Demand for artificial intelligence (AI) data center capacity is insatiable, and hyperscalers and AI companies have been taking up all that's available. This explains why neocloud provider CoreWeave (CRWV 6.37%) has been witnessing stunning growth in its revenue backlog.

CoreWeave rents out its dedicated AI data center capacity to hyperscalers such as Microsoft and Meta Platforms, as well as large language model leader OpenAI and other customers. The key parallel processing power in its data centers primarily comes from Nvidia's (NVDA 0.72%) graphics processing units (GPUs). But CoreWeave is more than just an Nvidia customer -- the chipmaker recently tightened its relationship with the neocloud provider.

Image source: Nvidia.

CoreWeave's growth could accelerate thanks to the latest investment

On Jan. 26, Nvidia and CoreWeave announced that they are expanding their prior relationship, under which the graphics card giant had committed $6.3 billion to purchase any unsold data center capacity that CoreWeave had through April 2032. Their new agreement will see Nvidia investing $2 billion in CoreWeave at a price of $87.20 per share.

NASDAQ: CRWV

Key Data Points

The press release announcing the agreement pointed out that it will "enable CoreWeave to accelerate the buildout of more than 5 gigawatts of AI factories by 2030 to advance AI adoption at global scale." Specifically, CoreWeave will continue to build AI infrastructure powered by Nvidia's advanced data center chip systems, including its upcoming Vera Rubin offerings.

Also, Nvidia's financial strength will help CoreWeave procure land to build AI data centers and electricity to power them. Citing a CoreWeave spokesperson, Reuters reports that the company will be directing the proceeds from the chipmaker's investment mainly toward research and development, workforce improvement, and other data center-related expenses. The money will not be used to purchase Nvidia's hardware, which should allay investors' concerns that this is a circular financing deal.

Even better, Nvidia will help strengthen CoreWeave's software suite. This should help the neocloud provider become more of a full-stack AI solutions company that provides its customers with the ability to build, deploy, and scale AI solutions efficiently, in addition to renting computing hardware to them.

But most importantly, the Nvidia investment should enable CoreWeave to quickly convert more of its tremendous backlog into actual revenue. That revenue backlog stood at nearly $56 billion as of the end of the third quarter of 2025, up from $15 billion a year earlier. This massive year-over-year increase was driven by huge contracts from Meta Platforms, OpenAI, and other hyperscalers.

For comparison, CoreWeave estimates that its 2025 revenue was around $5.1 billion. Another important point to note is that it had 590 megawatts of active data center capacity at the end of Q3 2025. The money that it receives from Nvidia will ensure that it remains on track to achieve its 5 gigawatt (5,000 megawatt) target by the end of the decade.

Nvidia's investment could pay off handsomely

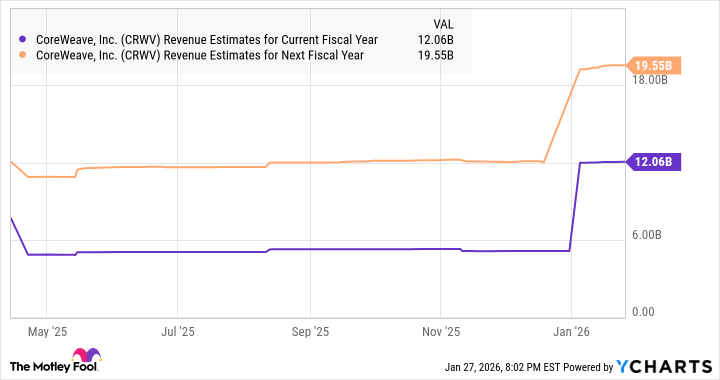

Between CoreWeave's terrific backlog and the backing from Nvidia, it's positioned to grow at a phenomenal rate. This probably explains why analysts who follow the company are expecting its revenue to quadruple in just two years.

CRWV Revenue Estimates for Current Fiscal Year data by YCharts.

If CoreWeave indeed generates $20 billion in revenue by the end of 2027 and trades at 5.5 times sales at that time (in line with the average sales multiple of the tech-heavy Nasdaq Composite index), its market cap would nearly double to $110 billion. That suggests that Nvidia may have made a smart investment here. Retail investors should consider following suit and buying CoreWeave stock before it skyrockets.