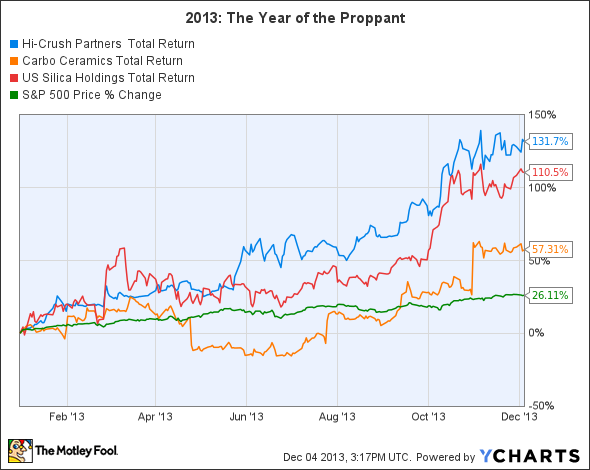

Proppants were the shocking winners of 2013. These tiny grains of sand, or ceramic, propelled Hi-Crush Partners (HCRS.Q), U.S. Silica Holdings (SLCA), and CARBO Ceramics (CRR) to be the some of the best performers of 2013. Don't believe me? Take one look at the following chart:

HCLP Total Return Price data by YCharts

Proppants are used by the oil and gas industry to prop up the tiny fractures that are created through hydraulic fracturing. Energy companies need these cracks in the rock to stay open so that oil and gas can flow out the well. Thanks to America's energy boom, proppants were one hot commodity in 2013.

Market crushing results

Hi-Crush Partners didn't go public until August 2012, so 2013 was its first full year as a public company -- and it led the way. Unfortunately, Hi-Crush started off on the wrong foot. In its first earnings release Hi-Crush announced that one of its top customers, Baker Hughes (BHI), terminated its supply agreement. That caused a sell-off in its units, which in hindsight was a fantastic entry point for investors.

Over the course of 2013, Hi-Crush acquired an interest in a new frac-sand mine as well as a major distributor of frac sand in the Marcellus and Utica Shale plays. Those deals helped boost its earnings and eventually lead to the company boosting its distribution to investors. Plus, oil and gas companies found that increasing the amount of proppants used per frac job actually improved results. To top things off, Hi-Crush eventually settled its dispute with Baker Hughes and signed the oil-field-service giant to a six-year supply contract.

Propelled by America's energy boom

U.S. Silica experienced similar success in 2013. The company was well positioned to supply America's energy boom with its 15 facilities and a vast distribution network. In fact, this past third quarter it supplied 37% more proppant volumes to oil and gas companies than the third quarter of 2012. Even better, those sales came at higher margins than the year before.

Strong results, as well as a very projectable future, enabled U.S. Silica to start giving back to its investors in 2013. While some of its private-equity backers were cashing out, investors who held on were rewarded as the company initiated a quarterly dividend policy earlier in the year. U.S. Silica remains very well positioned to continue to deliver for investors in the years ahead.

Premium returns

While both Hi-Crush and U.S. Silica are focused on selling inexpensive frac sand, CARBO Ceramics sells higher-end ceramic proppant. While ceramics cost more, the returns are higher as ceramic proppants can increase production by 20%, as well as the estimated ultimate recoveries of a well by 30%.

Many Bakken Shale companies, for example, have found that ceramics are the key to unlocking more oil from that play. This trend helped boost CARBO's volumes sold by 41% last quarter alone. Overall, CARBO has demonstrated that a premium product can be a big seller if it yields premium results.

Investor takeaway

It's pretty shocking to see an investment in a company that produces sand double in the past year. But that's just what happened in 2013 thanks to America's energy boom. It just goes to show that sometimes the simplest of investments can yield the greatest of returns.