When Exelon Corporation (NYSE: EXC) announced a Q4 earnings miss earlier this week, share prices jumped more than 5%. Quarterly reports aren't everything, and Exelon investors seemed to be interested in more than just earnings per share. The stock has been on the rise over the past month, causing some to wonder whether it's ready for a turnaround. Before you make your own decision, here are three things Exelon management wants you to know.

1. They're cutting costs

Exelon President and CEO Chris Crane started his earnings report statement with the following note: "Despite a challenging year for the sector, strong operating performance at both our utilities and our generation business enabled us to deliver strong earnings."

"Challenging" may be an understatement for utilities. Weak competitive markets, erratic weather, a slew of new environmental regulations, and an increasingly complicated choice of energy generation options have left stalwart stocks like Exelon Corporation on uneven footing. For any utility stock investor, it's essential to know how your investments are handling these challenges.

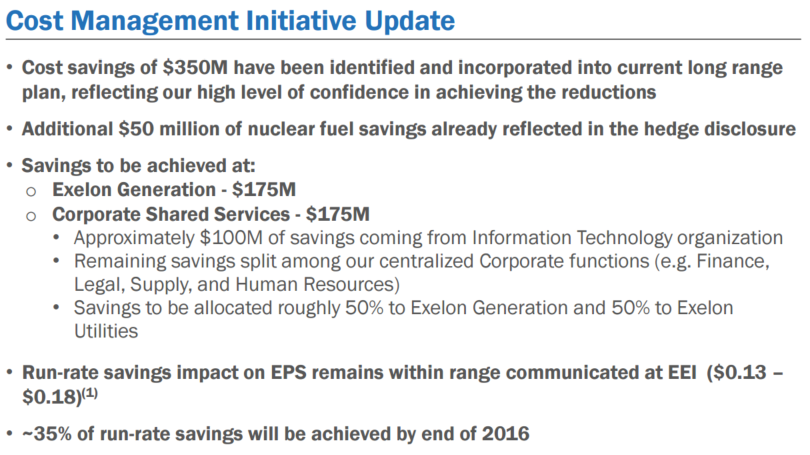

Exelon has plans to bring stability back to both its business and its stock. On the business side, Exelon is watching out for its bottom line by making good on a cost savings initiative. So far, the utility has targeted $350 million of unnecessary spending. It already expects operations and maintenance costs to enjoy a $125 million reduction in 2016. That's music to investors' ears. While utilities can only move the needle so much on highly regulated demand-driven revenue, trimming the fat means each dollar of sales ultimately transforms into more profit.

Image source: Exelon Corporation.

2. They're growing the dividend

Not only did Exelon management announce a plan to increase the dividend in 2016 -- they announced a plan to grow the dividend 2.5% each year for the next three years. While that's hardly a big boost, it does mean Exelon is back on a steady distribution schedule. Earlier this week, I predicted Exelon would set itself up for "a steady year of dividend distributions." The utility has gone slightly further than that, and investors seem to be taking the news well.

After an erratic back-and-forth over the past few years, many dividend stock investors will be satisfied with this slow annual distribution growth, from $0.31 to $0.334 in three years from now. At current rates, the company's dividend yield already clocks in at 4.1%, on par with its competitors'.

EXC Dividend data by YCharts.

3. They're ramping up regulated earnings

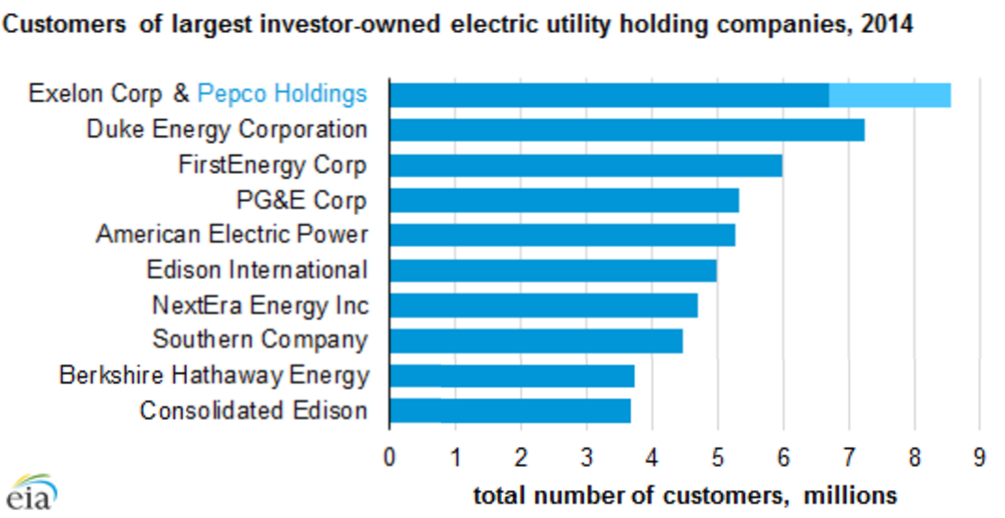

Exelon and its investors know what it's like to incur erratic earnings -- and they want to put an end to it. The utility is set on ramping up its regulated earnings, and continues to make headway on this front. If its proposed acquisition of Pepco Holdings goes through, the combined companies will enjoy more than 8 million electricity customers. That's enough to make it the biggest investor-owned electric utility in terms of customers, beating out second-place Duke Energy Corporation by more than 1 million.

Image source: EIA.gov.

The acquisition is still under regulatory consideration, but Exelon is also making internal moves to increase regulated earnings. It secured positive regulatory outcomes for two of its regulated utility arms in 2015 and will pursue additional opportunities in 2016.

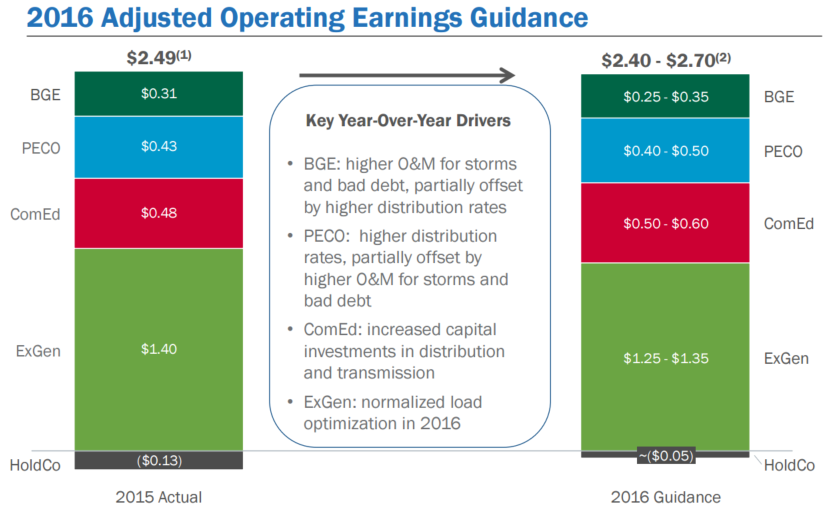

Image source: Exelon Corporation.

Looking ahead

Exelon announced 2016 EPS guidance in the range of $2.40 to $2.70. In the year ahead, the company plans to earn the same or more from its three regulated businesses, while dropping its competitive "ExGen" earnings around 5% to 10%.

So far, 2016 has been a good year for Exelon stock. Its affordable valuation makes any good news go far, and Exelon management has delivered on exactly the sorts of small but significant improvements that investors had been hoping for. But any signs of tough times in the quarters ahead could wipe out recent gains, and investors will need to keep a close watch on the next round of notes from Exelon management.