Finding cheap stocks with huge growth potential is a potent combination. This combines value investing with growth investing, and if done correctly, can yield incredible investment returns.

One area that has gotten a lot of attention over the past few years is artificial intelligence (AI), so it seems odd to find a value stock hiding in this area. However, Micron (MU 4.80%) appears to be that way.

Wall Street expects huge growth this year, yet the stock trades for a relatively cheap price tag. So is this a genius buy? Or is there a catch?

Image source: Getty Images.

Micron's stock is cheap for a reason

Micron makes memory chips, which are distinctly different from logic chips such as those produced by Taiwan Semiconductor Manufacturing. The primary difference between memory and logic chips is that there isn't really any differentiating technology between memory chips. This area has become commoditized, which means the companies in the space have relatively little pricing power.

NASDAQ: MU

Key Data Points

However, if demand outstrips supply, then prices can skyrocket, and that's exactly what's happening.

If you haven't checked on RAM prices for laptops or computers recently, do yourself a favor and research them. Prices have spiked because memory chips are being completely consumed by the massive demand caused by the data centers being built to power generative AI. As a result, companies like Micron can increase their prices to account for the huge supply imbalance.

This is the core reason why Micron's earnings are expected to explode throughout the year. Micron's fiscal year 2026 ends in August, and Wall Street analysts expect Micron's earnings per share (EPS) to increase from $8.29 in FY 2025 to $33.31 in FY 2026. Beyond that, they expect further growth to $42.79 in FY 2027. That's huge growth powered by insatiable AI demand, and it may be several years before memory companies have built enough capacity to meet demand.

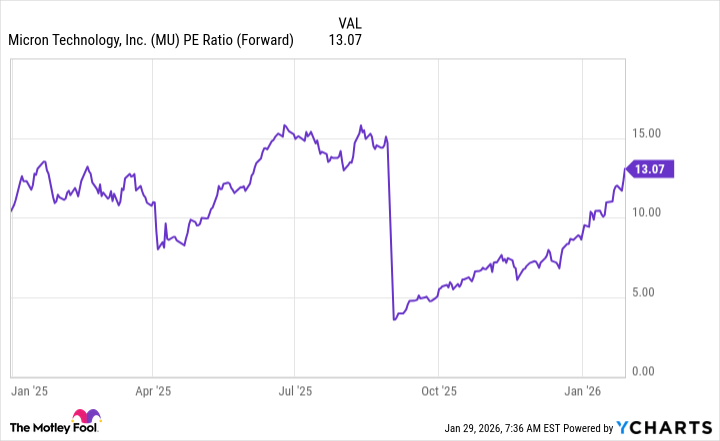

But that's the major problem with Micron. Memory demand is incredibly cyclical, and it could crash shortly after Micron and its peers have built enough production capacity to meet demand. This will reduce memory chip prices and cause the stock to slump. The market is well aware of this, which is why the company's stock trades for a dirt cheap 13 times forward earnings.

MU PE Ratio (Forward) data by YCharts

The primary question is: How long will AI demand last? Many estimates expect the buildout to occur through at least 2030, which gives Micron stock about five years to benefit from soaring memory prices. This factor could make Micron stock a great buy now, but you'll have to pay attention to the right time to sell.

I prefer my investments to be a bit steadier, which is why I don't own Micron stock. However, I still think there's a great investment opportunity here, and savvy investors can make a great return by investing in Micron stock.