Artificial intelligence (AI) has been a driving force behind the stock market in recent years, primarily driven by the productivity gains that this technology is anticipated to deliver for companies and users adopting it.

Market research firm IDC estimates that AI could contribute a whopping $22.3 trillion to the global economy by the end of the decade. The firm adds that each dollar spent on AI services and solutions could generate $4.90 in economic value. As a result, don't be surprised to see AI stocks soaring in the long run.

It is worth noting that companies like Nvidia and Palantir Technologies have made investors significantly richer in recent years because of their AI connections. Of course, betting on a few AI stocks and expecting them to make you a millionaire is not the right approach, as any potential weakness in the adoption of this tech could hurt your portfolio.

But buying top AI stocks as a part of a diversified portfolio could help investors achieve their long-term goals. That's why investors might want to take a closer look at Palo Alto Networks (PANW +0.44%) and Broadcom (AVGO +0.15%), two fast-growing companies that could deliver substantial gains in the long run.

Image source: Getty Images.

Soaring AI-fueled cybersecurity demand will be a tailwind for Palo Alto Networks

The rapid proliferation of AI will provide a significant boost to the cybersecurity market. Precedence Research anticipates the AI cybersecurity market's size to jump by 5.5x over the next decade, generating $168 billion in revenue in 2035. This robust growth will be fueled by the need to secure AI applications, as well as the adoption of AI-powered cybersecurity tools for preventing, detecting, and remediating threats.

Palo Alto Networks already benefits from the AI cybersecurity market. The company's Prisma AIRS platform, which allows enterprises to secure AI applications, agents, models, and data through the entire lifecycle of development to deployment, is a hit among customers. Palo Alto points out that the number of deals for its Prisma AIRS platform jumped by more than 100% sequentially in the first quarter of fiscal 2026 (which ended on Oct. 31, 2025).

The company has adopted a strategy of consolidating its multiple cybersecurity offerings, including AI tools, into a single platform. Palo Alto believes that its platformization strategy will help its customers improve the efficiency of their cyber defenses, as they won't need to buy different products for different applications. The good news is that customers are buying into this strategy, moving away from competitors and opting to secure their entire operations with Palo Alto.

NASDAQ: PANW

Key Data Points

Palo Alto saw a 32% year-over-year increase in platformizations in the fiscal first quarter. This strategy is helping the company sign bigger deals, which is evident from the 24% year-over-year growth in remaining performance obligations (RPO) during the quarter to $15.5 billion. RPO is the total value of contracts that a company has yet to fulfill, and the faster growth in this metric, as compared to the 16% growth in Palo Alto's revenue, indicates that its future pipeline is getting stronger.

Not surprisingly, Palo Alto has raised its fiscal 2030 annual recurring revenue (ARR) guidance by a third to $20 billion. The company estimates its total addressable market (TAM) at a whopping $300 billion by 2028, indicating that it is scratching the surface of a tremendous opportunity. As such, investors looking to construct a million-dollar portfolio will do well to take a closer look at this cybersecurity stock, as its growth could accelerate in the future due to a huge addressable opportunity and its improving revenue pipeline.

Broadcom has become a key player in AI chips

While Nvidia is the dominant player in the AI chip market, Broadcom is the second-most important player in this market with its custom processors.

NASDAQ: AVGO

Key Data Points

The custom AI processors that Broadcom manufactures have impressive traction at hyperscalers and AI companies because of their cost efficiency and computing performance. According to Bloomberg, the market for custom AI processors could grow at an annual rate of 27% through 2033, generating $118 billion in revenue at the end of the forecast period.

Broadcom is the biggest company that designs custom AI processors, and it is expected to maintain its dominance in the long run. Bloomberg estimates that Broadcom could control 60% to 80% of the custom AI processor market in 2033, driven by a solid clientele that includes companies like Alphabet, Meta Platforms, and OpenAI.

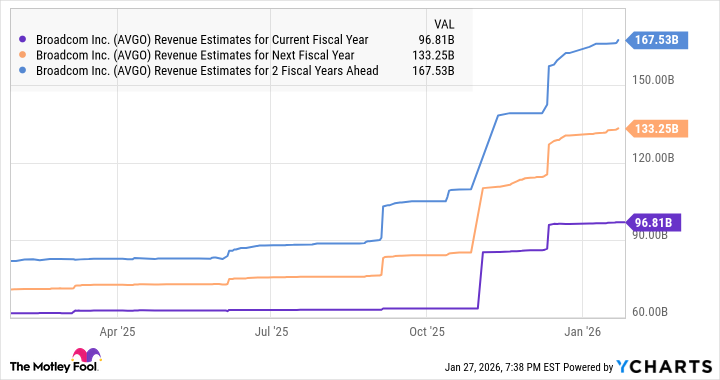

Broadcom's AI revenue could hit nearly $83 billion in 2033, assuming a custom AI processor market share of 70%. That would be a jump of over 4x when compared to Broadcom's AI revenue of $20 billion in the previous fiscal year. The solid growth in Broadcom's AI semiconductor business explains why analysts anticipate the company will become much bigger going forward.

Data by YCharts.

Broadcom reported $64 billion in revenue in fiscal 2025 (which ended in November 2025). So, the company's top line is on track to increase by over 2.5x in just three years. It can sustain its robust growth momentum in the long run as well due to the terrific growth opportunity in custom AI chips. Broadcom looks like a worthy semiconductor stock to buy right now as its impressive growth is likely to translate into solid stock market upside in the long run, making it an ideal pick for investors looking to construct a million-dollar portfolio.