their networks.

NYSE: CIEN

Key Data Points

The advent of AI has supercharged the demand for Ciena's products. That's because high-speed data transmission holds the key to handling huge data sets that enable AI model training and inference applications. For instance, a powerful data center graphics processing unit (GPU) can be hamstrung by slow data transmission and unable to perform to its potential.

This explains why customers such as Meta Platforms have flooded Ciena with orders for its components. The company received $7.8 billion worth of orders in fiscal 2025 (which ended on Nov. 1). That was well above the $4.8 billion revenue that Ciena generated during the year. The company is therefore receiving new orders faster than it is fulfilling them.

Not surprisingly, the company's growth is set to accelerate in fiscal 2026 following a 19% spike in its top line last year.

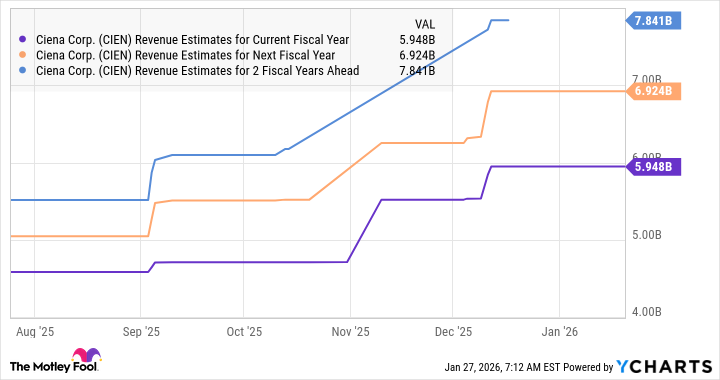

Data by YCharts.

The chart also shows that analysts have become bullish about Ciena's prospects over the next couple of fiscal years. That's not surprising, as the data center networking market is poised to grow by 4x through 2033, driven by the increasing adoption of AI, according to Grand View Research.

Ciena has been capturing a bigger chunk of this market. Its share of optical networking reportedly increased by four percentage points last year to 22%, according to Bank of America. The strong backlog indicates that it could keep gaining share in 2026, potentially paving the way for more upside.

The stock can keep soaring this year

Ciena stock has shot up an impressive 140% in the past year. Even then, it trades at 7 times sales, a discount to the U.S. technology sector's average sales multiple of 8.7. Assuming this AI stock trades in line with the index's average in the future and achieves $6 billion in revenue this year (as seen in the chart), its market cap could hit $52 billion.

That's a potential jump of 57% from current levels, indicating that Ciena's red-hot rally is here to stay in 2026.