Like its pure-play quantum computing peers, Rigetti Computing (RGTI 6.54%) has seen incredible stock returns recently. As of this writing on Feb. 4, 2026, share prices are up by 1,420% in the past 15 months. The jump is a few steps behind D-Wave Quantum (QBTS 6.93%) gaining 1,910% over the same period, but far ahead of IonQ's (IONQ 6.31%) 770% rise.

Rigetti investors expect quantum computing to disrupt many industries in the long run. From encryption and genetic analysis to financial forecasting, quantum's probabilistic calculations should eventually run circles around today's digital computers.

And Rigetti isn't laser-focused on a single aspect of this opportunity. Instead, it wants to offer a full stack of quantum computing solutions, from hardware manufacturing and system design to management software and cloud-based service delivery. Presenting the whole package as a unit could make Rigetti popular with deep-pocketed enterprise customers.

NASDAQ: RGTI

Key Data Points

But what about the stock?

You weren't asking about Rigetti's business ambitions, though. You want to know where the stock is going next.

Honestly, Rigetti can go wherever quantum hype takes it. I thought it would cool down in 2025 after a soaring launch at the end of 2024, but Rigetti posted a full-year gain of 45% instead. A few technology advances around the quantum computing sector kept pushing the stock chart higher (in a volatile way, of course). Sentiment can flip on a single headline, for better or for worse.

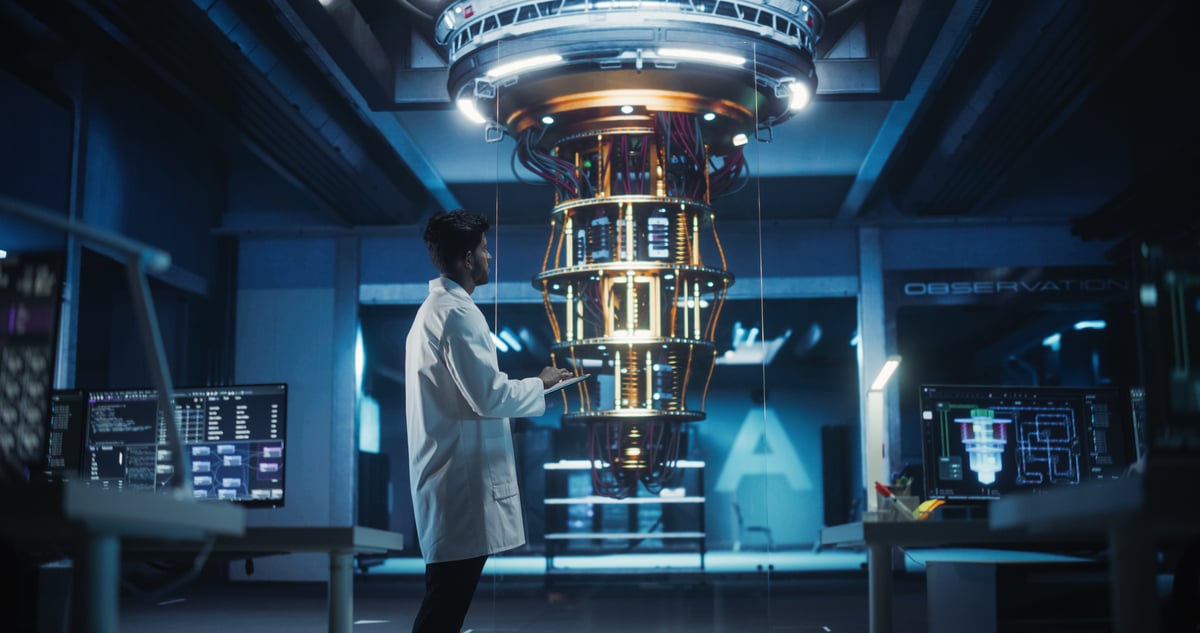

Image source: Getty Images.

So I can't really say whether Rigetti will rise or fall in the next short-term time period of your choice. But the company is deeply unprofitable and has a habit of selling more stock in order to keep the business running. And Rigetti's stock trades at downright unreasonable valuation ratios. At 757 times sales, Rigetti makes most market darlings (including IonQ and D-Wave) look cheap by comparison.

I wish Rigetti good luck in the long run, but the stock is poised for a steep price correction in the next year or two. Commercial success is probably more than a decade away, and cash-burning companies don't always survive a 10-year wait.