As investors, we often give up on companies that fall out of favor, particularly in the consumer good business. Dominant brands can quickly fall by the wayside as technology changes, new brands emerge, or even if they get so big they can only fall.

Three electronics companies suffered a downfall in recent years but are now slowly emerging from the stock market rubble as investors eye their possible turnarounds. Sony (SNE 2.11%), Nokia (NOK +2.46%), and Hewlett-Packard (HPQ 0.36%) are all trying to make a comeback after their stocks all fell more than 50% and missteps plagued each company.

SNE Total Return Price data by YCharts.

But recent weeks and months have seen a small comeback, and for the moment they have a little momentum on their side. So, will it last?

The return of Sony... maybe

Sony was once the dominant electronics retailer in the world, selling everything from its iconic Walkman to flat-screen TVs. But Sony missed out on the electronic music revolution Apple (AAPL 1.28%) created with the iPod, and eventually both TVs and PCs took a hit when lower-margin competitors entered the market.

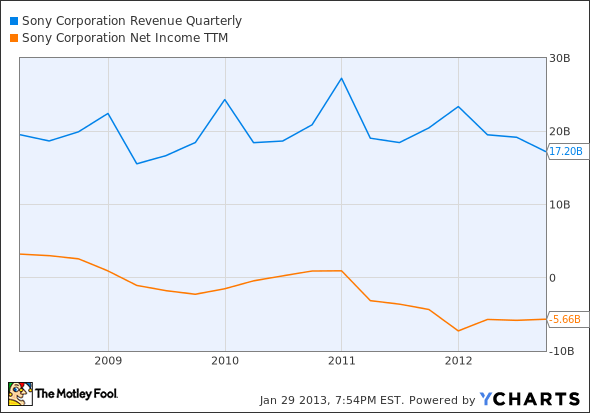

Sony's sales didn't nosedive during the 2000s, but the bottom line took a huge hit over the past few years as the company searched for a path forward.

SNE Revenue Quarterly data by YCharts.

Right now, investors seem to be happy things aren't getting worse. Sony managed a small operating profit in the fiscal second quarter and the hope is that financial results will turn around over the next year.

But the challenge for Sony is the same as it is for most fallen electronics companies. Sony needs to come out with a few killer products that consumers are dying to have. It's what Apple did to take the music business from Sony and it's what Samsung has done to take huge share in smartphones.

Sony's stock may be up 57% from its low, but the company is far from relevant again. Sony needs to make big, bold moves to get back into consumers' hearts.

Nokia fights back

I'll admit I was the one dissenting vote when fellow Fools Sean Williams, Alex Planes, and I debated Nokia back in August. Since we made an outperform call, our pick has outperformed the market by 29 points and investors who followed suit have been rewarded.

The key driver to Nokia's surging stock price is sales of the Lumia smartphone. Earlier this month the company said it shipped 4.4 million of the devices in the fourth quarter, which was a slight uptick from a quarter earlier. A slight uptick may not sound great, but after a nosedive in earlier quarters, it's progress.

Nokia made a risky move betting on Microsoft's mobile operating system and investors are looking for signs one way or the other that it will pay off. As Microsoft rolls out more Windows 8 licenses and consumers become comfortable with the operating system, I think it will pay off for Nokia.

Don't expect Nokia to be overtaking Samsung or Apple in the smartphone business any time soon, but there are signs of improvement. CEO Stephen Elop says the company will "achieve underlying profitability in the fourth quarter" and if it can keep improving its smartphone offerings, investors may indeed have a big winner on their hands.

The trials and tribulations of HP

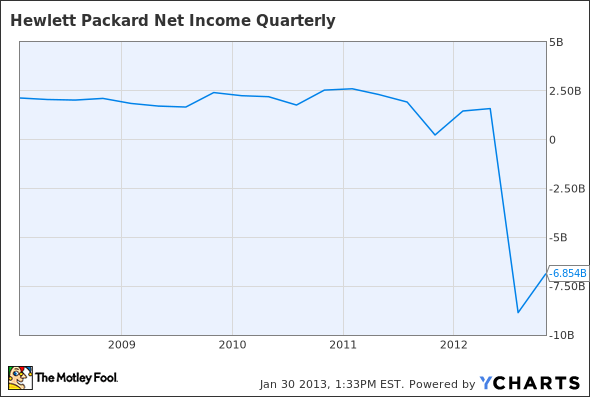

Hewlett-Packard is a little different story. HP isn't just behind the times with products, it has shot itself in the foot with acquisitions. The $8.8 billion writedown of Autonomy tanked the stock in 2012, but since bottoming out, the stock is up 46%.

Meg Whitman has been trying to engineer a turnaround, but so far that's consisted of cleaning house from previous managers. Net losses have been incredibly high in the second half of 2012, as you can see below.

HPQ Net Income Quarterly data by YCharts.

The challenge for Whitman and team is to turn around a variety of businesses that are struggling at the same time. In the most recent earnings report, the company said revenue fell in its five largest businesses and the trends don't seem to be getting any better.

The PC business is slowing rapidly, printing is in a long decline, and even the services business is struggling. On an adjusted basis HP is still making money, but what does the future hold?

Investors are betting the company is back from the dead for now, but the future is uncertain to say the least. HP probably has the biggest upside potential of the companies here, but it can also fall out of favor with investors quickly.

Foolish bottom line

Sony, Nokia, and HP have all been through tough times but investors have been betting on a turnaround recently. It's a risky bet but the rewards for those who get it right could be tremendous.