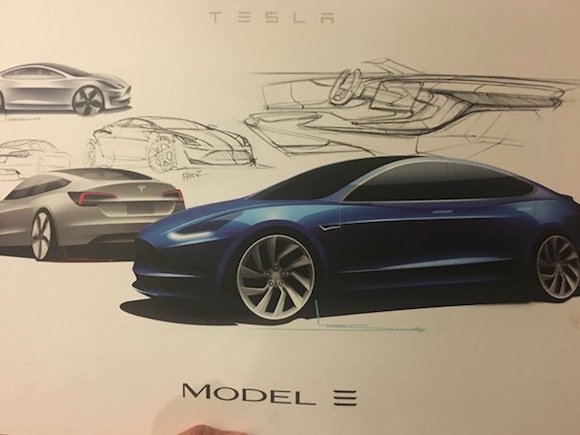

Model 3 design sketches. Image source: Elon Musk.

The skepticism surrounding Tesla's (TSLA 0.87%) incredibly aggressive new production ramp is palpable.

After a relatively better-than-expected earnings release, the real headliner was the company's accelerated plan to build 500,000 cars in 2018. That would be great news if the company can pull it off -- but the market's reaction shows that investors lack confidence in Elon Musk's grand plans. Shares have fallen since the earnings release, as investors digest the very likely upcoming capital raise combined with said skepticism about actually achieving the target.

What a difference one year makes.

Party like it's 2015

The EV maker had a secondary offering just last year, and there was no shortage of investor interest. Initially, the company was planning on selling 2.1 million shares in order to raise nearly $500 million, but the offering was so oversubscribed that Tesla increased the number of shares to 2.7 million. Even after that increase, the underwriters exercised the maximum number of options to purchase an additional 404,000 shares.

Tesla ended up raising a grand total of $739 million net of fees. Notably, shares actually jumped on the news, a contrast to the typical negative market reaction associated with secondary offerings. The reasons being that the dilution would be minimal thanks to the company's premium share valuation, the cash infusion was necessary to help fund capital expenditures to drive growth, and Musk was personally participating in the offering by buying $20 million.

Less than a year later, investors are seemingly balking at the idea of another secondary offering, considering the share weakness since the announcement. Keep in mind that the 2015 secondary offering was priced at $242, so investors that bought in to the offering are currently in the red.

Testing patience

Generally, Tesla investors are extremely patient, since they know just how incredibly capital intensive it is to build an automaker from scratch. Shareholders have casually brushed off mounting losses, intense cash burn, and soaring expenses. These are all par for the course for just about any young growth company. These are all amplified exponentially when we're talking about the auto industry.

But the 2015 offering was a lot more practical in terms of the related production goal. Model X was preparing to launch, and Tesla was continuing to build its Gigafactory (only 14% complete currently). Those were very practical and achievable goals for investors to get behind.

Tesla started off 2016 by telling investors that it would not need external capital, expecting to fund Model 3 development and tooling with internal cash flow. But blockbuster Model 3 demand is forcing Tesla's hand, and the company very strategically wants to optimize its domestic ramp around the federal tax credit that will begin phasing out shortly after Model 3 launches.

To be clear, I agree that raising capital to accelerate the ramp is the right strategy for Tesla's long-term prospects (albeit with intense execution risks). But Musk doesn't need to convince me; Tesla is already my largest holding. Musk needs to convince the market, but it seems that investors might be losing at least a little bit of patience.

Tesla is very much setting the stage for another capital raise, but the investor appetite to buy up newly issued shares looks diminished compared to the last time around.