While growth stocks often steal the headlines, ultra-high-yield dividend stocks with a strong track record of dividend stability and growth are among the most powerful tools for building real wealth. If your goal is to build a secure passive income stream for 2026 and beyond, here are five top high-yield stocks to buy right now.

Image source: Getty Images.

1. Enterprise Products Partners: 6.4%

Enterprise Products Partners (EPD 1.10%) is among the largest midstream energy companies in the U.S., with a pipeline spanning 50,000 miles. 2026 is a major inflection point for the pipeline stock. After spending nearly $4.5 billion on organic growth projects in 2025, Enterprise expects its capital spending to drop to $2.5 billion in 2026.

As new projects come online and capital expenditures (capex) taper, Enterprise will have more cash to return to its shareholders. It has already expanded its share repurchase program from $2 billion to $5 billion, and large dividend increases could be next in line. Enterprise has increased its dividend for 27 consecutive years.

2. Realty Income: 5.3% yield

Realty Income (O +1.07%) pays a dividend every month and has increased it for 113 straight quarters. As a real estate investment trust (REIT), Realty Income is required to distribute at least 90% of its annual taxable income as dividends to its shareholders.

Realty Income owns a highly diversified portfolio of over 15,500 commercial real estate properties across 92 industries. While a triple-net lease structure significantly reduces operating costs, diversification helps Realty Income generate stable cash flows across market cycles and interest rate environments, making it a top dividend stock to buy for 2026.

3. Brookfield Infrastructure Partners: 5% yield

Brookfield Infrastructure Partners (BIP 0.55%) owns high-quality assets across utilities, transport, midstream energy, and data sectors, most of which earn predictable income under long-term contracts. The company also sells mature assets periodically to fund new growth opportunities.

NYSE: BIP

Key Data Points

In 2025, Brookfield raised $3 billion through capital recycling and is deploying money into high-growth areas such as artificial intelligence (AI) data centers. Management foresees a strong 2026 and is targeting 5% to 9% annual growth in funds from operations and dividend per share in the long term.

4. Oneok: 5.3% yield

Oneok (OKE +0.80%) stock fell by over 25% in 2025 as its debt swelled after back-to-back mega acquisitions of Magellan Midstream, Medallion Midstream, and EnLink Midstream. The acquisitions, however, have significantly expanded Oneok's pipeline capacity and are expected to generate nearly $500 million in synergies in the near term.

Oneok's 4% dividend raise in January 2026 further underscores its ability to reward shareholders despite concerns over debt. With management confident of raising the annual dividend by 3% to 4% in the long term, Oneok is a compelling turnaround high-yield play for 2026.

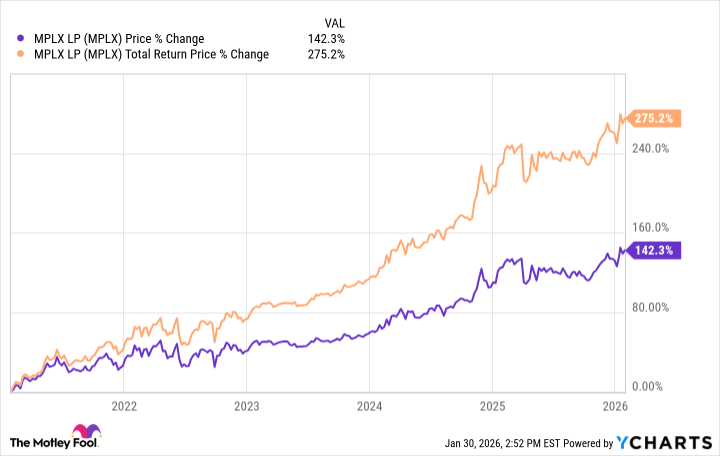

5. MPLX: 7.7% yield

MPLX (MPLX 0.60%) is one of the highest-yielding large-cap stocks in the energy sector. Marathon Petroleum's (MPC +0.14%) backing provides MPLX with predictable revenues from long-term contracts and significant growth opportunities.

MPLX's recent acquisitions and expansions in the Delaware, Marcellus, and Permian basins set the pace for a strong 2026. In the first nine months of 2025, MPLX's net earnings grew by 15%, and it raised its dividend by 12.5%. Investors can expect another big dividend raise later this year, making this monster high-yield stock a top buy.