A solo 401(k), also known as an individual 401(k) or a 401(k) with only one participant, is a retirement account available to business owners with no employees.

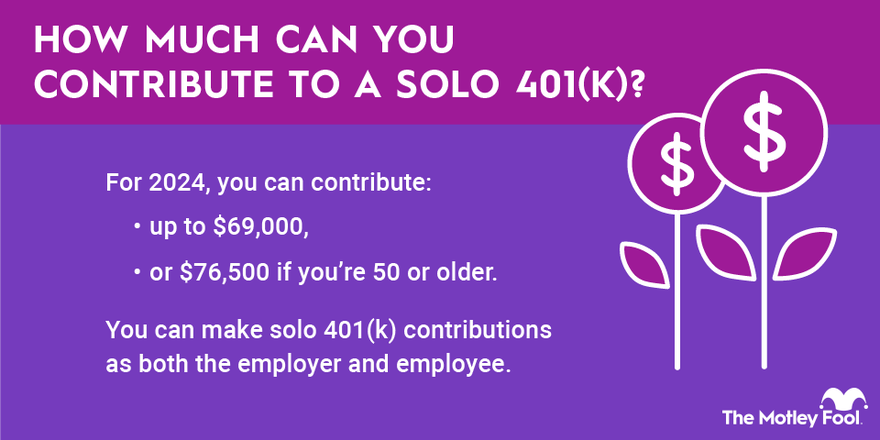

The big draw of a solo 401(k) is the high contribution limit. For 2025, you can contribute up to $70,000, $77,500 if you're ages 50-59, or 64 and older, and $81,250 if you're ages 60-63. For 2024, the limits were $69,000, or $76,500 if you're 50 or older.

What is a solo 401(k)?

A solo 401(k) is a type of retirement savings account for self-employed individuals, or for employers with no employees besides themselves and their spouses.

To be eligible to open a solo 401(k), you need to claim some self-employment income on your tax return. It's important to keep in mind that self-employment doesn't need to be your only source of income. For example, if you work a full-time job for an employer and do some consulting work on the side, you can use a solo 401(k) to set aside some of that extra income.

The only real requirement, other than making self-employment income, is not having any full-time employees other than yourself and your spouse. If you operate a small business with part-time workers (less than 1,000 hours per year each), you can still open a solo 401(k) account.

Solo 401(k) contribution limits

One of the biggest benefits of a solo 401(k) is that its contribution limits are usually the highest of all retirement account types. Just as with a regular 401(k), contributions can be made from the employer and the employee. However, in a solo 401(k), you play both roles, so you can make both contributions.

For 2024, you're allowed to elect to defer $23,000 of your self-employment income as an employee contribution, and this limit is increased to $30,500 if you're over 50 to allow you to "catch up" on your savings.

The limits increase to $23,500 in 2025. A $7,500 catch-up contribution is allowed for workers 50 and older. However, an additional catch-up contribution is afforded to those between the ages of 60 and 63, bringing the maximum catch-up contribution for this age group to $11,250. You can contribute your elective deferral to a traditional pre-tax account or a designated after-tax Roth account.

In addition to this, you can contribute 25% of your self-employment income or compensation as an employer contribution -- up to an overall maximum of $70,000 (or $77,500 for those who are 50-59 or 64 or older, and $81,250 for those ages 60-63) in 2025. The limits in 2024 were $69,000 (or $76,500 for those older than 50).

Calculating compensation for unsalaried entrepreneurs (sole proprietors) is a bit trickier. You'll have to reduce your self-employment income by the employer's half of the self-employment tax as well as adjust for the employer's contribution.

You can also contribute up to $70,000 to a SEP-IRA in 2025, or $69,000 in 2024. But a SEP-IRA is similar to the employer portion of a solo 401(k); you're limited to 25% of your compensation.

Other retirement savings vehicles have much lower contribution limits. So a solo 401(k) is ideal for entrepreneurs looking to save the highest percentage of their income in a retirement account.

Most SIMPLE IRAs, for example, has a limit of just $16,500 for employee deferrals in 2025 ($16,000 in 2024). Catch-up contributions for most plans are limited to $3,500 in 2024 and 2025. The employer portion is usually maxed out at just 3% of compensation. (Note that under the Secure Act 2.0, some plans can allow slightly higher contribution limits in 2025.)

Regular IRAs, which you can use in conjunction with a solo 401(k), are limited to just $7,000 in contributions for 2024 and 2025. In both years, you can make an additional $1,000 catch-up contribution if you're 50 or older.

You can make your solo 401(k) employee contributions up until the day taxes are due for the year. However, you must make your employer solo 401(k) contributions by the end of the calendar year. For example, if you want to max out your contributions for 2024, you have until April 15, 2025 to make your employee contributions, but the deadline for employer contributions is Dec. 31, 2024.

Related Retirement Topics

The results can be pretty incredible

Of course, many self-employed people don't have the ability (or need) to contribute the maximum amount allowed to a solo 401(k). However, even modest contributions add up over time.

For example, let's say that you're self-employed and that you'll have $80,000 in net self-employment income for 2025. You decide to set aside a total of 10% of your net self-employment income in a solo 401(k). Not only could this reduce your taxable income by $8,000 for the year, but if you repeat the process every year, you could end up with a retirement nest egg of more than $928,000 after 30 years -- and that assumes just 2% annual income increases and a historically conservative 7% annual rate of return.

Imagine if you decided to invest even more. With a solo 401(k), you can dramatically reduce your taxable income while building up a million-dollar nest egg.