Investing in the name of sustainability has taken off like a rocket over the last decade, and green bonds are one of the most talked-about green asset classes.

Green Bonds

These fixed-income securities are designed for initiatives that matter to the environment, such as renewable energy, fighting climate change, and supporting sustainable and environmentally sound development. Below, we break down green bonds, explaining what they actually facilitate and how to invest in them.

What are green bonds?

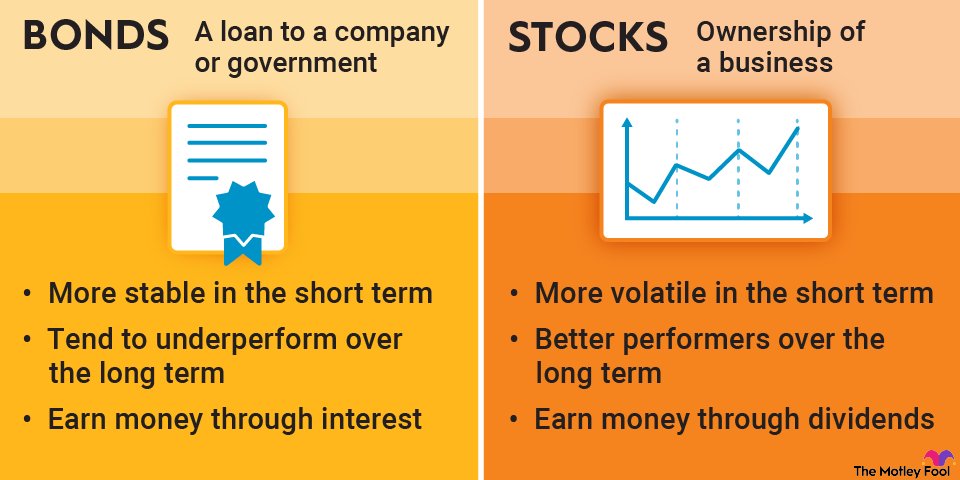

Green bonds are debt instruments issued to finance projects that have a positive environmental impact. Unlike traditional bonds, the proceeds from green bonds are earmarked exclusively for green initiatives, such as renewable energy projects, energy efficiency improvements, clean transportation, and general sustainability.

Just like traditional bonds, issuers can include governments, municipalities, corporations, and financial institutions. The key driver and distinction between traditional bonds and green bonds is the commitment to use the funds for positive environmental purposes.

Types of green bonds

Green bonds come in various colors, shapes, and sizes, each tailored to specific issuers and project types. The table below shows some of the most common ones.

Type of bond | Issuer and Purpose |

|---|---|

Corporate green bonds | Issued by companies to fund environmentally friendly projects within their operations |

Municipal green bonds | Issued by local governments to finance public infrastructure projects like sustainable transportation or water treatment facilities |

Sovereign green bonds | Issued by national governments to support large-scale environmental initiatives |

Supranational green bonds | Issued by international organizations, such as the World Bank, to fund global environmental projects |

Green asset-backed securities (ABS) | Backed by a pool of green assets, such as loans for renewable energy projects |

Green bond principles

Before issuing a true green bond, companies, governments, or institutions must abide by the Green Bond Principles (GBP). The International Capital Market Association (ICMA) established the GBP to provide voluntary guidelines for ensuring that transparency and integrity were part of the mix. The four core components are:

1. Use of proceeds

This principle ensures that the money raised from a green bond goes to green projects, such as solar farms, energy-efficient buildings, or clean water systems. Investors want to know their money is helping the planet, not just funding general business expenses. For example, if a city issues a green bond, the proceeds may be allocated specifically to building electric bus lanes, not repaving roads.

2. Process for project evaluation and selection

Before issuing a green bond, the organization has to demonstrate how it decides which projects are truly green. With green bonds, an investor would ideally know exactly what they are investing in and its purpose. A company may have an internal team that reviews proposals to ensure they meet the criteria for projects that truly help the environment.

3. Management of proceeds

Once the funds are raised, they must be tracked separately to make sure they're spent properly. It's not ideal for 10% of the funds to be allocated to a dam project and the remaining 90% to be diverted into a polluting project.

Some issuers use dedicated accounts or third-party audits to keep things clean. A solar developer, for example, might open a separate bank account just for bond proceeds used to build new solar farms.

4. Regular reporting

Just as a publicly traded company is required to issue financial statements to its shareholders on a regular basis, green bond issuers should disclose to their bondholders how the proceeds of the bond were spent. This helps build trust and shows the impact of the investment.

You've probably seen an annual letter from a nonprofit organization saying, "Thanks to your donation, we planted 10,000 trees." A green bond report might say, "This year, our project avoided 1,200 tons of CO₂ emissions."

Investing in green bonds offers several advantages:

- Environmental impact

- Portfolio diversification

- Tax incentives

- Market demand

- Reputational benefits

Examples of green bonds

Toronto

Toronto has raised almost $1 billion through green bond issuances to fund various environmental projects. This initiative allowed the city to reduce its reliance on federal funding and expedite important infrastructure developments aimed at achieving environmental stability.

Asheville, N.C.

Asheville's Water Resources Department issued a green bond to upgrade its drinking water infrastructure. The proceeds were used to replace failing water lines, enhance water tanks, and install emergency generators, which resulted in reduced water leaks.

Apple

Apple (AAPL -0.46%) issued a $1.5 billion green bond in 2016, marking the largest U.S. corporate green bond at that time. The proceeds were allocated to projects aimed at reducing the company's environmental impact, including renewable energy installations, energy efficiency improvements in facilities, and sustainable materials sourcing.

How to invest in green bonds

Investors can access green bonds through various channels:

1. Direct purchase of green bonds

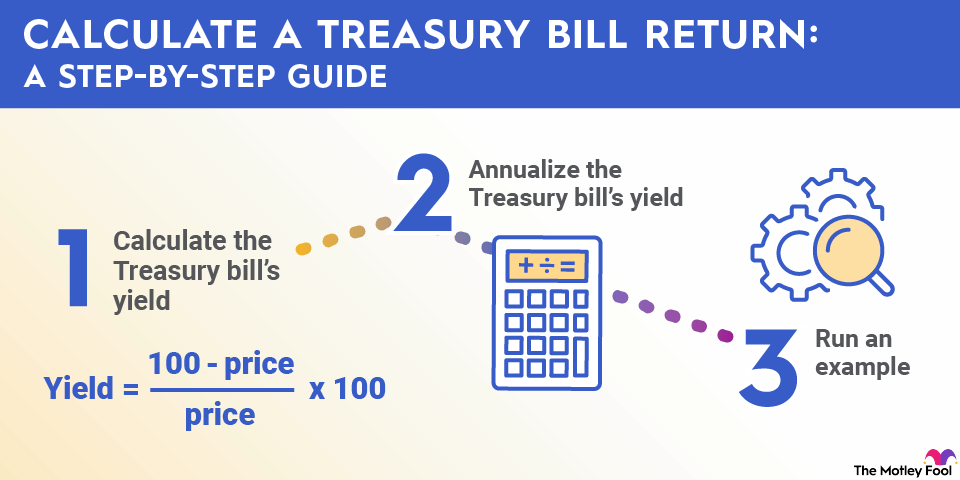

Much like buying regular bonds, investors can buy individual green bonds through most major brokerage accounts. In most cases, these are issued by governments, municipalities, or large corporations to fund eco-friendly projects.

For example, a company trying its hand at cheap water desalination might raise bonds for a specific project that utilizes a new, promising technology. This method can give you direct exposure to a specific project, but always do your homework before investing in anything that a company assures you is both green and a can't-miss investment.

2. Investing through green bond funds

Most people won't know a lot about the specifics of green projects, so funds are a great option to gain exposure to green bonds without picking winners and losers. Mutual funds and exchange-traded funds (ETFs) that specialize in green bonds are popular alternatives to picking specific green bonds. These funds pool money from many investors and distribute it across multiple green bonds for diversification.

3. Tracking green bond indexes

Green bond indexes, such as the Bloomberg Barclays MSCI Green Bond Index, track the overall performance of the green bond market. While you can't invest directly in an index, you can invest in funds that follow it and use it as a benchmark for your own investments.

4. Using sustainable investment platforms

Online investment platforms, such as Wealthify and Abundant Investments, now offer access to sustainable and environmental, social, and governance (ESG)-focused investments, including green bonds. These tools often curate options that meet environmental criteria, making it simple for retail investors to get involved. Some even allow you to filter by specific causes, like clean energy or saving whales.

Related investing topics

Pros and cons of investing in green bonds

Investing in green bonds is often something people do because they're at least somewhat interested in supporting green initiatives like clean transportation or green energy projects.

Here are the pros and cons to consider:

Pros

- Green bonds support sustainability projects, which can be great for the planet.

- Demand is increasing, which also creates the potential for gains on the secondary bond market prior to your bond's maturity.

- These bonds often have high credit quality due to backing from the government and blue-chip companies.

Cons

- Some green bonds may be "greenwashed," and only have the appearance of actually supporting sustainability and environmentally friendly projects.

- Reporting on environmental impacts isn't always transparent, so it can be difficult to know which bonds are actually doing what they say.

- Green bonds can have different risk profiles than other bonds, due to regulatory pressures and ebbs and flows in the interest in green projects.