Twitter's CEO Dick Costolo. Source: Twitter

A big focus for social media companies is average revenue per user. The metric distills a social media company's ability to monetize its content into one easily digestible number. There are three basic factors that impact average ad revenue per user for companies like Facebook (FB 0.04%) and Twitter (TWTR +0.00%): ad prices, ad load, and engagement.

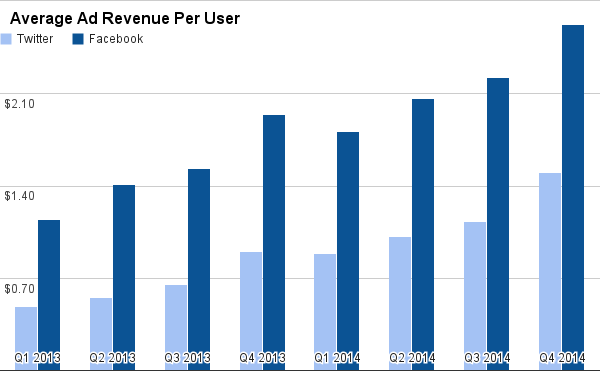

Both Facebook and Twitter have successfully grown their average ad revenue per user phenomenally over the last couple years. Thus far, Facebook's ad revenue per user has stayed well ahead of Twitter's, although Twitter is starting to close the gap. Notably, a few surprising results from Twitter's fourth quarter results indicate the company may make even more progress closing that gap in 2015.

How does Twitter stack up?

Over the last couple years, Twitter has rolled out new ad units and increased ad load in users' timelines. The result has been a rapid increase in ad revenue per user. Meanwhile, Facebook has successfully transitioned to mobile, with Newsfeed ads now carrying higher average ad prices than the company's old desktop right-hand column ads. As such, average ad revenue per user has grown robustly for both companies.

Source: Compiled by author based on 10-Qs and 10-Ks from Twitter and Facebook

In the fourth quarter, Facebook increased ad revenue per user 35%. Twitter, meanwhile, improved its ARPU 65%. The rapid growth from Twitter increased the company's revenue per user to 57% of Facebook's. That's up from just 40% in the second quarter of 2013.

The surprising part of that trend is Twitter has done it while its average ad price has declined. Twitter's average cost per ad engagement last quarter was just 46% of its average CPE in the first quarter of 2013.

Meanwhile, Facebook has exhibited the exact opposite behavior. Average ad prices in 2014 climbed 271% from 2012. Last quarter, Facebook increased its average ad price 335% year over year. That ad price growth has been offset by a decline in ad impressions.

Twitter is starting to grow ad prices too

Last quarter was the first quarter in which Twitter produced a year-over-year increase in its cost per engagement. The company reported average ad prices climbed 10% from the same period in 2013. That trend should accelerate in 2015.

In the long run, Twitter has the potential to increase its ad prices beyond Facebook's. Because of the way Twitter operates, it's at a distinct advantage to Facebook when it comes to determining its users exact interests.

Twitter is filled with people dispensing useful information about topics that users are most interested in. They can choose to follow those people. That creates a strong signal of interests that users willingly send to Twitter. That's why Twitter is trying to guide new users toward an interest-based timeline with its new instant timeline feature when people sign up.

On Facebook, people are friends with basically anyone they've met in real life and some relative strangers -- that creates a lot of noise for the platform. While users might like a few Pages, Facebook is more about connecting people.

Twitter timelines are filled with news, quips and information, whereas Facebook News Feeds are filled with social chatter. It stands to reason that advertisements on Twitter are far more effective, as the ads are tailored toward user interests on a platform users expect to interact with outside content.

What's more, Twitter still has plenty of ad inventory to open up as demand increases. At its analysts day in November, the company outlined a long-term goal of 5% ad load. On the company's fourth quarter earnings call, CFO Anthony Noto told investors that the company is still very far away from that goal.

Engagement is starting to trend upwards as well

As mentioned, there are three factors that impact ad revenue per user: ad price, ad load, and engagement. In the fourth quarter, Twitter's engagement showed improvement, increasing 3% year over year in terms of timeline views. That number had declined through the first three quarters of 2014.

Twitter will stop reporting its timeline views metric in 2015, as it focuses more on engaging new users and encouraging more visitors to sign up. However, the turnaround in the fourth quarter is encouraging, as is the company's rapid deployment of new features so far in the first few weeks of 2015. Twitter's new features are primarily aimed at engaging new users and signing up logged-out visitors.

Hitting the trifecta

In 2015, Twitter could find itself increasing its ad load, ad prices, and engagement. As such, average ad revenue per user will climb rapidly.

Facebook, comparatively, will see its ad impressions decline in the first half of 2015 due to changes to the right hand column, but ad prices are still growing very rapidly. Engagement at Facebook is still strong, but more users are flocking to Facebook's Instagram to share photos, which carries lower average ad prices and ad load compared to Facebook's flagship app.

As such, Twitter is well positioned to decrease the gap between itself and Facebook in average revenue per user. With user growth slowing, and strong expectations for revenue growth (nearly twice the rate expected for Facebook), it'll be necessary to beat analyst's projections.