Tax-free municipal bonds are fixed-income investments that fund public projects, such as schools, highways, and parks. State and local governments issue municipal bonds, "munis" for short. Since these bonds are government debt, they're a low-risk (but not risk-free) investment.

As the name suggests, they also save you money on taxes. There are no federal taxes on interest earned from tax-free municipal bonds. There are also typically no state or local taxes if you buy a municipal bond issued in your home state.

The easiest way to invest is through municipal bond funds since selecting municipal bonds yourself can be time-consuming. A municipal bond fund allows you to get exposure to hundreds or even thousands of munis for a diversified bond portfolio.

Best tax-free municipal bonds in 2026

Here are the seven best tax-free municipal bonds, along with the number of holdings, expense ratio, and 30-day Securities and Exchange Commission (SEC) yield for each bond fund.

1. Vanguard Tax-Exempt Bond ETF

The Vanguard Tax-Exempt Bond ETF (VTEB +0.08%) is an intermediate-term bond exchange-traded fund (ETF) that invests in about 10,000 bonds. Like just about all Vanguard tax-free municipal bond funds, the expense ratio is extremely low -- the cheapest on this list at 0.03%. The 30-day SEC yield was 3.49% as of Jan. 5, 2026.

NYSEMKT: VTEB

Key Data Points

For a municipal bond fund, this Vanguard ETF has a fairly high yield. It costs hardly anything in fees, and the large number of bonds keeps risk to a minimum.

2. iShares National Muni Bond ETF

The iShares National Muni Bond ETF (MUB -0.01%) aims to track an index of investment-grade U.S. municipal bonds. It holds more than 6,000 bonds. Some of its top holdings are bonds issued in California, New York, Massachusetts, and New Jersey.

NYSEMKT: MUB

Key Data Points

This bond ETF had a 30-day SEC yield of 3.34% in early January 2026, and iShares charges an expense ratio of 0.05%. The yield and annual fee are both highly competitive, as is the risk profile -- the fund invests primarily in AA and AAA bonds.

3. Vanguard High-Yield Tax-Exempt Fund

For bond investors looking for a greater return, the Vanguard High-Yield Tax-Exempt Fund (VWAHX +0.09%) is hard to beat. Its 30-day SEC yield was an impressive 4.23% at the start of January 2026.

NASDAQMUTFUND: VWAHX

Key Data Points

The expense ratio for this bond fund is 0.17%, which isn't the lowest, but it's reasonably priced. With the focus on generating a higher yield, this Vanguard bond ETF is more volatile compared to the average muni bond fund. However, it invests in more than 3,000 bonds, so it remains well diversified.

4. iShares California Muni Bond ETF

If you live in California and have a high marginal tax rate, it's a good idea to invest in tax-free municipal bonds issued there so you can avoid state taxes. The iShares California Muni Bond ETF (CMF +0.07%) fits the bill. It invests in investment-grade municipal bonds issued in California, holds more than 1,400 munis, and charges an expense ratio of 0.08%.

NYSEMKT: CMF

Key Data Points

This California bond ETF had a 30-day SEC yield of 3.01% as of Jan. 6. Because California has some of the highest income tax rates in the U.S., this fund's after-tax yield could be better than what you'd get from other bond funds.

5. Vanguard New York Long-Term Tax-Exempt Fund Investor Shares

New York is another state with high income taxes. If you live there, consider the Vanguard New York Long-Term Tax-Exempt Fund Investor Shares (VNYTX +0.09%). This fund invests in high-quality municipal bonds issued by New York state and local governments.

NASDAQMUTFUND: VNYTX

Key Data Points

The ETF holds more than 1,500 bonds and charges a 0.14% expense ratio. The 30-day SEC yield was 3.77% at the start of January. The combination of low fees and a solid yield makes this fund the top option for New York residents.

6. Invesco National AMT-Free Municipal Bond ETF

Some high-income investors need to pay the alternative minimum tax (AMT). The Invesco National AMT-Free Municipal Bond ETF (PZA -0.04%) invests specifically in municipal bonds that are exempt from the AMT.

NYSEMKT: PZA

Key Data Points

This fund holds more than 5,000 bonds, and it's notable for investing in long-term bonds with at least 15 years remaining until maturity. Bonds with longer terms generally pay more, which was reflected in the Invesco fund's 30-day SEC yield of 3.90% as of Jan. 6, 2026. The expense ratio is 0.28%.

7. Vanguard Short-Term Tax-Exempt Bond ETF

The Vanguard Short-Term Tax-Exempt Bond ETF (VTES +0.03%) provides exposure to short-term munis, specifically those with one month to seven years until maturity. An advantage of short-term bonds is that they carry less interest rate risk. If rates rise, the bondholder isn't locked into a lower rate for long.

NYSEMKT: VTES

Key Data Points

The expense ratio for this Vanguard bond ETF is a low 0.06%, and it holds about 3,000 bonds. The 30-day SEC yield was 2.53% at the start of January. Short-term bonds tend to have lower rates, which is the trade-off for less interest rate risk.

Why are municipal bonds tax-free?

In 1895, the Supreme Court ruled that the federal government had no power to tax interest on municipal bonds issued by state and local governments. The 16th Amendment to the U.S. Constitution, which authorized federal income taxes, included this exemption for municipal bonds.

One of the reasons the exemption has stuck around is that it enables states and governments to borrow money at a lower cost. This makes it more economically viable for them to invest in public projects.

Benefits and risks of investing in tax-free municipal bonds

Here are the biggest benefits of investing in tax-free municipal bonds:

- You save on taxes: If you're in a high tax bracket, tax-free munis could be just what your portfolio needs. You'll avoid adding to your federal taxes and possibly your state and local taxes, as well.

- They're safe: There's very little risk of losing money with municipal bonds. Their default rate from 1970 to 2022 was less than 0.1%, according to Moody's Investor Service.

- They provide a predictable income: Tax-free municipal bonds generally pay interest twice a year.

Like any investment, tax-free municipal bonds also have their downsides:

- They have low returns: Municipal bonds tend to pay less than other bonds, and over long periods, their average returns are well below the average stock market return. Make sure the tax savings outweigh the low interest rate.

- They have interest rate risk: If interest rates rise, the value of older municipal bonds with lower rates will decline.

- They're not always easy to sell: This can be an issue with smaller municipal bonds, but it probably won't be a problem if you stick to tax-free municipal bond funds.

Criteria for choosing tax-free municipal bonds

If you're looking for tax-free municipal bonds or bond funds, there are a few factors that can help you choose:

- Location of the issuer: If you want to avoid state and local taxes, you typically need to invest in munis issued in your home state. This is an especially important consideration if you live in a high-tax state.

- Types of bonds: Bond market options include short-term, intermediate-term, and long-term bonds, as well as investment-grade and high-yield bonds. By deciding which features are most valuable to you, you can narrow your search down to a specific type of bond.

- Yield: All things being equal, bonds with higher yields are preferable, since they make you more money. Don't forget to consider which bonds will save you the most in taxes, as well. The after-tax yield is what matters most.

- Bond rating: The bond rating measures the safety of the bond issuer. Municipal bonds rarely default, but it's still good to check bond ratings before you invest and pick funds that align with your risk tolerance.

Related investing topics

Should I invest in tax-free municipal bonds?

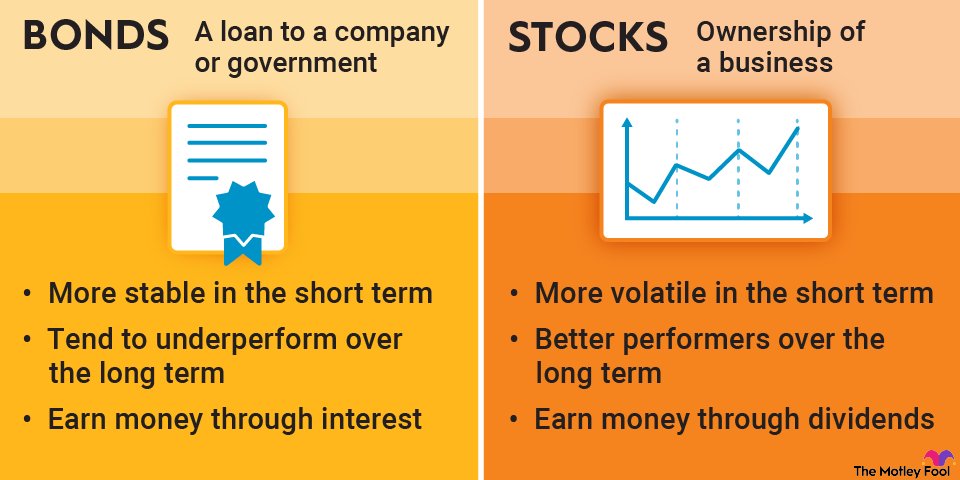

Consider investing in tax-free municipal bonds if you're looking for fixed-income investments and want to reduce your tax liability. Bonds, in general, are safer than stocks and are a good way to reduce volatility in your investment portfolio. They're particularly well suited for older investors who are retired or nearing retirement.

Whether you should invest in tax-free municipal bonds depends on your current tax situation. This type of bond typically pays less than other bonds, although there are some high-yield options available. The tax benefits are what make the difference.

Your marginal tax rate can help you figure out the right type of bond investment to buy by calculating the after-tax yield on bond funds. If a bond fund has a 5% yield but you'll pay 35% in taxes on the interest, then you'll net 3.25%. In that case, tax-free municipal bond funds paying 3.5% to 4% would offer a greater after-tax yield, making them the more profitable investment option.