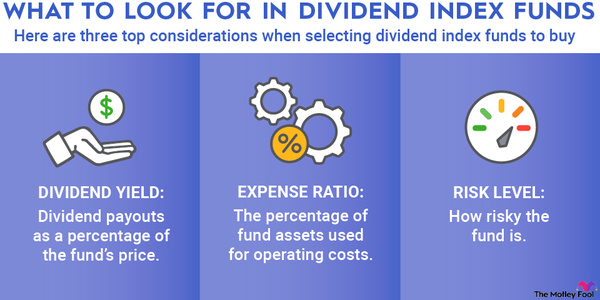

Low-cost index funds are pooled investments with low expense ratios or annual management fees. Investors who focus on minimizing their investing costs can generate vastly superior returns over time since money that would be lost to fees is compounding in your investment account.

Many investors prefer index funds -- which are a type of exchange-traded fund (ETF) -- over mutual funds because of their lower expense ratios and tax-efficient nature.

Exchange-Traded Fund (ETF)

Index-tracking ETFs typically have low expense ratios because they are passively managed, which keeps operating expenses low. Passive investing strategies don't require any in-house stock analysis or active trading. Low-cost index funds can allow investors without high levels of risk tolerance to put their money to work in the stock market.

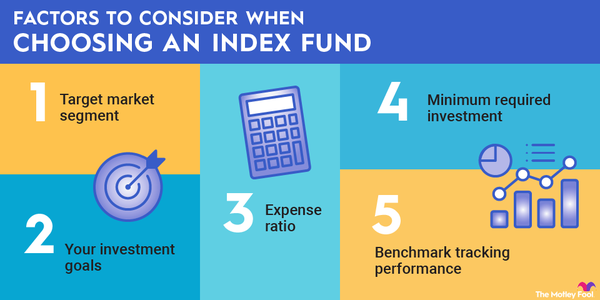

Choosing an index fund

Choosing a low-cost index fund

Low-cost index funds fit into a few categories. Understanding these different types can help you choose the best low-cost index fund for you:

- Total U.S. stock market funds: Investing in total U.S. stock market funds, which track indexes that include all publicly traded U.S. companies, is a solid choice for ultra-minimalist investors who want broad-based exposure to the U.S. stock market.

- S&P 500 index funds: Funds that track the S&P 500 (SNPINDEX:^GSPC) offer one of the simplest ways to gain diversified exposure to the largest U.S. companies.

- Index funds by market segment: Investing in ETFs by market segment is another way to structure your low-cost index fund portfolio. Investing in index funds focused on large-cap, mid-cap, or small-cap companies can help you tailor your portfolio in accordance with your appetite for volatility.

- Other index funds: There is a wide range of index funds available. Some allow you to invest in a particular stock market sector, such as technology. Others allow you to invest in a particular type of stock, such as a value stock, growth stock, or dividend stock.

You can also choose to invest in several types of low-cost index funds to maximize your portfolio's diversification.

Best low-cost index funds

10 Best low-cost index funds to buy

These index funds have some of the lowest expense ratios and could be worth a closer look:

| Index Fund | Expense Ratio | Assets Under Management |

|---|---|---|

| Vanguard S&P 500 ETF (NYSEMKT:VOO) | 0.03% | $1.07 trillion |

| Vanguard Large-Cap ETF (NYSEMKT:VV) | 0.04% | $49 billion |

| Schwab U.S. Large-Cap ETF (NYSEMKT:SCHX) | 0.03% | $39 billion |

| Vanguard Mid-Cap ETF (NYSEMKT:VO) | 0.04% | $160 billion |

| Schwab U.S. Mid-Cap ETF (NYSEMKT:SCHM) | 0.04% | $11 billion |

| Vanguard Small-Cap ETF (NYSEMKT:VB) | 0.05% | $139 billion |

| iShares Core S&P Small-Cap ETF (NYSEMKT:IJR) | 0.06% | $74 billion |

| Schwab U.S. Broad Market (NYSEMKT:SCHB) | 0.03% | $27 billion |

| iShares Core S&P Total US Stock Market (NYSEMKT:ITOT) | 0.03% | $53 billion |

| Vanguard Total Stock Market ETF (NYSEMKT:VTI) | 0.03% | $1.5 trillion* |

Let's take a deeper dive into a few of these low-cost index funds:

1. Vanguard Total Stock Market Index Fund ETF

If you want to hold a single index fund ETF that invests in the total U.S. stock market and in the right proportions, the Vanguard Total Stock Market Index Fund ETF is your best option. Holding shares in this fund makes owning other stocks or ETFs redundant unless you want to concentrate your portfolio's exposure in a particular market segment.

Holding shares in this fund means you'll hold large-, mid-, and small-cap companies proportional to the broader market -- and at a bargain-basement 0.03% expense ratio.

For the set-it-and-forget-it investor, this investment strategy is very difficult to match from a time- and cost-efficiency perspective. Many fund management companies offer total market funds at similarly low costs.

2. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF tracks the S&P 500. The benchmark index is weighted by market capitalization and includes 500 of the largest U.S. companies. The broad diversification of this fund is appealing to many investors.

The S&P 500 is "self-cleansing," meaning that when a particular company no longer qualifies for inclusion in the index, it is replaced by a growing company that deserves to be included. The formulaic nature of the inclusion process ensures that only high-quality companies are listed by the S&P and invested in by S&P 500 index funds, like the Vanguard S&P 500 ETF.

3. Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF invests in companies with mid-range market values, typically between $2 billion and $10 billion. The mid-cap market segment includes companies with established businesses and reliable revenue streams, many of which have yet to grow to their full potential.

Revenue

The ETF tracks the CRSP U.S. Mid-Cap index by aiming to hold the same stocks in the same proportion as the index. The fund's small expense ratio of 0.04% is competitive among mid-cap ETFs.

4. Vanguard Small-Cap ETF

The Vanguard Small-Cap ETF is an attractive option if you want to invest in companies with the most growth potential. The fund tracks the CRSP U.S. Small-Cap index, focusing on U.S. companies in the bottom 2% to 15% by market cap.

Investing in a low-cost, small-cap index fund ETF such as the Vanguard Small-Cap ETF can boost your overall returns. However, due to its small-cap focus, this ETF's performance can be more volatile than other investments.

Volatility

Volatility since COVID-19

At the beginning of the COVID-19 pandemic in March 2020, global stock indexes were down anywhere from 30% to 50%, depending on the market segment. Since then, indexes such as the S&P 500 recovered quite nicely before again falling almost 25% in 2022 from the previous year.

If you have held low-cost index funds since then, there's a good chance you've seen your net worth expand despite recent poor performance -- especially if you've held on to experience the modest recovery in 2023. Critically, if you instead picked individual stocks and bought and sold at the wrong times, you would likely not have captured such efficient performance.

The beauty of an index-based investing style is that you only need to buy and hold -- and be unwaveringly patient. Paying very little for such a strategy is not only possible but also the best way to ensure that you keep the majority of your investment returns over the long haul.

Related investing topics

Is a low-cost index fund right for you?

Paying higher fees to invest in an actively managed fund erodes your ability to generate compound interest. While index funds are generally broad-based, you can gain additional portfolio exposure to particular market segments by allocating more money to specific stocks or funds in accordance with your investment preferences.

With so many low-cost index funds available, there's little reason to pay more than the bare minimum in fees. Adding a low-cost index fund to your portfolio keeps more of your hard-earned money in your own pocket.

FAQs

Low-Cost Index Funds FAQs

What is a low-cost index fund?

A low-cost index fund is an ETF or mutual fund designed to track a certain benchmark index, such as the S&P 500. Because these simply track an index, they don't require professional investment managers and, therefore, have much lower costs than most actively managed mutual funds.

Is it good to invest in a low-cost index fund?

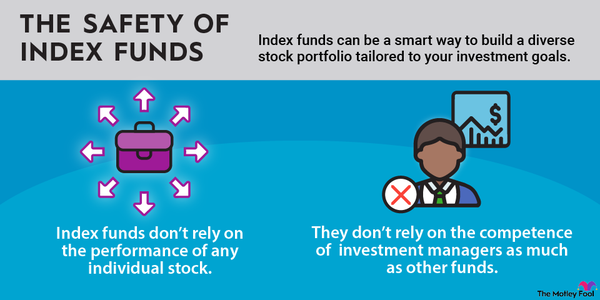

A low-cost index fund can help you invest your money in the stock market and pay minimal fees while doing so. Like any investment strategy, low-cost index funds aren't ideal for everyone, but they can be a great way to get exposure to the stock market without the risks and research involved with picking individual stocks.

Is the S&P 500 a low-cost index fund?

The S&P 500 is a benchmark index and not something you can invest in directly. However, several low-cost index funds are designed to replicate the performance of the index over time by directly owning the stocks of the 500 companies comprising the index.

How safe are low-cost index funds?

There are low-cost index funds that track various stock market indexes and indexes for commodities, bonds, foreign currencies, and more. Because of this, different index funds have different levels of volatility and safety and should be considered individually.