- They have low returns. Municipal bonds tend to pay less than other bonds, and over long periods of time, their average returns are well below the average stock market return. Make sure the tax savings outweigh the low interest rate.

- They have interest rate risk. If interest rates go up, the value of older municipal bonds at lower rates will decline.

- They're not always easy to sell. This can be an issue with smaller municipal bonds, but it probably won't be a problem if you stick to tax-free municipal bond funds.

Should I invest in tax-free municipal bonds?

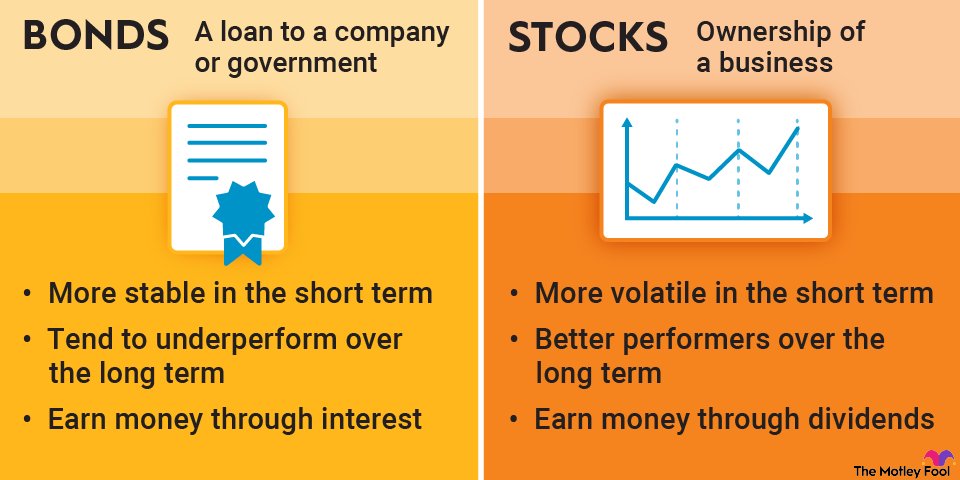

Consider investing in tax-free municipal bonds if you're looking for fixed-income investments and you want to lower your tax liability. Bonds, in general, are safer than stocks and a good way to reduce volatility in your investment portfolio. They're particularly well-suited for older investors who are retired or getting close to retirement.

Whether you should invest in tax-free municipal bonds depends on your current tax situation. This type of bond typically doesn't pay as much as other bonds, although there are some high-yield options. The tax benefits are what make the difference.

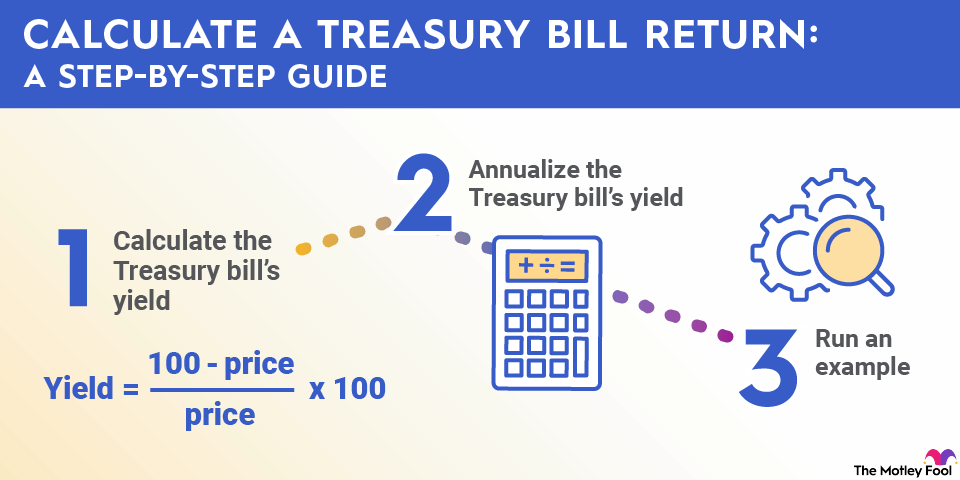

Your marginal tax rate can help you figure out the right type of bond investment to buy by calculating the after-tax yield on bond funds. If a bond fund has a 5% yield, but you'll pay 35% in taxes on the interest, then you'll net 3.25%. In that case, tax-free municipal bond funds paying 3.5% to 4% would offer a greater after-tax yield, making them the more profitable investment option.