Though pinning the term "best" on any bank is highly subjective, one of the key function of a successful bank is keeping its customers happy -- allowing the money to keep flowing. Based on recent customer satisfaction data, we can clearly see the nation's five best banks and how they address the top customer concerns.

Power in numbers

Two of the most reputable surveys of customer satisfaction come from J.D. Power and Associates and the American Customer Satisfaction Index. Over 120,000 customers are randomly surveyed in order to produce the two studies. These two sources take a comprehensive look at what customers care about most, and how the nation's banks stack up.

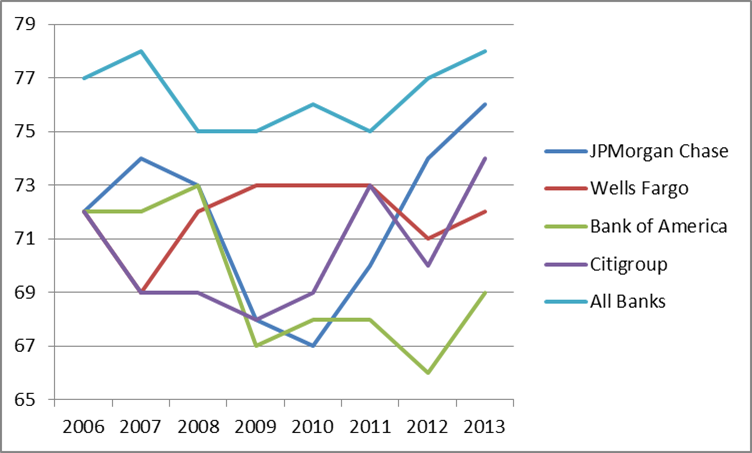

Over the past year, the banking industry as a whole has gained some major traction with customers, resulting in record high satisfaction ratings during the third quarter, according to ACSI. The nation's banks satisfaction rating jumped 1.3 points to 78 out of 100.

Though the bigger banks still trail the smaller regional banks and credit unions in terms of customer ratings, they continue to see improvements following the huge drop experienced during the financial crisis. As you can see in the chart below, the Big Four -- JPMorgan Chase, Bank of America (BAC 1.00%), Wells Fargo (WFC 1.47%), and Citigroup -- all had customers report far lower satisfaction rates than the industry average:

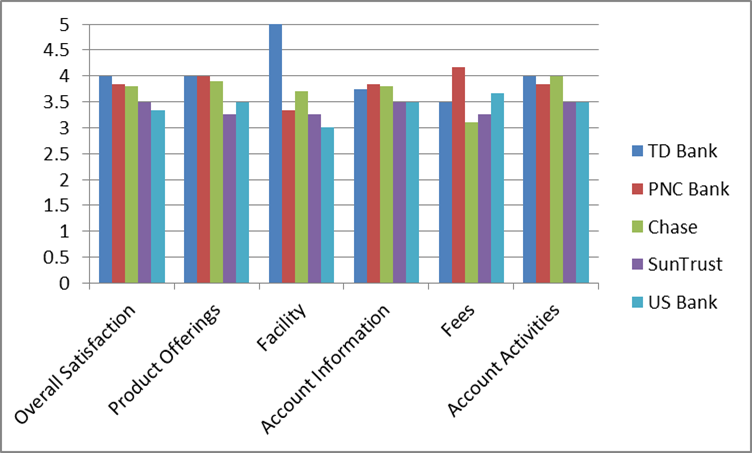

Though the American Customer Satisfaction Index does give an overall idea of how customers view their banks, the J.D. Power and Associates U.S. Retail Banking Satisfaction Study dives a bit deeper, analyzing customer ratings in five key categories:

- Product offerings -- the variation and specialization of available account options, ease in making account changes, effectiveness of communication regarding account information, and competitiveness of offered interest rates.

- Facility -- Ease of access to the financial institution, including number of branches and hours of operations.

- Account information -- clarity and ease of understanding of account information provided by the institution.

- Fees -- Understanding of the institution's fee structure.

- Account activities -- assessment of various methods of executing transactions, including: in-person, ATMs, online and mobile banking, and telephone transactions.

Coupled with an overall satisfaction rating, the five top banks in the nation (serving at least three of the 11 surveyed regions) are TD Bank, PNC Financial (PNC 0.14%), JPMorgan Chase's Chase Bank, SunTrust Banks, and U.S. Bancorp's (USB +1.08%) U.S. Bank.

Source: J.D. Power and Associates 2013 Retail Banking Satisfaction Survey.

TD Bank blew its competitors out of the water thanks to its flexible branch hours, including on Sundays. But PNC won the dreaded fees category, with the average rating topping 4.2 out of five.

Bottom of the barrel

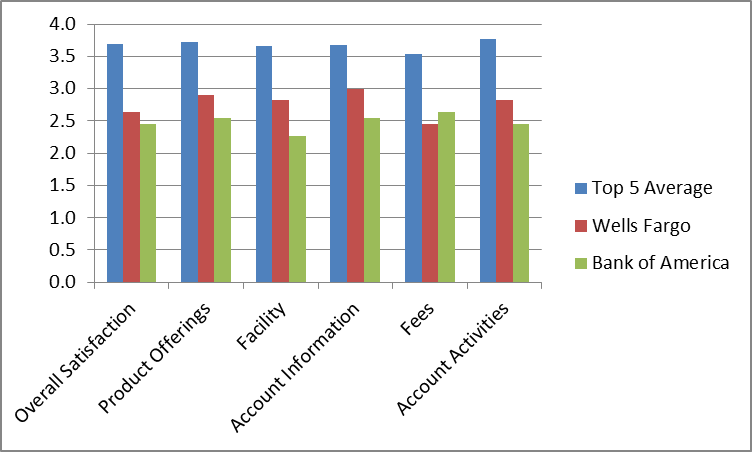

One of the surprising takeaways from the J.D. Power and Associates study is how customers ranked Wells Fargo. Most everyone is aware that Bank of America is commonly cited as the worst bank in the nation, but the study shows that it's not lonely down there on the bottom: Wells Fargo was consistently in the second-worst spot.

Versus the average ratings of the top five banks, Wells Fargo and Bank of America are falling short:

Source: J.D. Power and Associates 2013 Retail Banking Satisfaction Survey.

Why it matters

Studies have proven it's more expensive to attract new customers than it is to keep current ones. For banks, having a successful relationship with customers can lead to more lucrative accounts and expanded services. So, the banks falling short on customer satisfaction (ahem, Wells Fargo and Bank of America), will have a tougher time convincing their clients to expand the relationship -- while the top banks are likely to attract dissatisfied customers from their rivals.