Meta Platforms (META 2.96%) has been a big winner in the AI era, up 8x since the stock bottomed out in 2022, and its latest results delighted investors.

Revenue jumped 24% in the fourth quarter to $59.9 billion. Ramped-up spending weighed on margins, but investors had expected that, and net income still rose 9% to $22.8 billion, or $8.88 per share.

Looking ahead, Meta also issued better-than-expected revenue guidance for the first quarter, calling for $53.5 billion-$56.5 billion on the top line, up 30% from the quarter a year ago, which includes a 4% foreign currency tailwind. That would be its fastest quarterly growth in five years.

In addition to the strong headline numbers, Meta is on the verge of a milestone that few would have thought possible five or ten years.

Its advertising revenue could surpass that of Alphabet's (GOOG 0.02%) (GOOGL 0.05%) Google Search as soon as this year. Here's how.

Image source: Getty Images.

Meta stakes its claim to the advertising throne

Nearly all of Meta's revenue comes from advertising. It finished 2025 with $201 billion in revenue, of which $196.2 billion was from advertising.

Despite the attention on Meta's adventures in reality labs and the metaverse, as well as new gadgets like Quest headsets and Ray-Ban smart glasses, its business is nearly entirely driven by advertising on its social media platforms, Facebook and Instagram.

Ad revenue rose 22% last year and based on its guidance for the first quarter, its growth seems likely to accelerate in 2026. On the earnings call, CFO Susan Li credited the AI-driven improvements the company had made to its advertising product, adding, "They're driving strong conversion growth."

Based on Meta's guidance of 30% top-line growth for Q1, which includes a 4% foreign currency tailwind, a 28% growth rate in the ads business seems like a reasonable estimate for the full year, which would get its advertising revenue to $251.1 billion for 2026.

Alphabet hasn't announced full-year results for 2025 yet, but through the first three quarters of 2025, it reported $161.4 billion in revenue, up 12%, in the Google Search & other category.

If we assume that fourth-quarter revenue grows at the same rate, it would finish 2024 with $222 billion in revenue. If that grows another 12% in 2026, it would reach $248.7 billion in revenue, slightly below the forecast above for Meta.

NASDAQ: META

Key Data Points

Does Meta have the advertising advantage over Alphabet?

Alphabet investors have likely noticed that this isn't an apples-to-apples comparison. Search isn't Alphabet's only advertising business. It also has YouTube and Google Network, which refers to its business running ads on third-party websites.

Including those two segments, Alphabet will bring in more than $300 billion in ad revenue this year, giving it a comfortable cushion over Meta. However, the trend between the two companies is still the same, and if that holds up, it's only a matter of time, likely within a few years, that Meta surpasses Alphabet's entire advertising business.

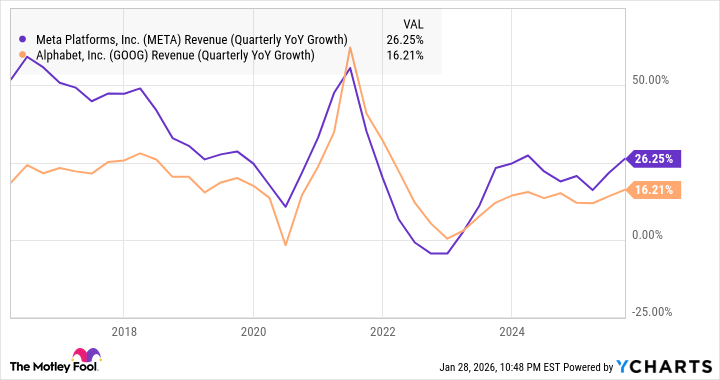

The chart below shows overall revenue growth at both companies, and you can see that Meta has outgrown Alphabet in nearly every quarter of the last decade, with the exception of the post-pandemic hangover period, so Meta seems like a good bet to continue outgrowing Alphabet.

META Revenue (Quarterly YoY Growth) data by YCharts

What it means for Meta

Alphabet has overcome earlier worries that its advertising business would be cannibalized by AI chatbots, and the stock has soared over the last six months in part on the strength of Google Gemini, its new chatbot.

However, as far as advertising is concerned, Meta's social media-based business model appears to have a significant edge in the AI era. The company has used AI to improve ad targeting on Facebook and Instagram and introduced generative AI tools that advertisers can use to create ads.

Alphabet, meanwhile, seems to have been forced to play defense with AI in advertising. It's introduced AI overviews in search, but that seems to be more about defending its market share from ChatGPT and other challengers, rather than using it to grow its ad business.

In the AI era, Meta looks likely to become the world's biggest advertising business. That's not a knock on Alphabet, which is driving growth in a number of its businesses, including advertising, but Meta's rapid growth in advertising is making it a winner, and AI has become a significant tailwind for the company in its core business. Regardless of when it outruns Alphabet, that's a good reason to bet on Meta to be a market-beater this year and beyond.