Source: Wikimedia Commons

When you need growth just turn to shale. Oil companies are looking at unconventional plays to find growth, and Apache (APA 0.25%) is no different.

Higher production

Since 2008 Apache has seen its production grow from ~500,000 boe/d to ~790,000 boe/d in the second quarter of 2013.This was almost entirely due to Apache's investment in domestic shale plays.

In 2009, 15% of Apache's production came from the Central and Permian plays, but by 2012 that went up to 34%. In that same time period Apache's production mix shifted toward liquids, from 49% of total production to 54%.

It get's even better for Apache's investment. Apache has 2.9 billion barrels of oil equivalent in proven reserves, but sees a possible 11.7 billion barrels of recoverable oil equivalent with the Permian and Central areas making up 85% of that potential.

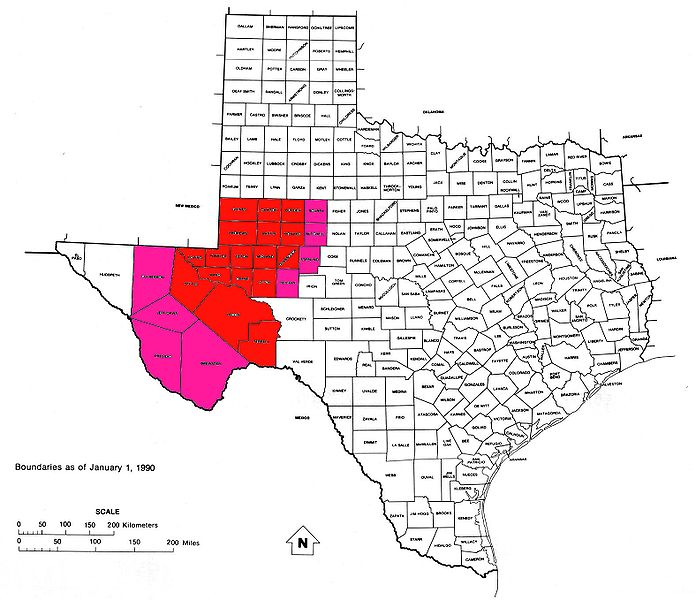

Texas

In 2013 Apache planned on operating an average of 34 rigs in the Permian Basin, but as of its second quarter Apache was running an average of 41 rigs. More rigs means more production and a higher chance of finding more recoverable resources.

So far the higher rig count is paying off, Apache is ahead of its guidance (set in May 2012) for production in the area. Currently Apache is pumping out ~123,000 boe/d as of the second quarter, which is roughly 5,000 boe/d ahead of its projections.

Apache's 2016 projection calls for ~170,000 boe/d from the Permian. If it stays ahead of guidance however, that could reach anywhere from 180-200,000 boe/d. Apache has plenty of locations to drill, with 34,518 know locations in the Permian Basin. That many possible drilling locations means Apache will be boosting production for years while continuing its shift to more liquids production.

Oklahoma

The Central play in Oklahoma and the Texas panhandle is another major source of growth. Apache has a production level of 90,800 boe/d in the play with 32,546 locations to drill.

Apache is pushing up production through higher levels of capex resulting in more well completions. In 2012 Apache's capex for the play was $1.1 billion to complete 196 wells, and for 2013 plans on spending $1.4 billion to complete 300 wells. The additional capex is being spent to increase its average rig count, which has gone up by 24 since 2010 to 29 rigs.

Apache is focusing on liquid-rich areas in the play, which has moved the production mix from 29% liquids to 50% liquids in just one year. Going forward Apache plans on completing more wells in the area and using the additional cash flow to operate more rigs.

Apache is just one of many E&P players with an eye on America; EOG Resources (EOG +0.77%) is also investing heavily in shale.

Another big Texas play

EOG Resources is investing in the Eagle Ford area and has set its sights on the southern part of it especially. EOG Resources sees the potential for 2.2 billion boe in reserves in the southern area with a production mix that is 88% liquids (78% crude). EOG is producing ~173,000 boe/d (as of June 30), and this is just the beginning because EOG has over 4,900 locations to drill.

For 2013 EOG is running 25 rigs to complete 440 net wells in all of the Eagle Ford. Well completion costs are down $3.3 million over the past few years due to drilling times decreasing by seven days. Going forward EOG will keep trying to find ways to reduce costs and drilling times, such as using its own sand in the fracking process.

The Eagle Ford's liquid-rich production mix is a fine example of why E&P companies are turning to shale for cash flow growth. Even better is that the Eagle Ford is heavily weighted with crude oil, which carries the highest margins.

EOG is also seeing Eagle Ford recovery rates increase due to downspacing. EOG used to drill 10 wells on 640 acre units, but has since switched to 16 wells per unit. This increased recovery rates from 6% to 8%, which is huge.

EOG is drilling deeper laterals as well, which increased from 3,911 to 5,890 feet to push up initial production rates from 483 to 1,226 boe/d. EOG plans on drilling down deeper and testing out different downspacing techniques to boost recovery rates and initial production levels, which allows EOG to maximize the return from each well.

Final thoughts

Shale plays have plenty of proven reserves and a lot more potentially recoverable resources hidden inside. Unconventional plays offer growth rates similar to those of growth tech stocks and allow companies like Apache and EOG to see better production mixes. Shale is the next big thing in America, and investors should have some exposure to E&P shale plays because of the strong growth prospects.