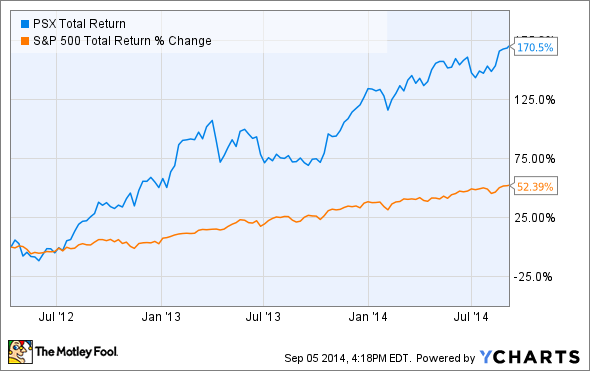

Since being spun off of ConocoPhillips (COP +1.39%) in 2012, Phillips 66 (PSX 0.36%) stock has crushed the market:

PSX Total Return Price data by YCharts

There are probably two questions investors are asking today: First, is the stock due for a pullback? Second, what are the long-term prospects for the business? Let's take a closer look at the business behind the stock, and see what the future could hold.

What is Phillips 66's business today?

Source: Phillips 66.

When ConocoPhillips decided to spin Phillips 66 off as a separate business in 2012, it created two companies that operate in two different segments of the oil and gas value chain. The ConocoPhillips of today is primarily an exploration and production -- or E&P -- business, and one of the largest global producers of oil and gas. This side of the business is a higher "risk-reward," as E&Ps must constantly search for and identify new oil and gas reserves to replace current production. Exploration can be incredibly expensive, especially with most new discoveries located in deep offshore locations, and expensive to produce onshore shale formations. Factor in the volatility of commodity prices, and there are a number of things outside the control of E&Ps that can affect the business.

Phillips 66, however, is one of the largest midstream and downstream operators, with oil and natural gas logistics services like pipeline operations, one of the largest refining businesses in the world, and a massive petrochemical manufacturing business called CPChem, which it shares 50-50 with Chevron (CVX +3.33%). As compared with E&P operators, midstream and downstream businesses can be much more predictable, as they focus in on moving and refining what the E&Ps produce. This largely shields the midstream business from the volatility of oil and gas prices.

Furthermore, midstream operators typically have long-term contracts for storage and transport of product, which makes for a more predictable and stable business.

Upsides for Phillips 66

There is one very strong trend that could lift two parts of Phillips 66's business in the coming years: the domestic oil and gas boom.

Biofuels like algal crude refined by Phillips 66 could be a big part of the future. Souce: Sapphire Energy.

While domestic demand for oil is declining, international demand remains strong. As one of the largest refiners in the world, Phillips 66's refining operations around the world will remain valuable assets. The company may need to invest in retrofits domestically, as the "light, sweet" crude oil produced in the U.S. and Canada needs to be handled differently by refineries than the "heavy, sour" oil that largely comes from the Middle East today. The company's refining business is critically important: In 2013, the $1.85 billion in profits the refining segment produced were almost half of the company's total.

Potentially the biggest growth opportunity is the joint petrochemicals business with Chevron. Phillips 66's share of CPChem profits in 2013 was $986 million, and is on track to reach $1.3 billion in 2014. This could be driven even higher in coming years, as domestic production of natural gas and natural gas liquids expands. As I wrote back in August, CPChem is one of the world's largest producers of olefins and polyolefins, key ingredients in the manufacture of hundreds of industrial, consumer, and commercial products, and the cost-advantage of domestic ethlylene is as much as 80% lower in the U.S. versus Asian production.

Combined, refining and chemicals make up almost 80% of Phillips 66's net income, and both appear to be critical businesses to meeting global demand for their products in coming years, while domestic supply of feedstocks create durable competitive advantages.

Source: Phillips 66; edits by author.

Risks

As I wrote about in this previous article, Phillips 66 could be affected by two things it has no control over, specifically environmental regulations that increase its domestic costs to meet, and the risks of sharing its petrochemical business with Chevron. The reality is, both of these risks are relatively low. The energy business is so critical to the domestic economy that it's hard to see the current administration as taking a hardline approach to methane emissions, when it has been relatively hands-off with the energy sector for almost six years.

As to CPChem, that business is performing very well, and the partnership with Chevron has been in place since well before the split from ConocoPhillips. Also, Chevron is an integrated major, meaning it operates in every segment of the oil and gas business. There's nothing to indicate that the JV is at any risk.

Positive actions for shareholders

It can be tough to value companies in the oil and gas business because the commodity price can sometimes cause share prices to move in irrational ways. Instead, it seems that a reasonable way to evaluate Phillips 66 is by understanding what the management team is doing to drive up per-share value:

Source: Phillips 66

As you can see from this recent presentation, the company is dedicated to returning significant cash back to investors, both by increasing the dividend more than 10% annually, and by repurchasing shares. By committing to returning significant cash flows to shareholders, this will not only put money in your pocket, but it will also make it less likely that management uses that capital in less than ideal ways, like acquisitions or other means to grow that might not pan out.

Final thoughts: not cheap, but a solid long-term investment

Since splitting off from ConocoPhillips 30 months ago, the company has already repurchased 10% of shares outstanding and increased the dividend 150%, so it's pretty clear that management is making good on its commitment to return cash to shareholders. Add in the macro tailwinds, and it looks really good for long-term-minded investors.

Could the stock fall some in the short term? Sure. It's not exactly cheap today, and there's always the risk of an unforeseeable event that will spook the market. But since we can't predict that with any accuracy, keeping an eye on the long-term outlook for the business is a better way to more reliably measure opportunity. With a dividend yielding 2.2% today, and a commitment from management to grow it 10% annually for the foreseeable future, Phillips 66 looks like a great business, and a reasonably valued stock today.