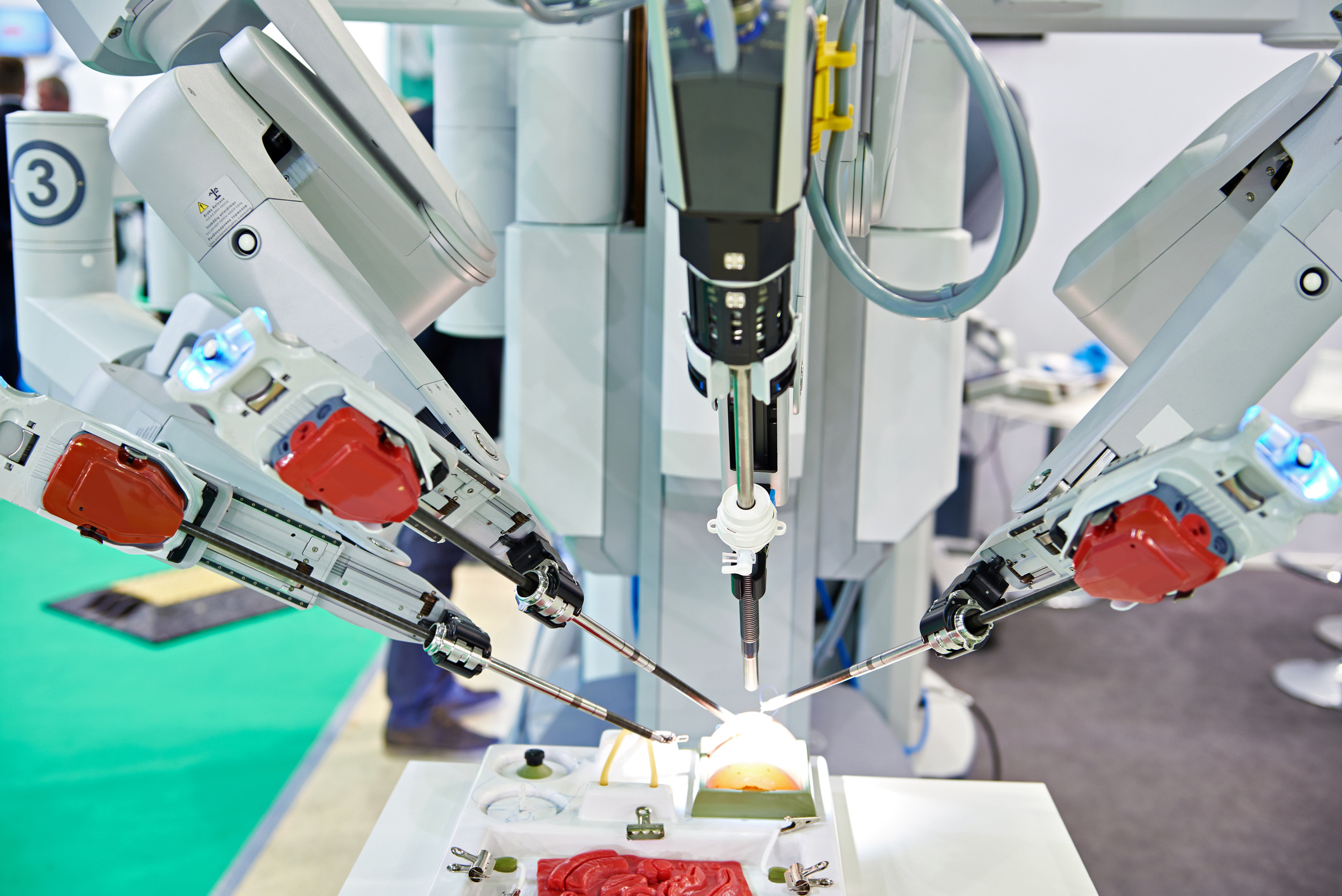

Investing in Intuitive Surgical (ISRG -3.55%) is the global leader in robotic-assisted surgery, best known for its da Vinci Surgical Systems. Surgeons in more than 70 countries have used its technology in over 16 million procedures, making the company a dominant force in minimally invasive surgery.

While the robots get the attention, the real business strength lies in Intuitive’s recurring revenue. More than 80% of sales come from instruments, accessories, service contracts, and operating leases tied to its installed base. That model has helped Intuitive generate steady profits and strong cash flow over time.

Here’s how to buy Intuitive Surgical stock and what to consider before investing.

How to buy Intuitive Surgical stock

The company is listed on the NASDAQ exchange and has an average daily volume of shares traded of around 1.5 million.

Here's the process for buying Intuitive Surgical stock:

- Open your brokerage account: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Fund your account: Transfer money so you’re ready to invest.

- Search for Intuitive Surgical: Enter the ticker "ISRG" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Intuitive Surgical stock?

Intuitive Surgical is a growth stock rather than a value stock, meaning relatively more of the value in the stock comes from its future earnings and cash-flow streams.

The company has a powerful competitive moat built around its installed base of da Vinci systems and a razor-and-blade revenue model. Each new system placement creates years of recurring sales from instruments, accessories, and services. As procedure volumes rise globally, Intuitive benefits even without dramatically increasing system sales.

That said, much of this strength is already reflected in the stock’s valuation. Intuitive doesn’t pay a dividend, and future returns depend largely on continued growth meeting high expectations. If adoption slows or competition intensifies, the stock could underperform.

Bottom line: Intuitive Surgical may appeal to long-term investors who want exposure to healthcare innovation and are comfortable paying a premium for market leadership. It’s best suited for growth-focused portfolios, not investors seeking dividends or bargain-priced stocks.

NASDAQ: ISRG

Key Data Points

Is Intuitive Surgical profitable?

Intuitive Surgical is a profitable healthcare company with an operating income of $2.4 billion in 2024. With its growing base of da Vinci systems, services revenue, and increasing recurring revenue, it's highly likely to grow sales and earnings for many years.

The company's nonrecurring revenue generates the bulk of its profits and is the key to its future earnings. The good news is that it's growing as a share of total revenue (from 71% in 2017 to 84% in 2024), indicating strong demand for the use of its systems in procedures.

Does Intuitive Surgical pay a dividend?

As a company focused on growth, it doesn't pay dividends and is unlikely to do so for the foreseeable future.

Exchange-Traded Fund (ETF)

Will Intuitive Surgical stock split?

Management has already initiated three stock splits along the way. There was a 1:2 stock split in 2003 when the price was less than $2 a share, followed by a 3:1 split in the summer of 2017 and another 3:1 split in May 2021. The last two splits were driven by the spectacular rise in the stock price over the previous few decades (up 22,400% since the start of 2003).

Given that the stock price stood at around $546 a share as of late 2025, management could go for another stock split since there's been a significant appreciation in the share price.

The bottom line

Intuitive Surgical is the clear leader in robotic-assisted surgery, with a powerful recurring-revenue model built around its da Vinci systems. That combination has driven strong, consistent growth and supports long-term earnings potential.

The trade-off is valuation. The stock doesn’t pay a dividend and already reflects high expectations for future growth. For investors comfortable with premium growth stocks, Intuitive Surgical could be a strong long-term holding. More conservative investors may prefer to gain exposure through ETFs or wait for a more attractive entry point.