Finding and identifying stocks that have the potential to double in a year is no easy feat. However, from time to time, one pops up that looks like a prime candidate. One stock that has been getting some buzz lately is AMD (AMD 6.13%). AMD has for some time been relegated to a distant second place in the artificial intelligence (AI) accelerator segment, where Nvidia's (NVDA 0.72%) graphics processing units (GPUs) hold the lion's share of the market. Meanwhile, Broadcom, with its application-specific integrated circuits, is becoming a popular alternative to both of them. Its growth could relegate AMD to third place, but AMD management has other ideas.

The company believes that some of the changes it has made in its product ecosystems will help it to thrive over the next few years, and 2026 could be the start of a huge comeback. But could that be enough to drive the stock up by 100% or more this year?

Image source: Getty Images.

AMD's management sees huge upcoming growth

AMD is a far more diversified chip business than Nvidia, which gets the large majority of its revenue now from data center sales. By contrast, AMD has a thriving OEM and gaming business that accounts for over 43% of revenue. It also has an embedded processor division that makes up about 10% of its business. That leaves its data center division delivering around 47% of its revenue.

Some investors may view this diversification as a positive thing. AMD is less reliant on AI-related sales than its rival, so if we're in an AI bubble and it bursts, it should experience a less pronounced slide than Nvidia. However, data centers still provide a large fraction of AMD's revenues, so it wouldn't be entirely insulated from a decline in AI infrastructure spending.

NASDAQ: AMD

Key Data Points

Additionally, management is aiming to boost the share of revenue that comes from the data center segment. It believes that over the next five years, its data center division will expand at a 60% compound annual growth rate (CAGR), while its other two divisions are predicted to achieve CAGRs of 10%. If matters pan out as management forecasts, by 2031, AMD's business will look a lot more like Nvidia's than it does today. However, artificial intelligence is one of the biggest technological revolutions mankind has ever experienced, so being highly exposed to this megatrend is a smart idea.

In Q3, AMD's data center revenue rose by 22% year over year, so the company has a lot of work to do if it's going to come close to hitting a 60% CAGR. But if it can hit that target, could the stock double this year?

AMD's path to a double is murky

If AMD's stock doubled from here, it would trade at about $500 per share. Should its revenue growth accelerate to the pace management is forecasting, I think that it would make sense for the market to assign it a price-to-earnings ratio of about 50. That's far lower than its current P/E ratio of 120, but that number is unusually high in part because in a recent quarter, AMD's earnings were depressed by an $800 million inventory write-down that it had to take due to Trump administration restrictions on exporting graphics processing units (GPUs) to China.

A P/E ratio of 50 on a share price of $500 would require earnings per share (EPS) of $10. Current analyst estimates for AMD for 2026 range from $5.36 to $8.02, undershooting that mark by a significant margin. However, if AMD can improve its profit margins, these estimates could prove too pessimistic.

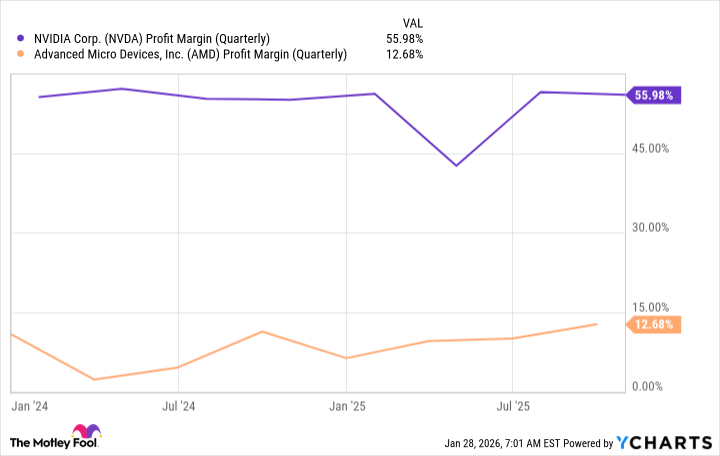

Currently, AMD's profit margin is ridiculously low compared to Nvidia's.

NVDA Profit Margin (Quarterly) data by YCharts.

If AMD can double its profit margin, that would dramatically improve the chances of the stock doubling.

However, I'm still skeptical. AMD hasn't shown that it can compete effectively with Nvidia in the GPU space yet. If that changes, then the stock could catch fire. However, I've seen no signs of that shift. Perhaps we will when AMD reports its fourth-quarter results on Feb. 3. Depending on what that report shows, I may be an AMD believer after that, but I'm more than happy to be patient until then.