Exelon Corporation (EXC 1.32%) stock plummeted 25% in 2015. The utility suffered sizable setbacks in 2015, and there's no guarantee 2016 will be any different. With an unstable economy, a final merger decision on Pepco Holdings (NYSE: POM) approaching, and a fine regulatory balance to keep, here are three reasons Exelon stock could fall.

1. The economy slows

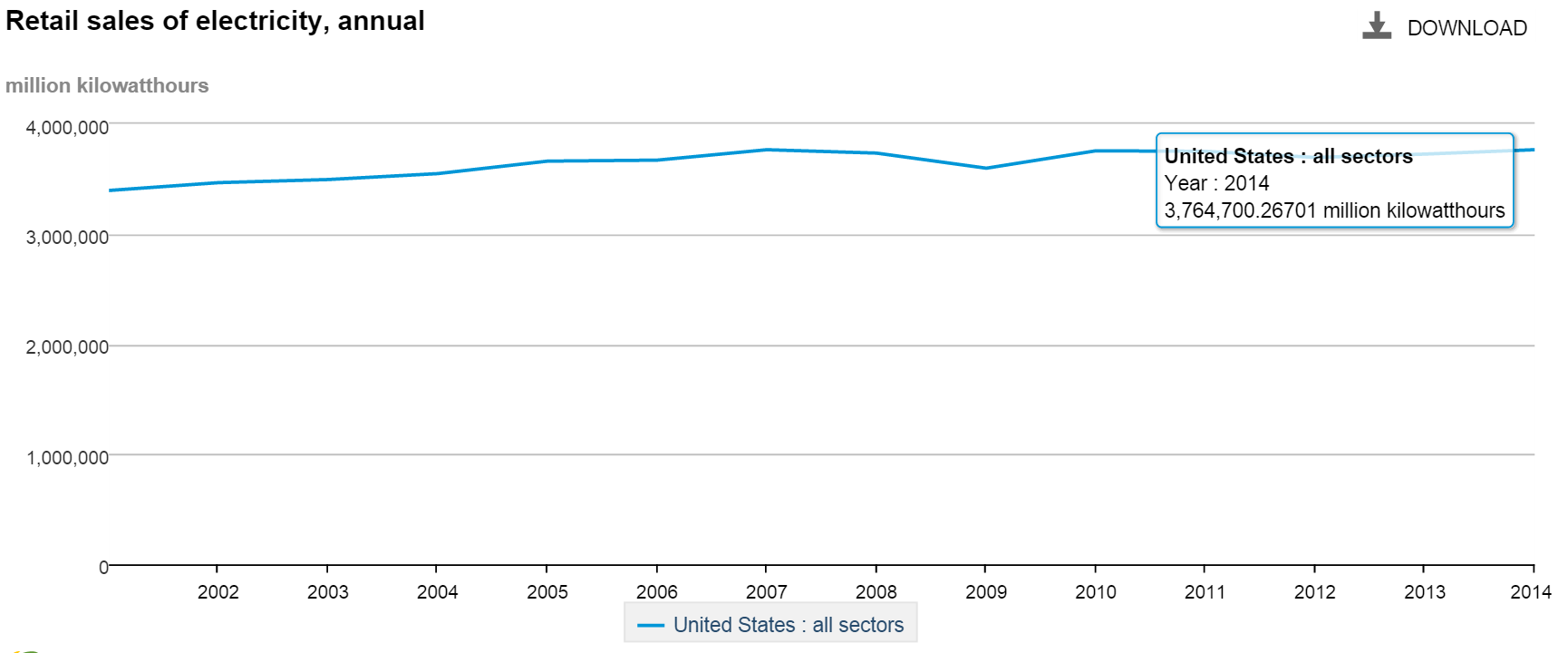

As the largest electricity provider in the United States in terms of sales, Exelon Corporation literally powers our nation's economic growth.

Historically, utility companies have relied on regulated earnings to pull in consistent earnings over time. But since sales haven't increased in seven years, utilities have had to find other ways to deal with flatlining fundamentals.

Source: EIA.gov; Retail sales of electricity (annual).

Rather than focus on increasing electricity demand from existing customers, utilities have been running a merger marathon for the past five years. Duke Energy Corporation (DUK +0.45%) kicked things off in January 2011, when it announced it would acquire Progress Energy. Just three months later, Exelon made its own splash when it revealed plans to merge with Constellation Energy.

Both companies have (obviously) seen sales skyrocket since then -- that's what happens when you add one company's revenue to another's. While retail electricity sales inched up just 3% since 2011, Exelon revenue increased 75%, and Duke Energy's expanded 126%.

U.S. Electricity Retail Sales data by YCharts.

A stagnant economy means stagnant sales, while mergers bring with them potential economies of scale. As signs of a slowing economy emerge again, Exelon is set to add another company to its ranks: Pepco Holdings.

2. The Pepco merger folds

When Exelon announced on April 30, 2014, that it planned to purchase Pepco Holdings for $6.8 billion, its investors weren't elated. Pepco stock immediately popped up 20% to account for the purchase premium, but Exelon stock prices barely budged. Since then, some of the steam has left Pepco stock, and Exelon stock has been on a slow and steady decline.

The lackluster performance can be boiled down to two issues. First, it's unclear whether the acquisition will even occur. After almost two years of regulatory scrutiny, Exelon has managed to snag approvals from FERC, Maryland, Delaware, New Jersey, and Virginia. But D.C. regulators have proven problematic, and the two corporations are still waiting for an uncertain final verdict, which is expected this quarter.

The second issue is the looming uncertainty as to whether this merger will pay off for Exelon. Its major selling points are increased economies of scale and a more regulated energy portfolio. If the merger goes through, the new megautility will enjoy a 9 million-person electric customer base, outstripping Duke Energy Corporation's current leadership position of 7 million.

Source: EIA.gov.

However, a bigger top line is important only if the bottom line follows. Over the past five years, Exelon's gross and operating margins haven't done much, and Pepco Holdings' own margins aren't faring any better. Compared to competitor Duke Energy, both companies are doing a poor job translating sales into profits.

POM Operating Margin (TTM) data by YCharts.

3. Regulated earnings drop off

In 2014, Exelon earnings were nearly an even split between regulated earnings and competitive generation. By 2018, the company expects to tip the scales to 60% regulated and 40% competitive. That creates stability for investors, and it allows Exelon to better predict its future value return to shareholders via stock repurchases and dividends. As Exelon recently promised, "If investments do not meet our thresholds, we will return capital to shareholders."

The biggest unknown for Exelon's regulated earnings is whether the Pepco Holdings merger will go through. Without it, Exelon expects to grow its existing $22 billion rate base to $28 billion by 2018. With the merger, that rate base would expand an extra $10 billion to $38 billion -- that's equivalent to nearly 140% of Exelon's total revenue for fiscal year 2014. With an increasingly erratic economy and an energy sector undergoing significant change, investors will want to make sure Exelon is doing everything it can to provide stable earnings in the years to come.

Sell Exelon in 2016?

Exelon stock could fall in 2016 -- but it could also rise. The list above highlights three important risks every Exelon investor should be aware of. Balancing risk and return is the only way to develop a fully informed investment thesis, so read on and read up -- there's a lot to learn about the future of businesses you own.