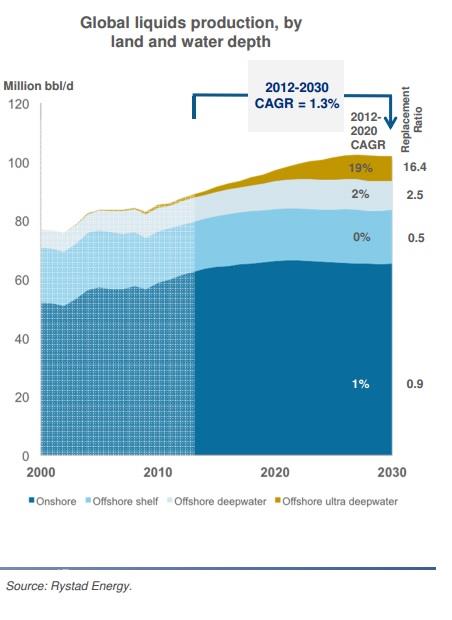

According to the Rystad Energy consulting firm, ultra-deepwater offshore oil production is expected to grow at 19% annually through 2030, 19 times faster than conventional land based production.

Source: Seadrill 2014 Howard Weil Energy Conference presentation

One of the latest techniques in offshore drilling is offshore fracking, what David Wethe of Bloomberg calls "the next frontier in fracking." This article explains how this new technique works, the challenges it faces, and how you can profit from it.

Challenging drilling environments

Offshore fracking has been around for over 20 years, but not until recently has new technology allowed this practice to take off in places such as South America, Africa, and, most of all, the U.S. Gulf of Mexico. For example, the geology in many offshore formations consists of loose sand and shale, much like sand on a beach. This causes sand to get clogged and damage pipes and equipment due to the high pressures and speed at which oil, gas, and sand are extracted (much like a sandblaster).

New techniques such as the use of thick sand filters and increased use of frack sand (which props open cracks in shale and helps oil and gas flow), has helped make the technique economically viable. But thanks to the need for drilling in waters over a mile deep and the need for up to 125 tons of frack sand per well, the cost per well can be staggeringly high: up to $100 million per well and $1 million per day to operate.

According to Ron Dusterhoft, an engineer for the world's largest fracking company, Halliburton (HAL +2.75%), "It's the most challenging, harshest environment that we'll be working in. ... You just can't afford hiccups."

Obama's on board the offshore-fracking train

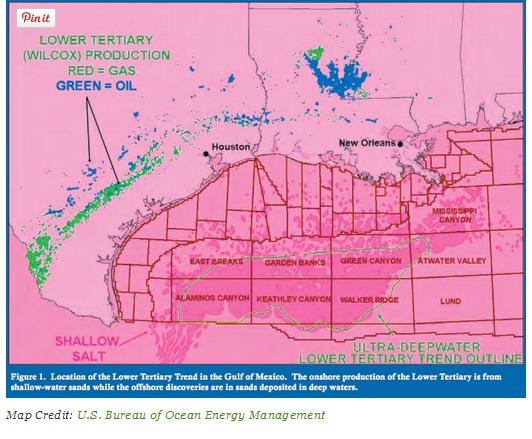

Recently the U.S. Department of Interior's Bureau of Ocean Energy Management opened up 21.6 million acres of land for auction from interested oil companies such as BP (BP +2.08%), Royal Dutch Shell (NYSE: RDS-A), and Chevron (CVX +0.37%) in what is known as the Lower Tertiary basin. This formation is thought to hold 15 billion barrels of oil, worth $1.5 trillion at today's oil prices.

To help cash in on this mother lode, oil companies are expected to increase offshore fracking by 10% between 2013 and 2015, according to Douglas Stephens, president of pressure pumping at oil service provider Baker Hughes (BHI +0.00%).

That kind of energy/economic potential has gotten the attention of the Obama administration. Mike Connor, deputy secretary of the Department of the Interior, said of the news:

This sale underscores the President's commitment to create jobs and home-grown energy through the safe and responsible exploration and development of offshore energy resources. ... The Gulf of Mexico has been and will continue to be a cornerstone of our domestic energy portfolio, with vital energy resources that spur economic opportunities and further reduce our dependence on foreign oil.

How can you cash in?

As previously mentioned, major oil companies such as BP, Royal Dutch Shell, and Chevron are all investing billions of dollars to tap the riches of the Lower Tertiary Basin. But an even better way to profit from offshore fracking is with the oil service companies that provide the fracking expertise -- companies such as Halliburton, Schlumberger (SLB +3.28%), Baker Hughes, and Superior Energy Services (SPN +0.00%).

Baker Hughes is especially well poised to prosper, owning a third of the world's offshore fracking fleet and some of the industry's best technology. For example, it recently fracked a well for Brazilian oil giant Petrobras in 8,211 feet of water that reached to 27,000 feet beneath the surface.

What about environmental concerns?

"Deepwater fracking in the Gulf should be banned immediately as the true impacts to the marine environment are unknown," says Jonathan Henderson, coastal resiliency organizer for the Gulf Restoration Network. Such are the concerns activists, including writer Cherri Foytlin, who fears that chemical contamination of the Gulf could destroy the fragile ecosystem of the Gulf:

If the BP oil spill of 2010 taught us nothing else, then perhaps it should be that policies, both environmental and economic, should center around the compatibility of an ethic that truly represents the value of our oceans and waters as a life source that we who live in the Gulf know them to be.

On the other hand, stringent regulations already exist to prevent just such environmental devastation. Offshore fracking is regulated by both the EPA and Department of Interior's Bureau of Safety and Environmental Enforcement, under the Clean Water Act and its National Pollutant Discharge Elimination System permit program. The program requires extensive treatment of fracked water (mostly sea water is used) that removes all but trace amounts of fracking chemicals, permits no oil contamination, and imposes strict toxicity limits on water discharged into the Gulf.

Foolish takeaway

Offshore fracking represents one of the most promising, yet challenging, ways to increase global America's oil production and reap immense economic benefits. But the seven companies mentioned above, especially the oil services companies, represent great ways for long-term investors to cash in the $1.5 trillion that's up for grabs in the Gulf of Mexico.