The combined 2026 capital spending commitments made by Amazon.com and Alphabet over the last couple of days total up to $385 billion. It's an incredible figure that dwarfs even the mammoth combined $222 billion in 2025. While those stocks both declined in response to the news, the AI infrastructure companies did much better, including GE Vernova (GEV +5.67%), which rose by more than 5% in late trading.

An AI spending boom

It's no secret that the market is far from convinced by Oracle's exposure to OpenAI. For reference, they have a $300 billion deal under which Oracle will build out infrastructure to sell computing power to OpenAI. Not least because OpenAI needs a huge amount of funding to support it through a cash burn that could total $115 billion by 2030, according to reports.

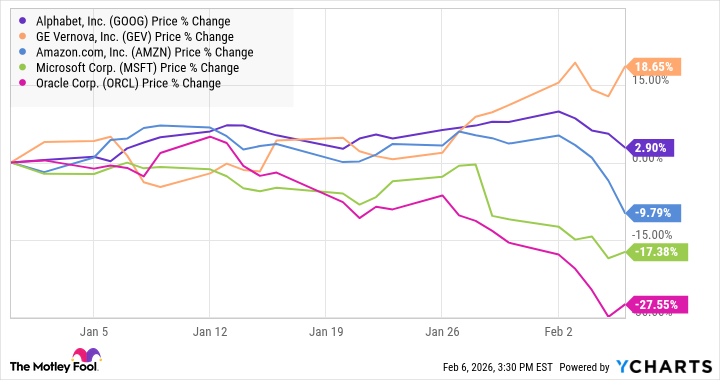

Similarly, Microsoft stock has suffered this year due to 45% of its Azure backlog's exposure to OpenAI, but, as shows below, GE Vernova continues to power higher.

Why GE Vernova keeps outperforming

The reason is the same as the one for the stock being up again today: insatiable demand for power to fund data centers. That's feeding through into a step-change in demand for GE Vernova's gas turbines and its electrification equipment from hyperscalers, after the company was previously heavily reliant on notoriously conservative utilities. Demand is so strong that GE Vernova is even selling slot reservation agreements to customers who want to ensure they will receive gas turbines in the future.

Image source: Getty Images.

As such, management expects mid-teens revenue growth from 2025 to 2028 with earnings more than doubling in the period.

The spending commitments of Alphabet and Amazon in recent days have encouraged investors to feel confident about GE Vernobva's guidance, and that's why the stock continues to do well.