If you are like most dividend investors, you are trying to find a balance between yield and company quality. If you reach too far for yield, you'll end up with a portfolio filled with dividend risk. If you reach too far for quality, you'll likely end up with low-yielding stocks. Schwab U.S. Dividend Equity ETF (SCHD +0.42%) tries to find the sweet spot in between. Here's why a $500 investment could set you up for years of reliable cash flow.

What does Schwab U.S. Dividend Equity do?

Technically speaking, Schwab U.S. Dividend Equity just tracks an index. In this case, the index is the Dow Jones U.S. Dividend 100 Index. This is pretty normal for an exchange-traded fund (ETF). To understand the ETF, however, you need to understand the index.

Image source: Getty Images.

The Dow Jones U.S. Dividend 100 Index starts out by screening for stocks that have increased their dividends for at least 10 years. That's a typical screen for a dividend investor, since it shows a company has a proven track record of paying reliable dividends. (Real estate investment trusts are excluded from consideration.)

A composite score is then created for each of the remaining companies. The score is the magic sauce, including cash flow-to-total debt, return on equity, dividend yield, and a company's five-year dividend growth rate. Each of the components highlights something important.

Cash flow-to-total debt is a measure of financial strength. Return on equity looks at a company's quality. Dividend yield is, well, dividend yield. The five-year dividend growth rate provides another view of both dividend and corporate growth, since dividends generally grow only when a business is growing. Each component is something a dividend investor is likely to consider when evaluating individual stocks.

The 100 stocks with the highest composite scores are included in the index and in Schwab U.S. Dividend Equity ETF, using a market-cap weighting. Market-cap weighting means that the largest companies will have the greatest impact on the ETF's performance. The list of holdings is updated annually.

NYSEMKT: SCHD

Key Data Points

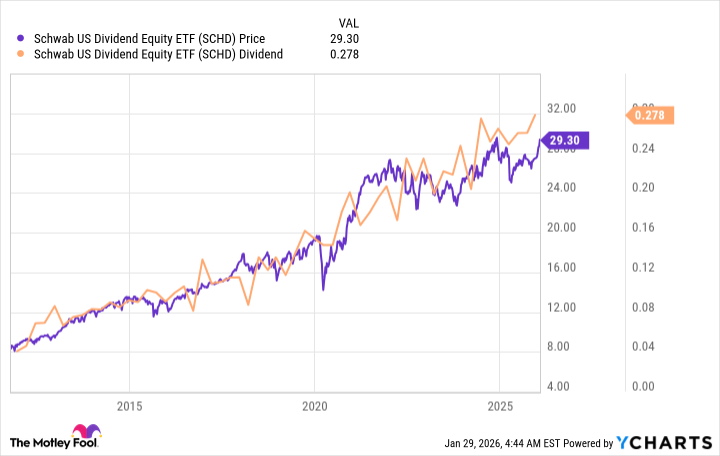

A generally rising price and a generally rising dividend

With 100 stocks, the portfolio is fairly well diversified. It could easily be the only equity-focused investment you have in your portfolio. And, notably, the expense ratio is a very low 0.06% despite all of the heavy lifting going on with the stock selection process.

Of course, all of the above matters only if the returns Schwab U.S. Dividend Equity ETF offers are worthwhile. They are. The ETF's dividend yield is around 3.8% today, which is more than three times the roughly 1.1% yield of the S&P 500 index. You could easily find a higher-yielding ETF, but for most dividend investors, Schwab U.S. Dividend Equity ETF's approach is going to be more desirable than other higher-yielding ETF options.

Meanwhile, Schwab U.S. Dividend Equity ETF's dividend and price have both trended steadily higher over time. You not only get a reliable and growing dividend but also capital appreciation. That's a powerful combination that should please just about all dividend lovers.

A good mix of yield and growth

There's no perfect investment, and Schwab U.S. Dividend Equity ETF doesn't excel all the time. In fact, it has lagged the market recently as large technology stocks with low dividend yields, or no dividend at all, have been the driving force behind the stock market's advance. But if you want a steady stream of cash flow without having to do the work of picking individual stocks, this ETF could be the perfect fit for you. A $500 investment will buy around 17 shares.