On March 29, 1973, the U.S. declared an end to the Vietnam War, withdrawing the last American "combat soldiers" from South Vietnam. Forty-one years later, it looks like we're going back.

Last week, the U.S. State Department confirmed that the United States will resume sale of military weapons to Vietnam. They specifically denied that the move is related to reports of increased military threats to Vietnam at the hands of the Chinese Navy, referencing instead the Vietnamese government's improved record on human rights, and alluding to China only by mentioning unspecified "U.S. security interests."

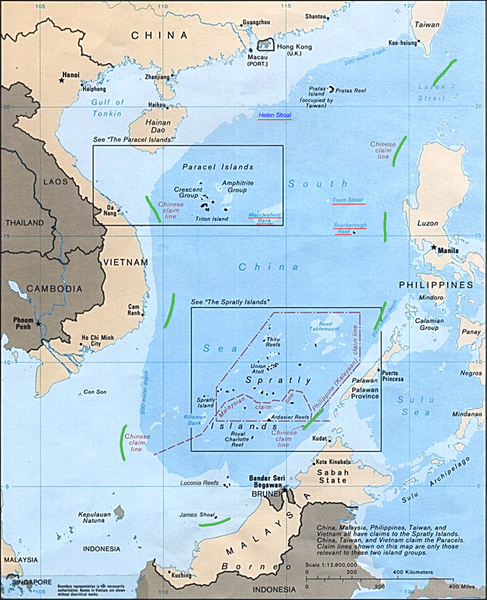

China has "interests" in Vietnam, as well. Seen here -- China's famous "nine-dash line," which claims as China's exclusive province nearly all of the South China Sea, including waters arguably belonging to Vietnam and the Philippines. Illustration: Wikimedia Commons.

This past summer saw multiple incidents of Chinese warships and commercial fishing vessels skirmishing with Vietnamese boats in the South China Sea, battling for position around a Chinese oil rig that's been set up within Vietnam's exclusive economic zone. In one notable incident, a Chinese vessel rammed, and sank, a Vietnamese fishing boat. (The sailors were rescued by other Vietnamese boats nearby, but the incident escalated hostilities nonetheless.)

Now, according to combined reports from ABC News and DefenseNews.com, we learn that at the same time as China is raising the temperature on territorial disputes in the South China Sea, the U.S. may begin selling Vietnam "maritime security assets." This, says DN, could include everything "from prop planes like the A-29 Super Tucano" (jointly manufactured by America's Sierra Nevada Corp and Brazil's Embraer) to Boeing's "large P-8 maritime surveillance aircraft."

Boeing's P-8 Poseidon. If it looks a lot like a militarized 737... that's because it is. Photo: Flickr.

ABC adds that boats such as the five fast patrol boats provided to Vietnam under an $18 million aid package late last year -- unarmed, as the ban on weapons sales had not then been lifted -- could also be offered to Vietnam, should it be inclined to buy them.

Vietnam -- it's got potential

DN notes that, as of this moment, Vietnam "does not have any equipment on order." But with news of the State Department's new policy only a week old, that could change quickly. And with Vietnam sporting an annual military budget of anywhere from $3.4 billion to $4 billion, this is not an insignificant opportunity for U.S. defense contractors.

It's probably not too early for investors to keep an eye on this part of the world -- where spending on naval forces could reach $200 billion during the next two decades -- to begin considering the possibilities of which companies could benefit from a resumption of U.S. arms sales to Vietnam. So let's do that.

Who benefits?

In the air, the two most obvious candidates to benefit for Vietnamese arms buying for maritime security are the two firms that DN has already highlighted -- Boeing, which makes Poseidon, arguably the world's most advanced maritime patrol aircraft, and Embraer/Sierra Nevada, which builds the Super Tucano prop-driven fighter plane -- bargain-priced for countries with sub-$10 billion defense budgets.

A third alternative to consider, though, is Textron (TXT +0.24%), which has developed a faster, and possibly even cheaper, Super Tucano alternative in the form of its TextronAirLand Scorpion fighter jet.

Textron's Scorpion is still in search of its first buyer. Will Vietnam make a bid? Photo: Textron.

And, of course, you can't forget Sikorsky, whose Seahawks (and their Black Hawk analogs) are preferred maritime patrol helicopters around the world.

In the U.S. and around the world, Black Hawks and Seahawks are the world's No. 1 most popular military helicopter model. Photo: Wikimedia Commons.

Meanwhile, in the water, the most likely U.S. contenders for Vietnamese military sales are probably, in order, privately held Bollinger Shipyards, which builds small Cyclone-class patrol coastal vessels for the U.S. Navy, Huntington Ingalls (HII +3.37%), the Coast Guard's go-to source for coastal "cutters," and Lockheed Martin (LMT +1.28%), which, along with Australia's Austal, builds Littoral Combat Ships for the U.S. Navy ("littoral" being just the place where Vietnam has been having so many conflicts with China of late).

Which of these companies will ultimately win defense contracts to help Vietnam arm up and defend its coastal waters? Only time will tell. But now, at least, now you've got a list of "likely suspects" to keep an eye on.